UK shares have enjoyed some impressive gains since the start of 2024. The FTSE 100’s risen 6% in value. However, these strong upward movements are fuelling fears of a potential stock market crash.

These dire warnings aren’t just coming from fringe commentators either. None other than the Bank of England has warned of a potential storm for financial markets.

On Thursday (27 June), the central bank warned prices of many assets such as shares and bonds remain high relative to historical norms, and some have continued to rise. This suggests investors in financial markets are continuing to expect the economy to recover and inflation to fall.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

They are placing less weight on risks, such as geopolitical developments or continued high inflation, that might cause weaker growth or interest rates to stay higher than expected.

These risks make it more likely that there could be a sharp correction in asset prices.

What should I do now?

Investors can take steps to protect themselves. They can do this by scouring the market for cheap stocks.

Companies that trade at a low price — whether that be relative to their earnings, assets, dividends or future cash flows (known as intrinsic value) — have a built-in cushion against losses.

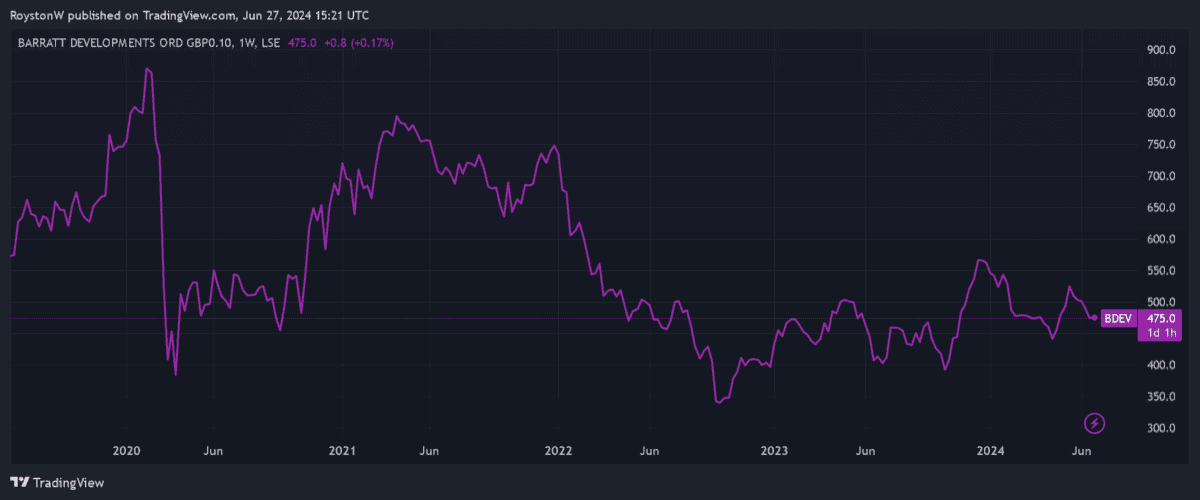

Barratt Developments (LSE:BDEV) is one such stock I’d consider buying today. It currently trades on a forward price-to-earnings growth (PEG) ratio of 0.7, below the value watermark of 1.

Meanwhile, its dividend yield for this year stands at a market-beating 4.1% for this year. This surpasses the forward average of 3.5% for FTSE 100 shares.

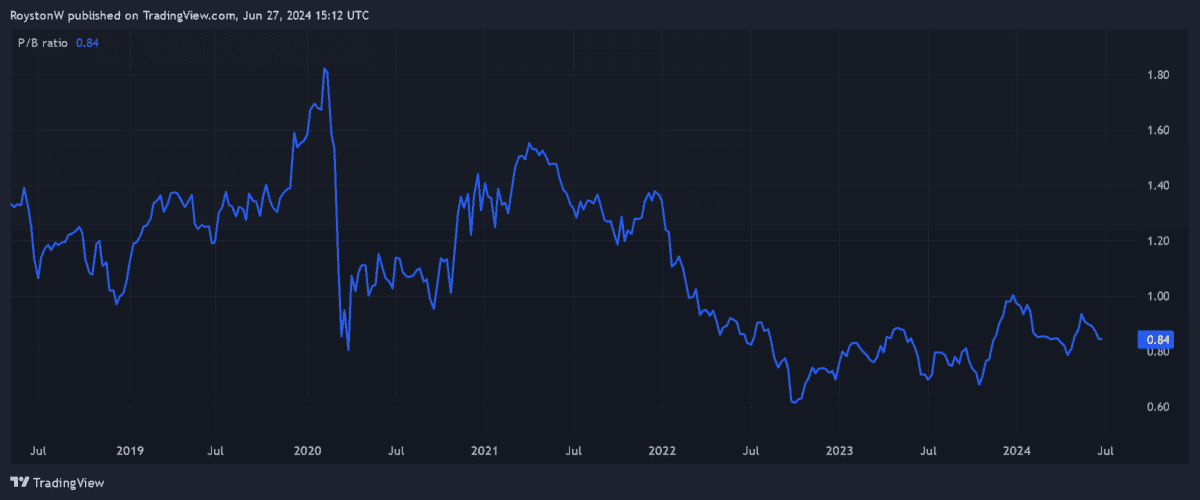

And finally, Barratt looks cheap relative to its price-to-book (P/B) ratio (see below). Like the PEG multiple, a sub-1 P/B ratio indicates that a stock is undervalued.

Bright future

Barratt could still experience some near-term turmoil if the stock market corrects. But over the long term, I believe the company has the potential to deliver exceptional returns.

But there’s risk here. Lloyds Bank chief Charlie Nunn told Sky News this week that mortgage rates of between 3.5% and 4.5% will be the “new normal” going forward. This is above 1.5-2.5% in the last decade.

An environment of higher mortgage rates would, in turn, harm newbuild sales and home prices. Yet, on balance, I still believe housebuilders like Barratt have enormous investment potential.

Demand for new homes is set to steadily grow as the population expands. This is illustrated by Labour’s pledge to build 1.5m new homes in five years.

What’s more, housebuilders’ profit margins should rise sharply as cost inflation steadily eases.

Keeping the faith

Sudden share market corrections are a constant risk. But speaking as an investor, the threat of fresh volatility isn’t enough to discourage me from buying UK shares.

Past performance is no guarantee of the future. But history shows that share prices always recover strongly from periods of extreme weakness.

The Footsie has endured several economic crises since its inception in 1984. And last month, it printed new closing highs of 8,445.80 points.

As a long-term investor, I’m prepared to accept some near-term pain to make significant eventual returns. So I’ll keep buying British stocks despite the Bank of England’s warning.