Financial advisors often champion passive income, a strategy that lets investors earn money even while they sleep. As billionaire investor Warren Buffett famously said: “Find a way to make money while you sleep, or you’ll work until you die.”

One effective method for achieving this hands-off income stream is by investing in shares that pay dividends. Starting such an investment strategy as early as possible will help achieve the best results. A long-term approach balances out the impact of short-term market fluctuations.

Additionally, reinvesting the dividends maximises the benefits of compound returns. Like compound interest in savings accounts, reinvesting the dividend payments to purchase additional shares fuels further growth over time.

Not all dividends are created equal

A dividend yield represents what percentage a dividend amounts to in comparison to a single share. For example, if shares cost £1 and it pays an annual dividend of 10 cents per share, the yield is 10%. But this value changes constantly as the share price fluctuates. The company can also choose to change the dividend at any time or cut it completely.

So choosing a dividend stock with a high yield today doesn’t mean it will have a high yield tomorrow. But some companies are known as Dividend Aristocrats for their long history of uninterrupted payments.

One example worth considering is the popular British insurer Legal & General (LSE: LGEN). It currently sports a huge 9% dividend yield! And since 2010, annual dividends have increased steadily from 4.75p to 20.34p per share, representing a 10-year average growth rate of 8.14%.

A history of reliable growth and payments makes it easier to calculate long-term returns with a higher degree of accuracy. However, the firm recently announced a slowdown in dividend growth, so I think 4% is probably a more realistic rate to use for future estimates.

Let’s work it out

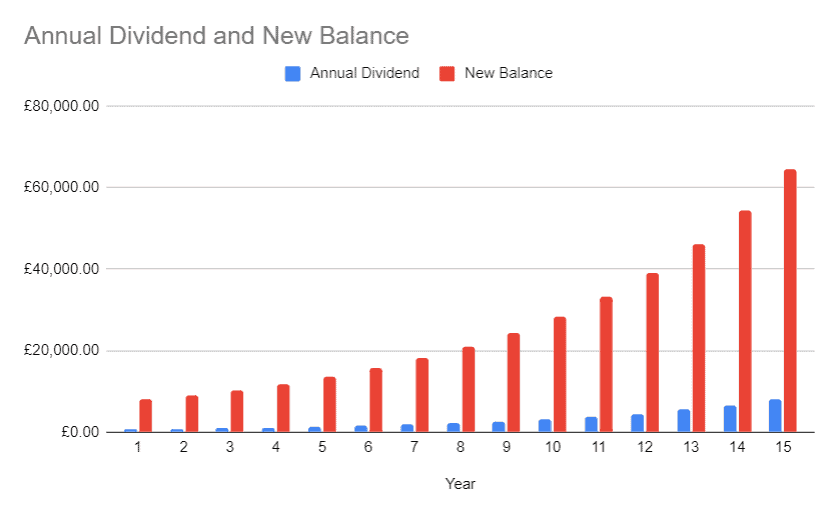

Imagine I bought 3,043 Legal & General shares for £7,000 today. With a 9% yield and an average 4% price growth, it would be around £7,930 after one year. I would earn £671 in dividends that year. By the second year, my investment would be over £9,000, paying dividends of £780 a year.

Keep that going for 15 years and I could have £64,580, paying more than £8,000 a year in dividends — approximately £666 a month.

But what’s the chance that will actually happen? I can’t say for sure, but I do know that I’d trust a company with a good track record over one without. Will Coca-Cola still taste like Coca-Cola next year? I can’t guarantee it, but I think there’s a fair chance it will.

And that’s not the only risk

The insurance and investment industries are sensitive to economic conditions, so an economic downturn could hurt the company’s profitability. Things are looking better since Covid but fears remain of a looming recession. Facing strong competition from rival insurance firms like Prudential and Aviva, it must keep on its toes to retain its customer base.

A reliable dividend’s only as strong as the company paying it. So I wouldn’t pick only one — diversifying an investment across several stocks will help safeguard against a single point of failure.

This is always best practice when aiming for long-term growth.