Speeding downhill can feel exhilarating on a bike. The same is not necessarily true in the stock market. Cycle and motoring retailer Halfords (LSE: HFD) is a case in point. Halfords shares have dipped 32% over the past year.

With the company releasing its results today (27 June), now seems like a good opportunity to look into whether that price tumble has been overdone. Could Halfords shares be a bargain to scoop up for my portfolio?

Improving sales trend

On the profit side of things, the results were not especially exciting. Still, the group remains firmly profitable, with earnings after tax of £39m. That was within 1% of what it managed last year, though underlying basic earnings per share fell 14%. Those figures are for continuing operations though. Including discontinued operations like Halfords’ tyre supply chain operation, profit before tax fell 45% to £20m.

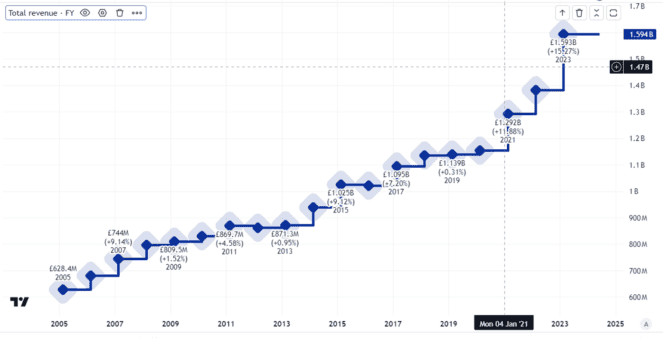

The good news though came in the topline. Revenues rose 8%, driven by an 18% increase in Halfords’ autocentres division.

This continues a long trend of impressive revenue growth at the company.

Created using TradingView

I think that bodes well for the business, as it shows ongoing high customer demand. That will hopefully be the basis for long-term profitability.

One general concern I have about investing in retailers is that profit margins can be slight. Including discontinued operations, Halfords’ gross margin last year was 48.2%, but its net margin (profit after tax as a percentage of revenue) was just 1%. That is wafer thin.

Uncertain dividend

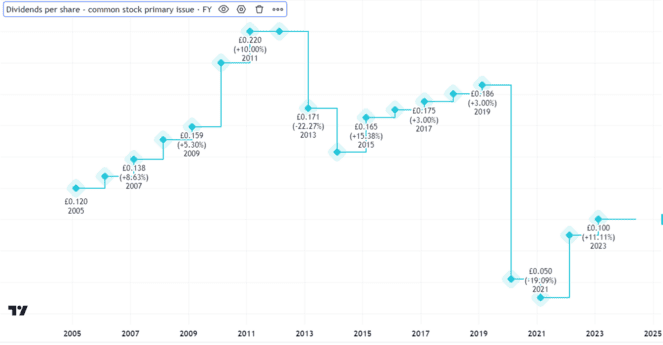

The final results contained the news that the business plans to cut its annual dividend by a fifth compared to last year.

With a yield standing at 7%, cutting the dividend by a fifth could still leave it at over 5%. Still, I rarely take a dividend cut as a positive sign. Halfords’ dividend has been all over the place over the past 20 years.

Created using TradingView

So when weighing up the option of investing now, I am not focusing too much on the historical yield. If the restructuring pays off and earnings boom next year, the dividend could well move up again. Equally, the board has shown it has no compunction about cutting the shareholder payout.

Long-term potential

With a restructured business, could Halfords shares do better in future than they have in the past year?I think the business should benefit from strong long-term customer demand. It is a well-recognised brand and shop network could help it capitalise on that. Its price-to-earnings ratio of 11 does not look expensive.

That said, while cars and bicycles may have a lot of moving parts, I fear the same is true of Halfords’ business. There has been a lack of consistency in its long-term performance that concerns me. So while I think the shares look fairly priced, I do not plan to buy.