From an investing perspective, National Grid (LSE: NG) can seem like the stuff of dreams. Energy distribution networks are critical infrastructure likely to benefit from long-term demand – and often with little or no competition. On top of that, the National Grid dividend per share has been on an upwards march for years. The yield currently stands at a juicy 6.1%.

But I have no plans to buy National Grid shares, partly because I have concerns about the long-term sustainability of the dividend at its current level.

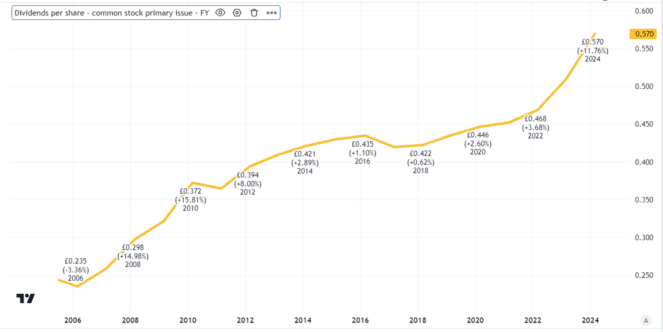

Attractive dividend history

The share has been a solid payer of dividends for many years.

Created using TradingView

The dividend has seen a steady increase over time. The annual growth may not be market-leading, but it is not negligible either. Last year it was 5.6%.

The company’s policy is to raise the dividend each year in line with the average UK CPIH inflation, meaning that it ought to hold its value in real terms.

Some investors have done even better, by opting to receive what are known as scrip dividends. That means that they get the value of the dividend in shares not cash. Effectively it is an effortless form of compounding.

As the National Grid share price has risen 22% in the past five years, that has lately been a rewarding move.

Structural challenges of the industry

So far, so good. What, then, is it that puts me off adding National Grid to my ISA?

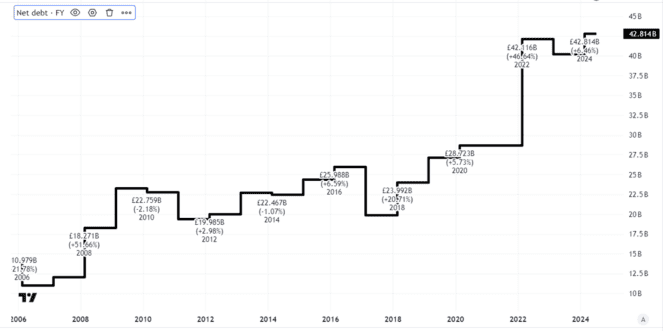

Here is a chart showing the company’s net debt.

Created using TradingView

Last year saw net debt rise 6% to £43bn. In itself, debt is not necessarily a problem. A lot of large FTSE 100 companies like National Grid have large amounts of borrowings.

If they can borrow money at a lower cost than they generate in returns by using it, it can be a profitable financing strategy (though not without risk, such as rising interest rates).

But what concerns me here is not the absolute level of National Grid’s debt. I see that as high but manageable for a business with good transparency of likely customer demand and revenues of close to £20bn annually. Rather, it is the way that the company’s net debt has ballooned overt the past two decades.

That reflects the fact that running a large energy network is a capital-intensive industry that requires heavy upfront expenditure and often sizeable ongoing maintenance spend.

Potential impact on the dividend

Indeed, the company’s so-called “investment programme” – basically capital expenditure and associated costs – was the justification for a £7bn rights issue this year, that diluted existing shareholders.

Having more shares in circulation will make it harder to sustain let alone raise the National Grid dividend in the absence of strong profits growth. In a heavily regulated industry, that can be difficult.

One option would be to keep piling on debt, but sooner or later the balance sheet would start creaking if it had too much.

For now I expect the company to keep growing its dividend each year. As a long-term investor, though, I am concerned about its sustainability.