Earning a second income doesn’t always mean sitting up until midnight working on a side hustle. Sure, putting in the time and effort is one way to earn extra cash. But another way is by saving and investing.

With little effort, most people could save £7 of spare change each day. It wouldn’t be difficult — but it would add up to a decent £200 a month.

Putting that money to work could go a long way. But where to put it? A savings account is secure but barely beats inflation and few index-tracking funds return over 5%. What about a carefully picked portfolio of high-yield dividend shares?

Should you invest £1,000 in Greencoat Uk Wind right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greencoat Uk Wind made the list?

Now there’s an interesting option.

Aim for a yield of 7%

The average yield on the FTSE is around 3.6%. This is brought down by many stocks that pay less than 1%. But many pay 7%, or above. The top payers change frequently but some seem to always be near the top 10. These are the stocks to aim for.

But to maintain a yield of 7% requires careful planning. The portfolio will need a mix of reliable stocks with yields that are likely to remain between 6% and 8% for the long term. This is impossible to guarantee but there are ways to improve the chances.

Checking a stock’s track record

Take Aviva for example. It has a 7% yield today but look back 10 years. The yield is all over the place, spending much of the past decade below 5%. Taylor Wimpey also looks good with a 6.3% yield but before 2022, it was mostly below 5%. Phoenix Group looks solid with a yield above 6% since 2011, occasionally going as high as 9%. But wait a second – the share price is down 24% in five years. That’s less promising.

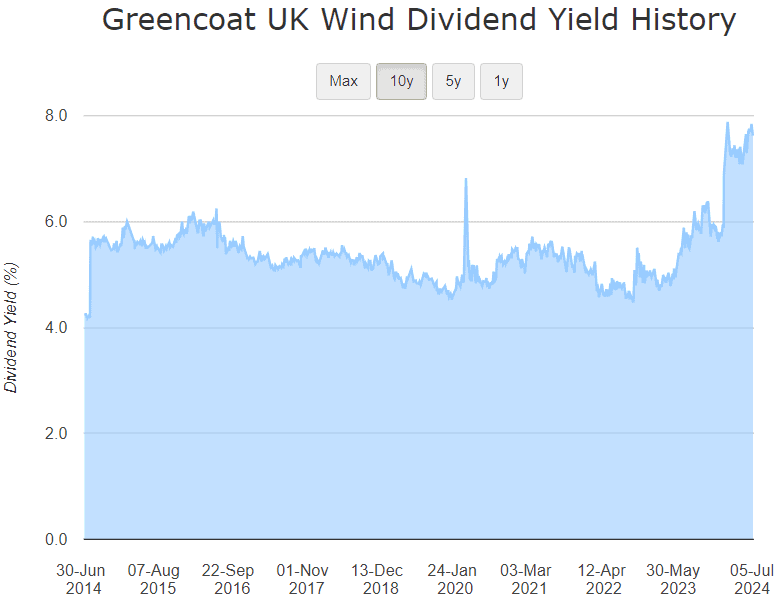

What about the lesser-known FTSE 250 real estate investment trust (REIT) Greencoat UK Wind (LSE: UKW)? It currently sports a tasty 7.6% yield and it’s held solid above 5% for the past decade so could be one to consider.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

It has a healthy balance sheet with an acceptable debt level and decent cash flows. Admittedly, the share price hasn’t done well recently but is up 30% since July 2014. If the price and yield continue in this fashion, it would make a good addition to a 7% dividend portfolio.

Risks

The renewables energy sector is expected to grow considerably over the next decade and I, for one, am enthusiastic about it. That said, it’s not without risk. UK Wind’s earnings rely on selling wind power to the local grid, the price of which is set by the regulator Ofgem. This limits the control it has over its own success.

Wind power can be expensive and unreliable, whereas oil and gas are more predictable. In a tough economy, even the most eco-friendly consumers may be put off by rising costs. If sentiment shifts against renewables it could hurt the UK Wind share price.

These risks can be offset by including a mix of high-yield dividend shares from different industries. A monthly investment of £200 into a 7% yielding portfolio could grow to £157,000 in 20 years, paying annual dividends of £12,000 – or £1,000 a month.