Investing in UK shares can be an effective way to source a large and growing passive income. The FTSE 100 and FTSE 250 in particular are home to stacks of top dividend growth stocks.

These indexes are packed with established businesses that have market leading positions and robust business models, giving them stable earnings and strong cash flow. This is the perfect recipe for them to deliver a dependable (and often growing) dividend over time.

A top SIPP buy

Remember that dividends are never, ever guaranteed. Indeed, they can fall, or even be suspended altogether, when broader economic conditions worsen.

However, a well diversified portfolio — one which provides exposure to different companies across multiple sectors and geographies — can still generate a rising passive income year after year.

But which UK shares are the best ones to buy for dividend growth today? Here, I’ve identified one that could be a great long-term buy for those who own a Self-Invested Personal Pension (SIPP).

REITs rule

Real estate investment trusts (REITs) can be some of the most secure dividend stocks out there. The regular rents they receive often provide a dependable income that they can distribute to their shareholders.

In fact, these special property stocks are required to pay 90% of annual rental earnings out by way of dividends. While other shares can choose whether or not to pay dividends, REITS simply have no choice if their rental operations are profitable.

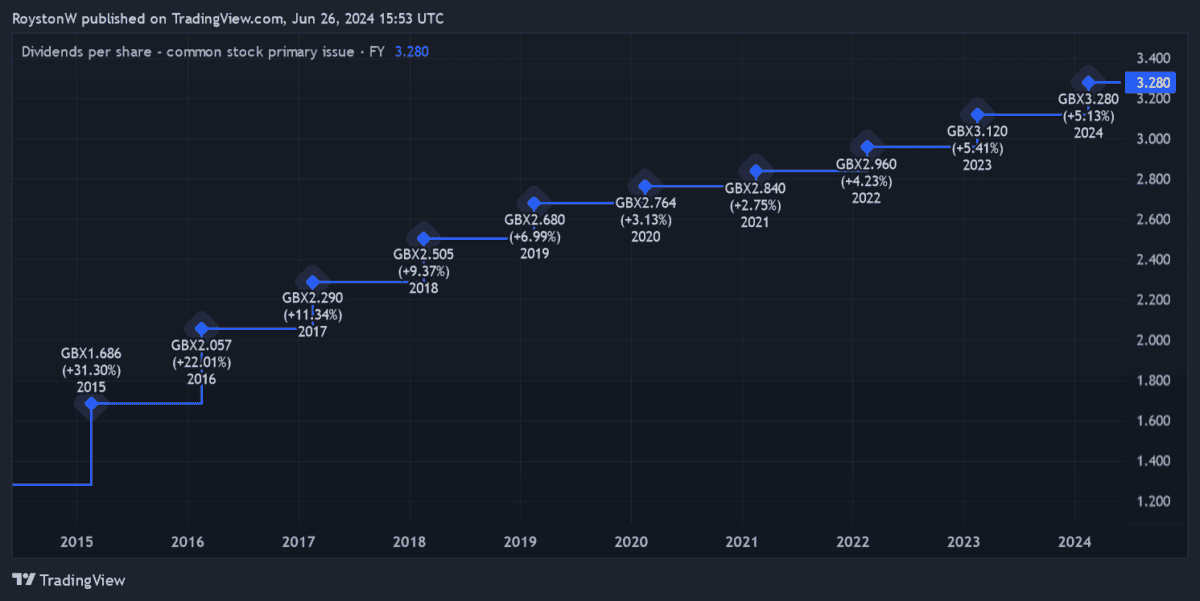

Assura (LSE:AGR) is one such share with a strong history of dividend growth. It’s raised annual payouts for the last 11 years on the spin. Over the past nine years, dividends have risen at a healthy compound average of 7% too.

Robust earnings

There are around 50 REITs listed on the London Stock Exchange today. But I like this one because its operations can be considered particularly defensive. As mentioned above, stable earnings usually translate to regular — and in this case, growing dividends.

You see, Assura owns, manages, and leases out medical centres across the UK. More specifically, it owns more than 600 GP surgeries, diagnostics centres and primary healthcare facilities.

Needless to say, these properties remain in high demand at all points of the economic cycle. So in this regard, Assura doesn’t have to worry about empty buildings and problematic rent collection during downturns.

Furthermore, the majority of rents that doctors, NHS bodies and other healthcare providers pay the company are indirectly funded by the government. This, in turn, reduces the possibility of rent defaults.

8.7% dividend yield

Of course no share is without risk. In the case of Assura, changes to NHS policy could significantly alter its long-term growth prospects.

But as things stand today, it’s looking good. Demand for primary healthcare facilities is growing as the government tries to ease the strain on packed hospitals. It is likely to continue expanding too, as Britain’s elderly population swells.

City analysts are expecting Assura’s dividends to continue growing for the next three years, at least. This means its dividend yield stands at a whopping 8.4%, and eventually rises as high as 8.7%.

If I didn’t already own shares in industry peer Primary Health Properties, I’d buy Assura shares to boost my long-term passive income.