Investing in UK equity income funds is an easy way to gain exposure to several top FTSE 100 dividend stocks. But I believe investing in individual shares can be a more profitable option.

By selecting shares individually, investors are inclined to research the companies they choose and, subsequently, gain a better understanding of the market. This knowledge can help to guide and balance a portfolio, which can pay off substantially in the long run

However, funds have their place. They can help provide insight into which stocks professionals are choosing. In the UK, some of the most common stocks are Shell, GSK, HSBC and Unilever. But the most popular stock seen in the majority of equity income funds is major oil and gas giant BP (LSE: BP).

Why is it so popular and is it worth consideration?

Value investing

Looking at the BP share price over the past 10 years, the value proposition isn’t immediately obvious. Today’s 490p share price is mere pence away from where it was in July 2014. It would be easy to blame Covid for the low growth, but between 2004 and 2014 it was similarly stagnant.

In fact, the price has endured hardly any noticeable growth since the late 90s, yet it remains a frequent fixture in the portfolios of value investors. This can be confusing for beginners who typically look for stocks with high growth potential.

BP’s value is more deeply rooted in its strength as a reliable dividend-payer with strong earnings growth. While the share price may lack that WOW factor, strong earnings forecasts give the firm a forward price-to-earnings (P/E) ratio of 7.4. That’s below the industry average of 7.9 and considerably lower than the FTSE 100 average of 18.5.

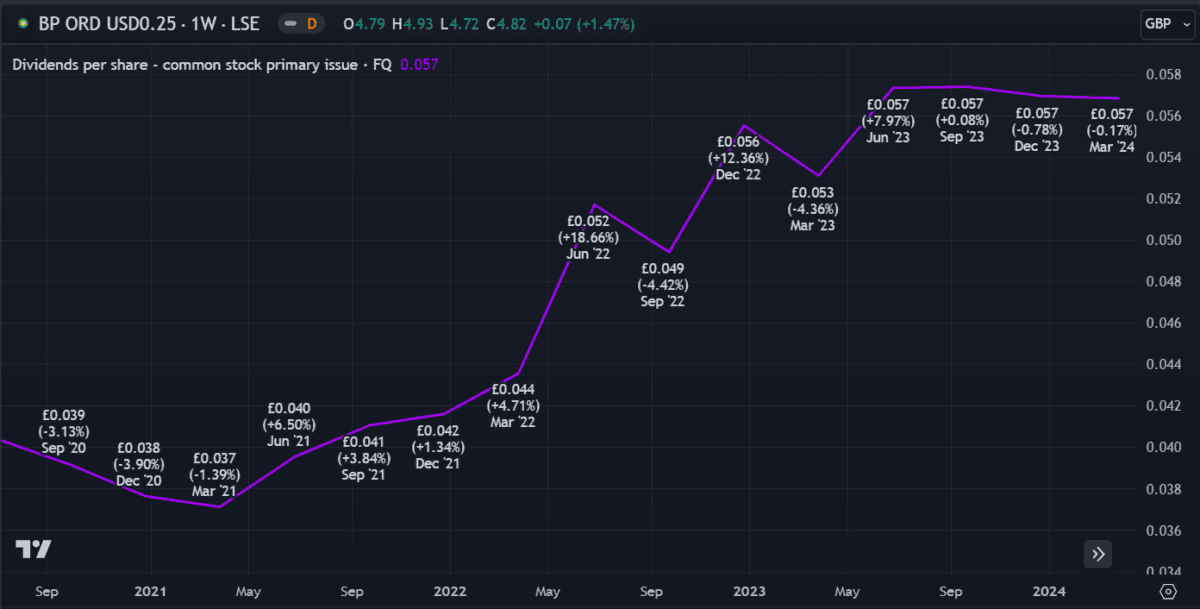

This is what value investors like to see. Strong earnings usually equate to profit, and with income stocks, that often results in higher dividends. Other than a partial cut in 2010, BP’s been paying consistent quarterly dividends many years.

Environmental challenges

Reliable dividends or not, eco-conscious investors may find BP a hard pill to swallow. Last week, it announced a slowdown on its renewable initiatives, with new CEO Murray Auchincloss shifting focus back to oil and gas. Lacklustre returns from wind and renewables have left shareholders wanting.

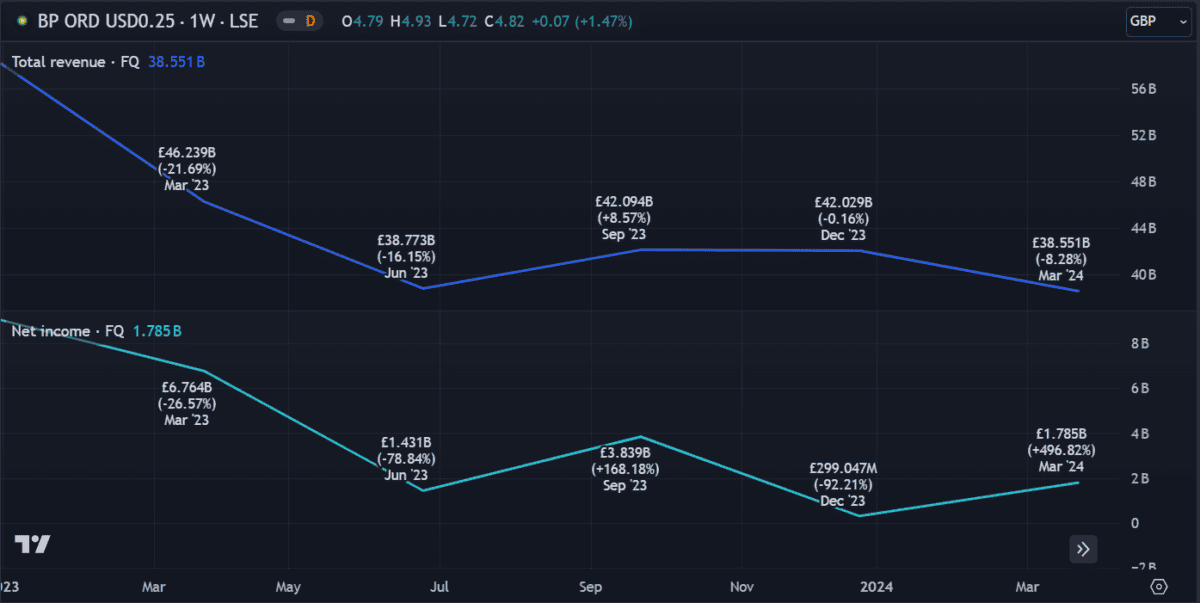

In its latest Q1 call, revenue and earnings missed analyst expectations by 14% and 24% respectively.

Subsequently, the ‘environment’ component of BP’s ESG score has now fallen below that of rival Shell — although it remains well ahead of US oil giant Chevron. The shift in focus is risky. Auchincloss may be underestimating the impact of ESG scores and the lengths that activists will go to hold companies accountable.

Keeping shareholders happy while meeting increasingly strict emission targets is now the biggest challenge that oil and gas companies face.

Making the right choices

For beginner investors, funds can provide an easy entry point. However, investors may end up supporting companies with policies they don’t necessarily agree with. They may also find the investment strategy doesn’t align with their personal goals.

Time spent assessing the risks and benefits associated with each investment opportunity is invaluable. It’s a critical part of the investment journey, helping investors better understand their personal goals and risk appetite.