The Bunzl (LSE:BNZL) share price has risen by a whopping 88% over the past decade. And while it’s down since the start of 2024, the company is staging a comeback as sales and margins show signs of recovery.

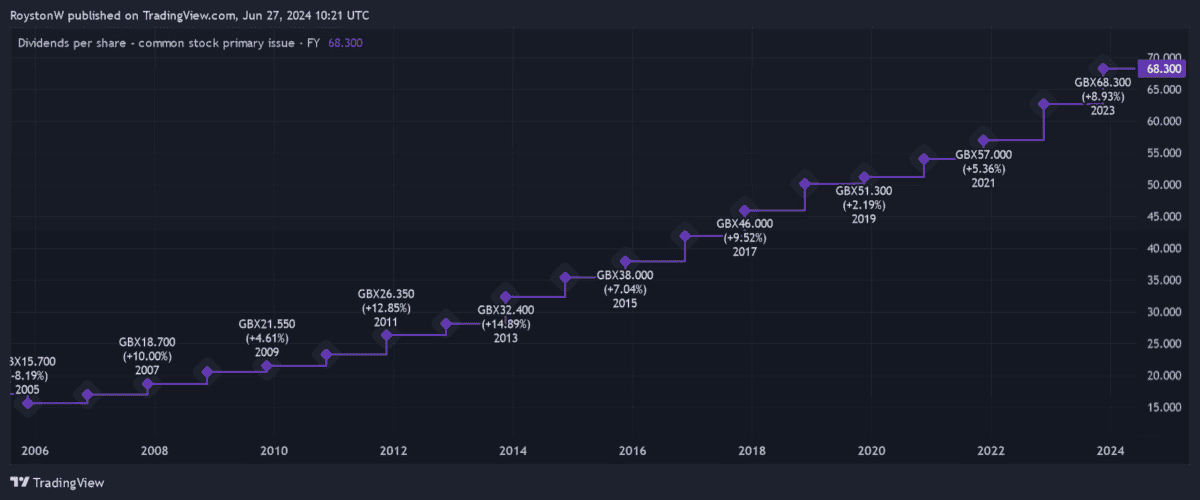

I’m looking for the best passive income shares to buy in July. And Bunzl — with its 31 straight years of dividend growth — is near the top of my shopping list.

In fact, following an excellent trading statement today (27 June), I may finally be about to pull the trigger. Here’s why.

A stable performer

Support services giant Bunzl sells a wide range of essential products to a variety of sectors across the globe. This includes food packaging to supermarkets, disinfectant to cleaning businesses, gloves to medical professionals, and hard hards to construction companies.

Put simply, its provision of everyday goods and services helps the world go round. As a result, earnings tend to be stable at all points of the economic cycle, which in turn gives Bunzl the strength and the confidence to deliver that long-term dividend growth I mentioned above.

Profit upgrade

But the company hasn’t had it all its own way more recently. Weak trading in North America has impacted revenues and margins, and this remains a threat if interest rates fail to meaningfully backtrack from current levels.

Bunzl confirmed today that sales are likely to have dipped 3% to 4% in the first half, or 0% to 1% at stable currencies. It said that “volume reductions and deflation in our US business” will likely drive revenues lower.

However, a sharp uptick in operating margins is helping to offset this problem. Indeed, Bunzl said margins are now expected to beat 2023’s levels, which in turn prompted the firm to raise its earnings forecasts for the full year.

It said that effective margin management and the benefit of acquisitions mean that “good margin growth is expected in North America in the first half of the year and very strong margin growth in the UK & Ireland and Rest of the World.”

Bunzl also said it now expects to announce “robust revenue growth” at constant currencies for the full year.

Dividend growth

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2023 | 68.3p | + 8.9% | 2.2% |

| 2024 | 72p (f) | + 5.4% | 2.3% |

| 2025 | 76p (f) | + 5.6% | 2.5% |

| 2026 | 79.3p (f) | + 4.3% | 2.6% |

So what dooes this update mean for future dividends? Well, City analysts were expecting payouts to continue rising before Thursday’s update, as shown in the table above. Today’s news is sure to reinforce their bullish estimates.

On the downside, brokers think dividends will grow at a more modest rate than in previous years. The payouts on Bunzl shares have risen at a compound rate of around 9% since 1992.

Nonetheless, dividend growth is expected to outpace that of the broader FTSE 100. For instance, AJ Bell projects a modest 2.3% rise in cash rewards (including special dividends) for 2024. This is less than half the growth rate brokers anticipate for Bunzl’s dividends this year.

And if the business can keep its recent momentum going, analysts might actually upgrade their dividend forecasts for the short-to-medium term. I think dividend chasers should give Bunzl shares a close look right now.