We’re now just a week away from the Britain’s next general election. If investor predictions prove accurate, we could be about to see a surge in the value of UK shares.

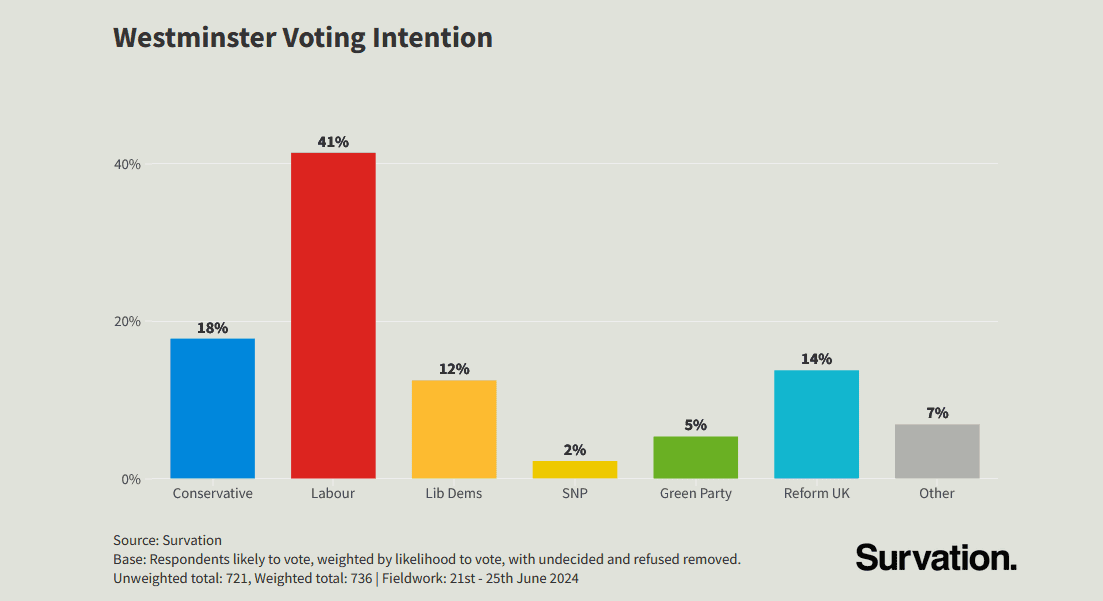

As I type, it appears the Labour Party is on course to secure a thumping House of Commons majority. A convincing win by any political party is always cheered on by the markets, thanks to the stability it provides.

The results are in!

New research suggests that many retail investors believe a Labour victory could be good for the London stock market.

Should you invest £1,000 in Bank of Georgia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bank of Georgia made the list?

According to eToro, 44% of investors think British share prices will increase if Keir Starmer enters Downing Street. That compares with 30% who believe the opposite.

There’s some historic basis for believing a new bull run could soon be upon us. Dan Moczulski, UK managing director at eToro, says that “when Labour won power in 1997 the FTSE 100 rallied by 35% over the next 12 months.”

He adds that “whilst we’re unlikely to see anything quite so dramatic this time around,” he notes that “the FTSE 100 has already returned 7% so far this year, indicating that markets are comfortable with the expected outcome of this election.”

Nothing’s certain

However, there are some important caveats for investors to remember. Past performance is no guarantee of future returns. And, right now, inflationary pressures and escalating geopolitical tension remain a threat to share prices across the globe.

It’s also important to remember that not all stocks will benefit equally from a potential Labour victory. Housebuilders like Barratt Developments and building materials suppliers like Kingfisher could benefit from a possible rise in newbuild numbers.

Increased spending on healthcare and education might also boost primary healthcare facility provider Assura and educational resources supplier Pearson respectively.

However, potential losers could be water supplier United Utilities and train operator FirstGroup, given the greater threat of re-nationalisation.

A potential riser?

Those seeking possible strong performers after the election may want to look at Greencoat UK Wind (LSE:UKW). It is one of many renewable energy stocks in the UK that could benefit from Labour’s drive to improve green investment.

According to its election manifesto, Labour plans to “work with the private sector to double onshore wind, triple solar power, and quadruple offshore wind by 2030“.

Manifesto promises famously aren’t legally binding. But the growing climate emergency means rising investment in clean energy looks a certainty, regardless of which party wins the election.

Wind turbines generated 29.4% of Britain’s electricity in 2023, according to National Grid. This was up from 26.8% a year before as wind capacity continued to sharply rise.

This doesn’t mean companies like Greencoat will deliver powerful earnings growth every year. Even a ‘supermajority’ won’t allow Labour to control the weather. So businesses will still suffer during calm periods when energy generation tails off.

But over the long term, buying renewable energy shares could offer significant returns to investors. FTSE 250-listed Greencoat has delivered a total shareholder return close to 270% over the past 12 years. This could improve significantly if Labour makes good on its green investment plans.