The UK election results are in. And Labour’s won by a mile. So what does this major political shift mean for UK stocks? Let’s take a look at what the research says about the impact of different governments on the British stock market.

Analysing the FTSE All-Share index’s performance

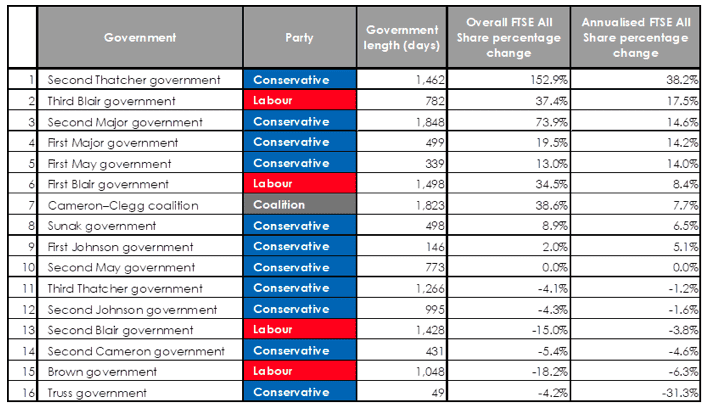

According to research from Bowmore Asset Management, the UK stock market has performed better under Conservative governments than Labour governments.

Its research shows that between 1983 and April 2024, the FTSE All-Share index (which comprises about 600 stocks on the London Stock Exchange including both large-caps and small-caps), grew 4.9% a year under Conservative governments and 3.9% a year under Labour.

Source: IFA Magazine and Bowmore Asset Management

Bowmore found that one of the best periods for the UK stock market was between June 1983 and June 1987. This was when the Conservative Party – led by Margaret Thatcher – was in power.

Globally connected

Now, at first glance, these stats look a bit concerning from a wealth-building perspective. But I wouldn’t worry too much about them.

These days, markets are globally connected. Therefore, a lot of what happens in the UK market is beyond the control of the government.

For example, when UK stocks crashed in the Global Financial Crisis of 2008/2009, that was a global issue stemming from the housing market collapse in the US. It had little to do with the government in power here at the time.

Interest rate cuts could boost UK stocks

Ultimately, the stock market today is usually more influenced by global economic trends and interest rates than by moves from specific governments.

And the good news here is that interest rates are looking set to come down in the second half of 2024.

In the UK, investors expect the Bank of England to make its first rate cut in August. This interest rate activity could potentially benefit the UK stock market and push share prices higher.

A value opportunity to consider

As for investment ideas to consider, one stock I like the look of right now is Smith & Nephew (LSE: SN.). It’s a healthcare company that specialises in joint replacement technology.

This stock’s well off its highs today. It currently trades at a very reasonable valuation (the forward-looking P/E ratio using next year’s earnings forecast is just 12).

At its current price, I think the stock’s a bargain. And I’m clearly not the only one who sees value. Earlier this week, it came to light that activist investor Cevian Capital has taken a 5% stake in the FTSE 100 company. Cevian’s known for building stakes in underperforming companies and calling for change to boost business performance and improve returns for shareholders.

Smith & Nephew owns fundamentally attractive businesses in structurally growing markets, but the company has not generated shareholder value for many years. Cevian sees the potential to create significant long-term value by improving the operating performance of the company’s businesses.

Friederike Helfer, Partner, Cevian Capital

Of course, there’s no guarantee this stock will do well going forward. It’s up against some powerful competitors including Johnson & Johnson and Stryker.

But with the global joint replacement market likely to grow at a healthy pace in the decade ahead due to the world’s ageing population, I think the risk/reward setup’s attractive right now.