There are many growth stocks for bargain hunters to consider today. Here are two whose share prices could soar in the weeks and months ahead.

Pan African Resources

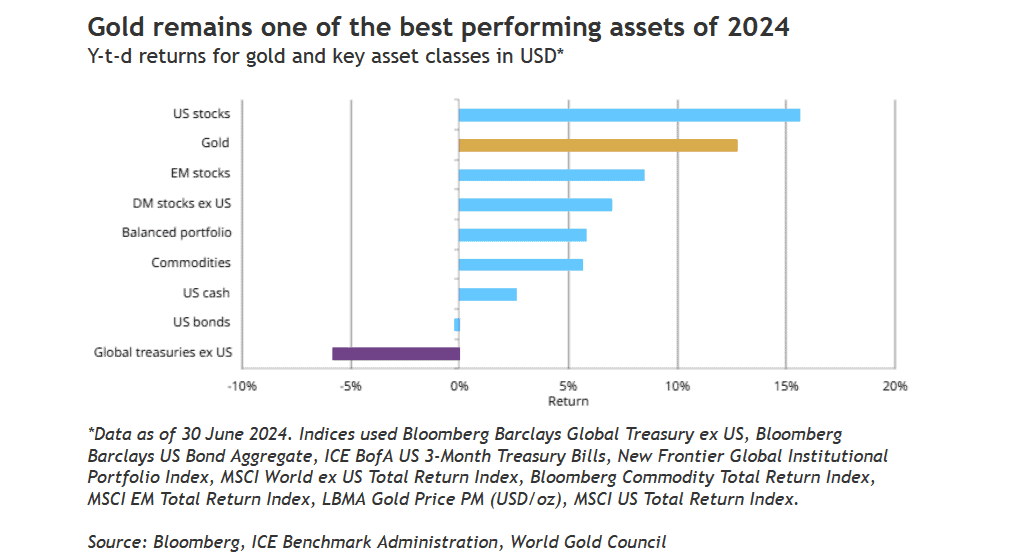

Gold’s surge to fresh record highs has been one of the big investment stories this year. As the graphic below shows, the yellow metal has soared in popularity more recently, a symptom of growing fear over the global economy.

Gold has retraced about $90 from May’s record peaks around $2,450 per ounce. But many experts believe the commodity is poised to move to new highs.

Should you invest £1,000 in Central Asia Metals Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Central Asia Metals Plc made the list?

Analysts at Goldman Sachs, for instance, have predicted the precious metal will end the year at around $2,700. This is thanks to “solid demand from central banks in emerging markets and from Asian households”.

Fears over sticky inflation, election uncertainty in the US and Europe, and growing geopolitical tension could also propel the safe-haven asset to fresh highs. This could make buying gold stocks a great idea.

One such contender is Pan African Resources (LSE:PAF), a company that has already enjoyed stratospheric price gains.

City analysts think earnings here will soar 31% in the current financial year (to June 2025). A further 24% increase is forecast for the following year too, which also reflects the firm’s plans to hike production by 25%.

Investing in gold miners over a gold-tracking fund can be risky business. Operational problems are common that can put earnings estimates under severe stress.

But I believe this could be baked into Pan African Resources’ low valuation. At 27.8p per share, the business trades on a forward price-to-earnings (P/E) ratio of just 7.7 times.

On top of this, certain gold miners also offer a dividend, while a fund or the physical metal itself offer zero income potential. The dividend yield at Pan African Resources sits at solid 3% too.

Central Asia Metals

Central Asia Metals (LSE:CAML) is another cut-price growth mining share I believe is worth serious consideration from investors today.

Like gold, copper has had a stratospheric rise in 2024 as supply concerns have emerged. With inflation falling and interest rates tipped to follow, metal demand could improve substantially and fuel worries over shortages, driving prices even higher.

Copper prices at the London Metal Exchange hit their highest for two years back in May, around $10,860 a tonne.

This bright price outlook means Central Asia Metals — which owns the Kounrad copper mine in Kazakhstan — is tipped to grow earnings 27% in 2024. At 205p per share, this leaves the stock trading on a corresponding P/E ratio of 9.9 times. A 12% profits increase is tipped for 2025 too.

China’s lumpy economic recovery could put these forecasts in peril. But right now, Central Asia Metals looks in good shape for strong profits growth in the near-term and beyond. Copper demand is tipped to boom over the next decade as decarbonisation efforts take off, and global urbanisation continues at a rapid pace.