Electric appliance retailer AO World (LSE: AO) has been on a stock market rollercoaster ride in the past few years. After listing at £2.85 in 2014, the AO World share price hit £4.12 on its first day of trading, before falling to less than one seventh of that by April 2020.

The following year it hit £4.29, before losing over 90% of its value by 2022. Over the past year, the shares are up 36%.

With the company having released its final results today (26 June), I have been looking at whether I ought to add the company to my portfolio in the hope of the AO World share price hitting its old highs above £4 again.

Sales are down, but profits are up

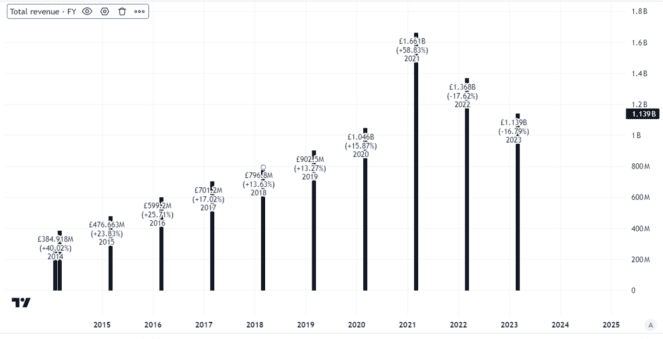

Last year saw revenues fall 9% to £1.0bn. That follows a recent trend of declining revenues for the company after years of steadily increasing sales prior to the pandemic.

Created using TradingView

The consistently declining sales trend is a clear concern to me. However, sales are still above where they were before the pandemic, even though they are well below their pandemic peak.

In part, those declining sales reflect an increased focus on profitability. The company says it has made a “strategic pivot to focus on profit and cash generation”. That has included moves like exiting the German market and controlling overheads.

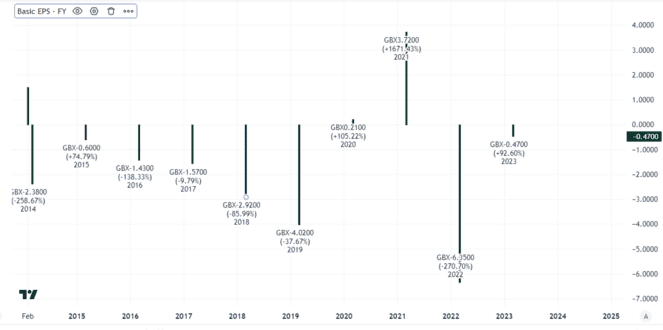

The push for profitability seems to be working. Last year, basic earnings per share nearly quadrupled to 4.3p. That is the best performance since listing.

Created using TradingView

Investment case looks more attractive

Declining revenues concern me as in the long term, I think mass market retail is about selling high volumes. But getting rid of some unprofitable sales to boost earnings can make good financial sense, as I think AO World’s performance last year clearly demonstrates.

Net debt more than halved to £31m. The UK business increased its cash inflow to £22m. On the strategic priorities of improving profitability and cashflows, I think the business is headed in the right direction.

For the current year, the company expects to deliver double-digit revenue growth and adjusted profit before tax of £36m-£41m. That would be an improvement on last year’s adjusted profit before tax of £34m.

With a sizeable customer base, more focused operation and competitive position in a market area that will see long-term demand, I am positive about the investment case for AO World.

High P/E ratio

Still, even with the much stronger basic earnings per share, the company is trading on a price-to-earnings (P/E) ratio of 27, which I see as expensive.

Hitting a £4 share price implies a prospective P/E ratio of 93. For a home appliances retailer with fairly modest profitability that strikes me as far too pricey.

After all, net profit margin last year was just 2.4%. If a competitor – and there are many – decides to discount heavily, AO World risks losing sales, or else cutting its already thin profit margins.

The expected growth in adjusted profit before tax this year is not necessarily the same as a growth in earnings. For now, at least, I think the shares are pricy as they are. I would be shocked if they hit £4 any time soon and have no plans to invest.