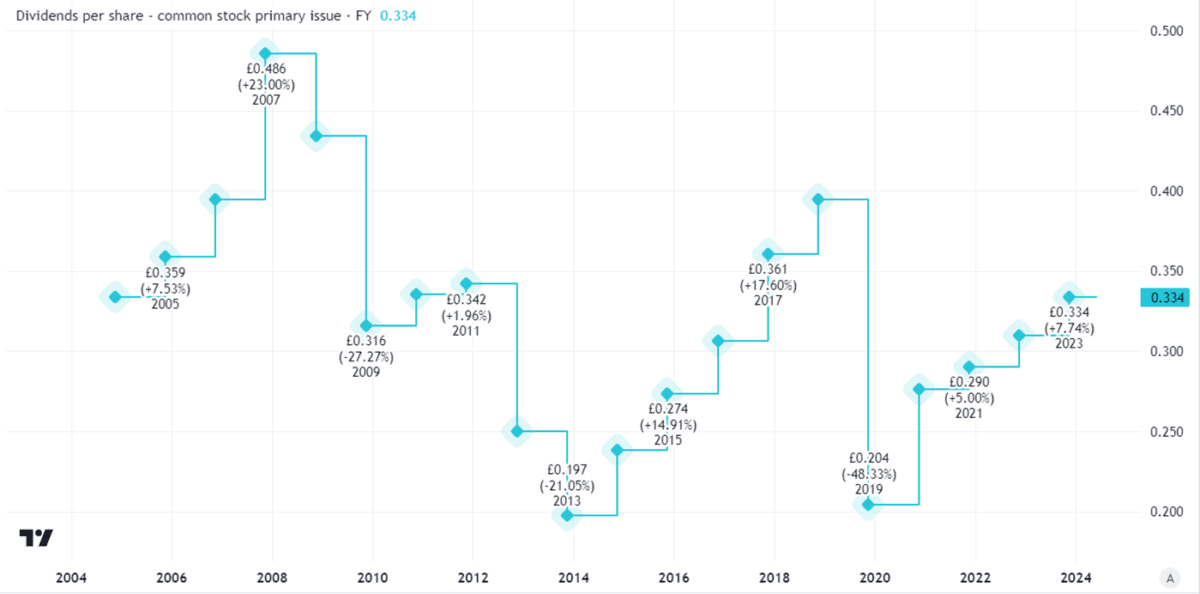

Looking at the annual shareholder payout from insurer Aviva (LSE: AV), I like what I see. At the moment the Aviva dividend yield is 7%.

I think it could go higher from here. So, should I invest?

Promising dividend outlook

Let me start by explaining why I am upbeat about what might happen to the payout. After all, it is just a few years since we saw an Aviva dividend cut (a reminder that no payout is ever guaranteed to last).

Created using TradingView

There are a couple of ways one might look at this as far as I am concerned.

One is to say that insurance is a cyclical business – rates go up and underwriters do well, then at some point they fall again across the industry and profits shrink.

Another analysis is that Aviva has historically been a ragbag of different businesses, but under current management has become more focussed and has now put its dividend on a more sustainable footing than used to be the case.

Which of these is more true (as both may be valid), only time will tell. But I think there is a lot to like about the business outlook for the insurer, from its large customer base, strong position in the UK market, and brand to its proven underwriting capabilities.

The dividend grew by 7.7% last year. The yield is already 7%. So if the dividend growth rate can continue at its current level, the prospective yield a couple of years from now will be 8% and within five years, the FTSE 100 share will be yielding a juicy 9%.

Balancing risks and rewards

Current management of the company strikes me as competent and realistic. So, for the Aviva dividend to keep growing at a strong clip, the business performance will need to support it.

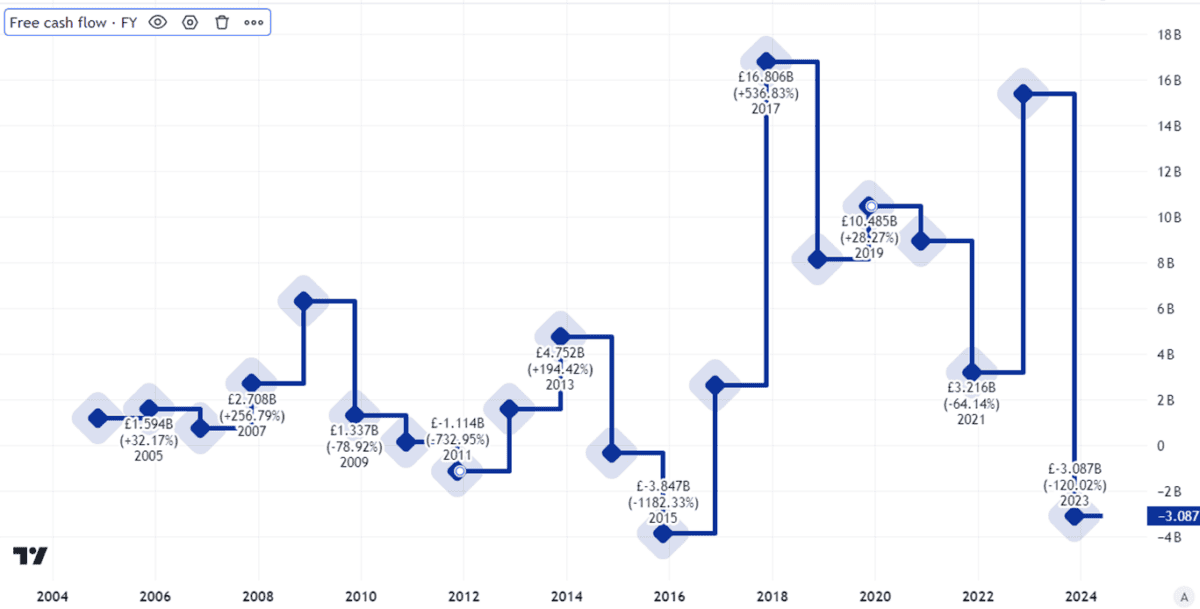

Often when looking at the sustainability of a dividend, I look at a firm’s free cash flow.

Can that help here, though? Look at the chart.

Created using TradingView

Like a lot of financial services firms (especially insurers), free cash flow does not help me as much as it could. It reflects monies coming in and out that do not necessarily illustrate the underlying health of the company.

So I pay more attention to how much surplus capital Aviva generates, as it can use that to help fund its dividend.

Here, I think things look promising. In its full-year results for last year, the company announced a share buyback. It also announced the cash cost of its dividend is set to keep growing by mid-single digits each year. That could be, for example, 5% — but as the buyback reduces the number of shares, that could mean a higher per share growth in the payout.

If I had spare cash to invest, the potential of a growing Aviva dividend would make me want to add this income share to my portfolio.