Building generational wealth is a common financial goal today. This kind of wealth can provide long-term financial security for your loved ones, and set your family up for success for generations to come. If you’re interested in building wealth for future generations, you may want to consider investing within a SIPP (Self-invested Personal Pension). Here’s why.

A tax-efficient investment vehicle

From a wealth-building perspective, it’s hard to beat the SIPP as an investment vehicle, in my view.

For a start, contributions come with tax relief. Contribute £800 as a basic-rate taxpayer, and the government will add in another £200 for you, taking your total contribution to £1,000. That’s a risk-free 25% return (higher-rate and additional-rate taxpayers can claim even more tax relief).

Next, your money can grow free of Capital Gains Tax (CGT). This is a valuable perk, especially now that the annual CGT allowance is just £3,000.

Additionally, money in a SIPP can be passed onto future generations free of Inheritance Tax (IHT). That’s a huge plus for those looking to build generational wealth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Finally, SIPPs generally give investors access to a wide range of investments. That means it’s possible to generate high returns over the long term and compound gains.

Investing within a SIPP

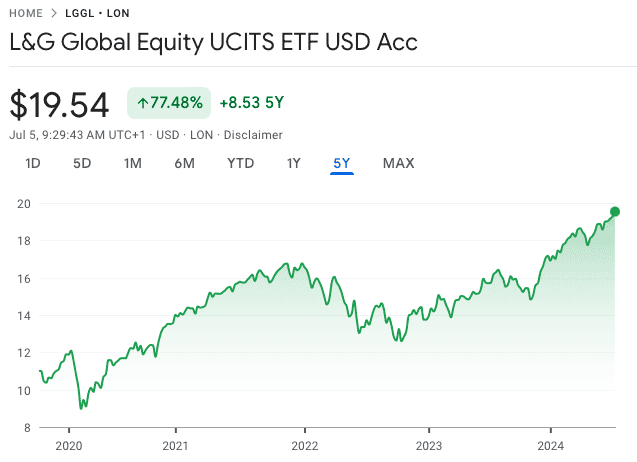

One example of an investment that can be purchased within a SIPP is the L&G Global Equity UCITS ETF (LSE: LGGL).

Source: Google Finance

This is an exchange-traded fund (ETF) from Legal & General that provides broad exposure to developed countries’ stock markets (over 1,400 stocks in total).

The beauty of this ETF is that it allows access to a range of top companies. Currently, its largest holdings include Apple, Microsoft, Nvidia, and Amazon.

Another big attraction is its low fee. The ongoing charge here is just 0.1%, which is very low.

Over the last five years, this ETF has returned a little over 12% a year. That’s an excellent return. Investing £100k in the product five years ago would now be worth over £175k.

Past performance is not an indicator of future performance though. If global stock markets (or the tech sector) were to experience a period of weakness, returns could be significantly lower.

Money for future generations

Let’s say an investor was able to generate a return of 9% a year on their capital over the long term. And they invested £8k a year into their SIPP (£10k after tax relief as a basic-rate taxpayer) for 35 years (ie between the ages 30-65). I calculate that in this scenario, a potential of around £2.2m could be built over the 35-year period within their SIPP. That’s a lot of money.

Now, that figure doesn’t factor in inflation. In other words, it’s not in today’s money.

However, realistically, it should be more than enough for retirement, meaning that there should be plenty of money left over for future generations to enjoy.