Trying to spot the next Nvidia-like growth stock is no easy feat. These firms are often operating in emerging industries that many people think are overhyped or unrealistic.

Take the internet, for example. It was still being touted as a “passing fad” in 2000 by some newspapers. In 2009, Charlie Munger explained to a table full of people all the ways the electric vehicle start-up Tesla would fail, according to Elon Musk.

Nowadays, nobody questions the internet or EVs, while Amazon and Tesla haven’t done too badly. Nvidia stock is up a staggering 51,180% since 2010!

Should you invest £1,000 in Marshalls Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Marshalls Plc made the list?

So where might the ‘next big thing’ be? Well, to most people, the idea of electric flying taxis sounds like pie-in-the-sky stuff (literally). Yet this industry is tipped for extraordinary growth.

A leader in the space today is Joby Aviation (NYSE: JOBY), whose shares cost $5 apiece. I recently added more to my portfolio.

The Uber of the Sky

The company has built an electric vertical take-off and landing (eVTOL) aircraft and plans to begin an air ride-hailing service.

These eVTOLs fly at speeds of up to 200 mph and are near-silent, meaning they could play a key role in the green revolution. Each one carries four passengers and a pilot, though Joby aims to make them autonomous.

The firm is backed by Toyota, Delta Air Lines and Uber. These are well-chosen strategic partners. Toyota is assisting with manufacturing, while Delta and Uber aim to help reduce commutes between John F Kennedy Airport and nearby areas from one hour to seven minutes.

Joby acquired Uber’s flying taxi venture in 2020, and the two firms agreed to integrate their respective services into each other’s apps. I think partnering with Uber, which now has 149m customers using its platform, will give the firm a noteworthy competitive advantage.

Global ambitions

Initially, the company intends to start services in New York and Los Angeles. However, it recently signed an exclusive six-year agreement agreement to provide air taxi services in Dubai.

Plus, it will sell aircraft to Mukamalah, the aviation arm of oil giant Saudi Aramco, which will introduce eVTOLs to Saudi Arabia.

Last year, the firm also delivered the world’s first ever electric air taxi to the US Air Force. So there are two parts to the business here. One is the ride service for consumers and the second is selling eVTOLs to firms and organisations around the world that want to reduce their carbon footprint.

Timeline

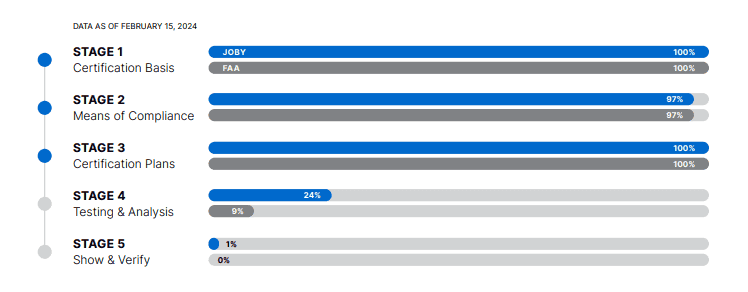

Joby plans to start commercial operations in 2025. However, there could be delays as it’s still working towards securing full airworthiness approval from regulators.

Meanwhile, the firm is losing around $100m per quarter right now. This makes the investment very risky.

However, it did have $924m in cash on the balance sheet at the end of March. So it seems adequately capitalised, at least for now.

A high-risk stock

In conclusion, Joby plans to start offering a greener and faster alternative to driving that’s bookable at the touch of an app. JPMorgan sees this global eVTOL market being worth $1trn by 2040.

The stock could deliver Nvidia-like returns in the years ahead or crash and burn. Therefore, it’s only a small part of my overall portfolio.