Stock markets never move in a straight line. But over the long term, investing in FTSE 100 and FTSE 250 shares has proved time and again to be an effective way to build wealth.

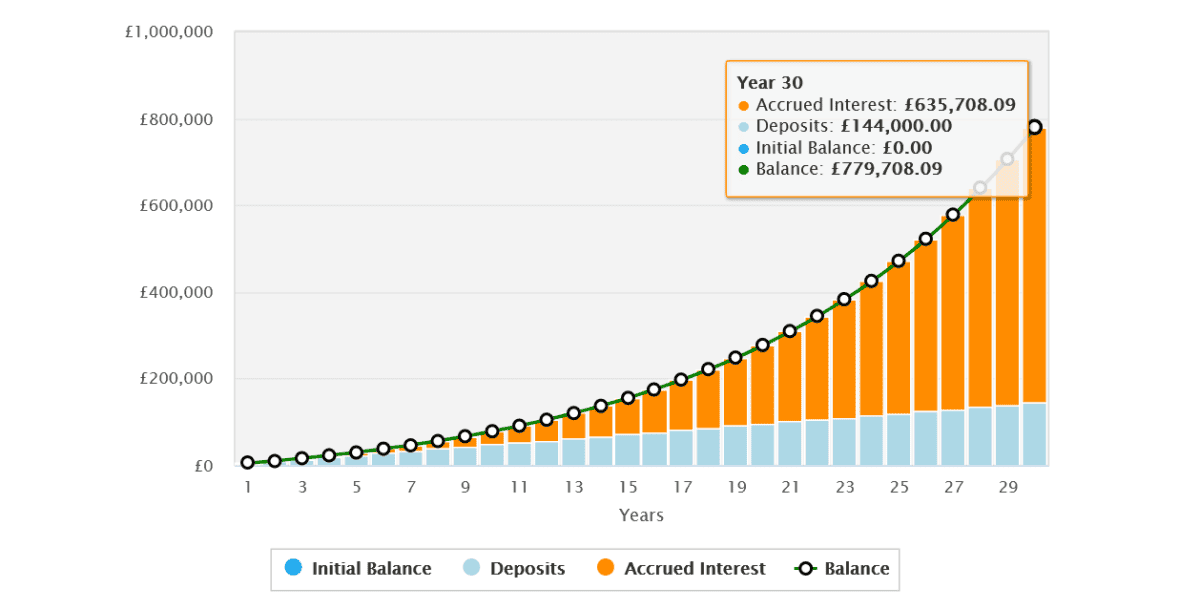

Averaged out, the FTSE 100 and FTSE 250 indexes have delivered an average annual return of 9.3% since the early 1990s. Based on this figure, someone who invested £400 a month for the last 30 years could have made a brilliant £779,708 to retire on.

I’m confident these long-term records will last. But which shares would I buy to target a nest egg for my retirement?

Market growth

Defence shares like BAE Systems (LSE:BA.) could provide significant returns as the world embarks on what looks like a new cold war.

The firm has had significant share price gains since early 2022. And I believe the bull run has much further to run following Russia’s invasion of Ukraine.

Countries across the West are ramping up military spending, in what some describe as the most dangerous decade since World War II. Fears over Russian and Chinese expansionism are fuelling growth in defence budgets. Lasting concerns over the Middle East and terrorist threats are also supporting arms demand.

In the UK, both the Conservatives and Labour have pledged to lift defence spending as a proportion of GDP, to 2.5%. Spending is also steadily increasing in the US, the world’s biggest military power.

Sales soar

As a top-tier supplier to both countries, BAE Systems is already reporting a significant uplift in demand. It enjoyed £600m worth of new orders in 2023, which in turn pushed its order backlog to a record £69.8bn.

And the company plays a critical role in some of the world’s biggest defence programmes. As a major submarine builder, for instance, its technology will provide a vital role in AUKUS security pact between the US, UK, and Australia. The total cost of the programme is estimated at $268bn-$368bn up until 2050.

For the near term, BAE has predicted sales growth of 10% to 12% this year, up from 9% last year. Underlying earnings before interest and tax (EBIT) are therefore tipped to increase between 11% and 13%.

On the downside, I am concerned about the growing threat of supply chain issues for defence companies like this. This week Airbus issued a profit warning on account of “persistent” problems sourcing parts. Enginebuilder Rolls-Royce has also cautioned of “continued industry-wide supply chain challenges” in recent weeks.

Reassuringly expensive

Any problems here could have significant consequences for BAE Systems’ share price. Its 140%-plus rise since the start of 2022 leaves it trading on a high price-to-earnings (P/E) ratio of 22.2 times.

This is well above the company’s five-year average of 15 times. And it means investors could charge for the exits if any bad news comes down the line.

Still, I think BAE shares are worth this premium valuation. A strong track record of execution, expertise across many sectors, and robust market outlook means its share price could continue rocketing.