A lot of penny shares are in obscure firms most people have never heard of. But not all. Take ME Group (LSE: MEGP) as an example. Four years ago, the company was trading firmly in penny share territory. Since then, it has more than quadrupled, thanks to solid profits and cash flows.

While you may never have heard of the company, there is a fair chance you have seen (or even used) one of its thousands of photo machines in supermarkets, shopping centres, and elsewhere, or one of its RevolutIon laundry machines.

Attractive business model

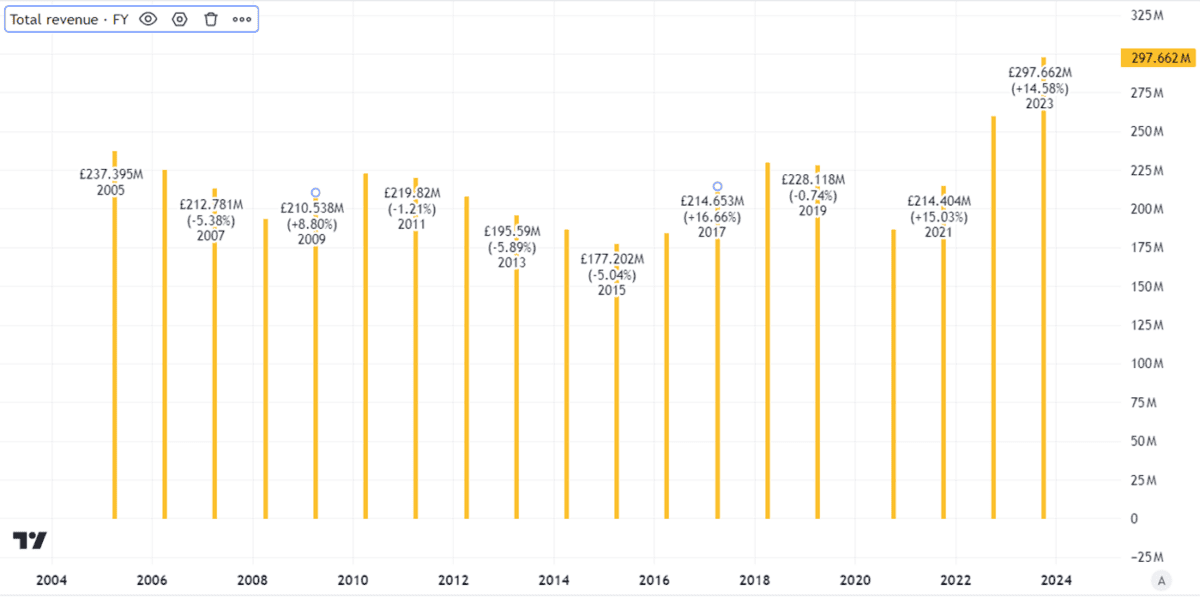

This is a lucrative business. The company operates in areas that have high demand. Even during the depths of the pandemic, when ME Group was trading as a penny share, revenues fell but did not collapse.

Created using TradingView

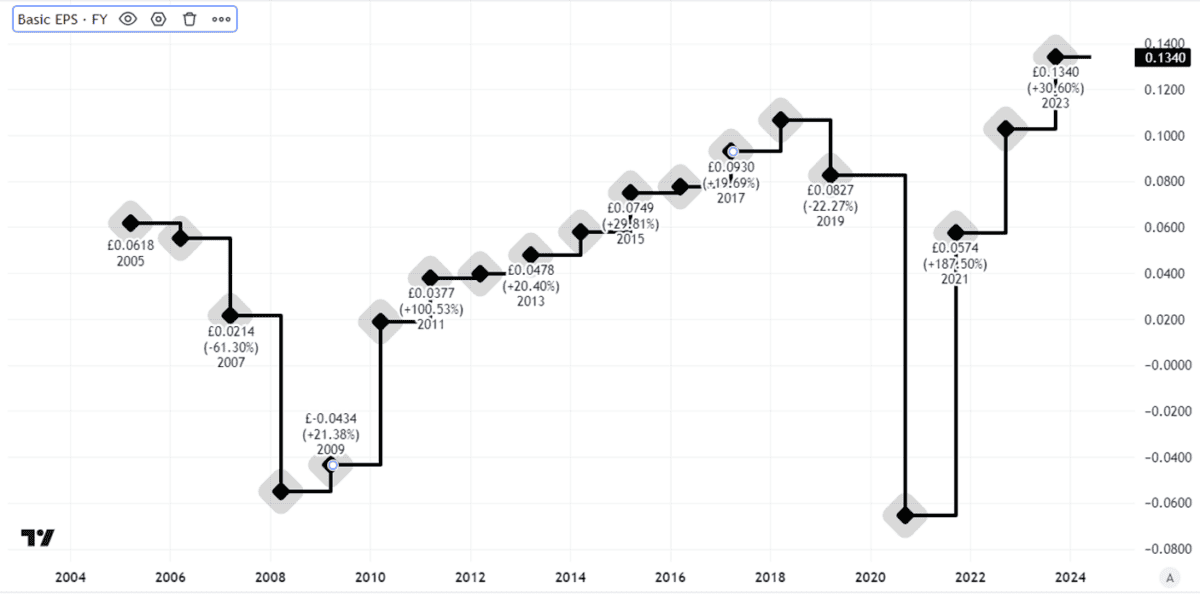

When it comes to profitability, earnings have moved around.

Even before the pandemic earnings per share had declined – and they took a pummelling over the next several years, helping explain why ME was trading as a penny share.

Created using TradingView

But as the chart above shows, they are now stronger than they have ever been. I think that speaks to the appeal of ME’s business model: its automated machine network means that its labour costs can be kept low, while the services it offers tend to have robust demand. If people need to do their laundry, they need to do their laundry.

Valuation could offer long-term value

But a good business does not necessarily make a good investment. Valuation matters too.

I think ME Group stacks up fairly well on that front. Looking at the current price-to-earnings ratio of 13, I think it offers the potential for long-term appreciation if earnings per share continue to increase in future.

On top of that, the dividend yield of 4.3% looks attractive to me.

I think the company’s unique estate of machines and long experience of vending machines helps set it apart from competitors. But there are risks. As we saw during the pandemic, any drop in the number of people visiting shopping centres can lead to a sharp drop in demand.

Buy or wait?

Having been a penny share within the last four years, though, could ME Group head back there any time soon?

Anything is possible in the markets, of course, but for now at least I think the firm’s robust business performance is likely to keep the share price buoyant. Its lack of competition in many areas gives it pricing power, which I think could mean we see even higher earnings in future.

So, even though it no longer offers the screaming value it did as a penny share, if I had spare cash to invest today I would be happy to add ME Group to my portfolio.