A yield of 9.8% is a rare treat. It would mean that, if I invested £1,000 today and the dividend stayed the same, I should earn £98 per year in passive income. Even better, if I compounded the dividends at 9.8% annually, after 20 years my £1,000 investment today ought to be worth over £7,000. That explains why I have been weighing up some pros and cons of a FTSE 250 share that yields 9.8%.

But should I buy?

Well-known financial services provider

The share in question is abrdn (LSE: ABDN). It strikes me as a ludicrous name. Despite that, this is a serious, proven business.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

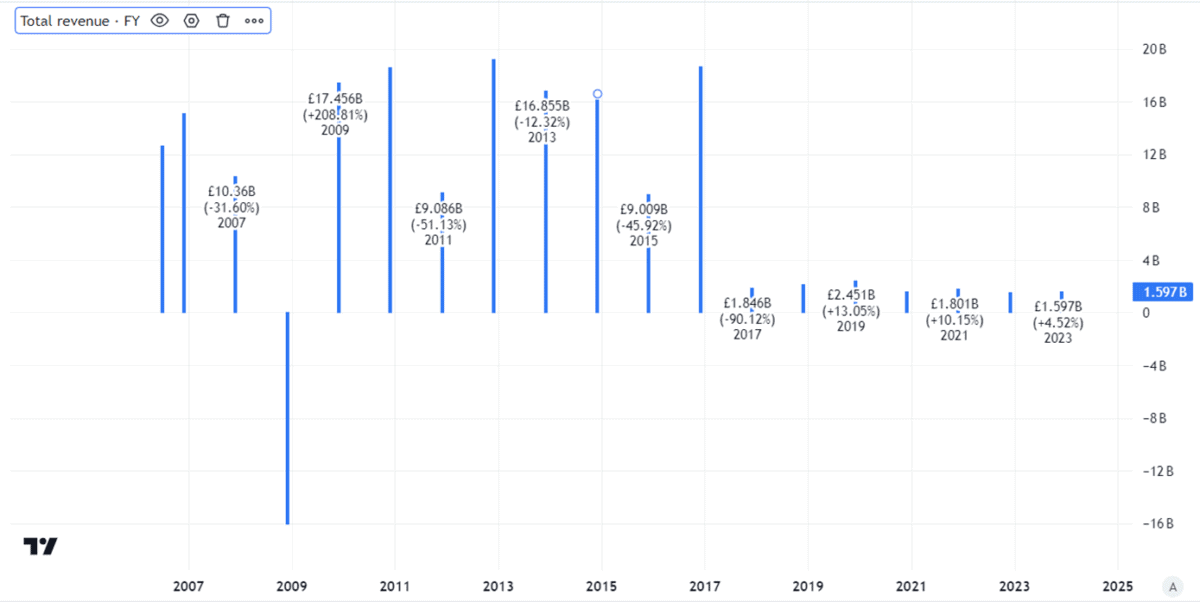

Last year, revenues weighed in at £1.5bn. The company has a large customer base. Its subsidiary, ii (again, a daft name), alone has over 400,000 customers.

Still, revenues are a fraction of what they once were.

Created using TradingView

Partly that reflects the fact that this is a very different business to what it used to be, after multiple rounds of restructuring.

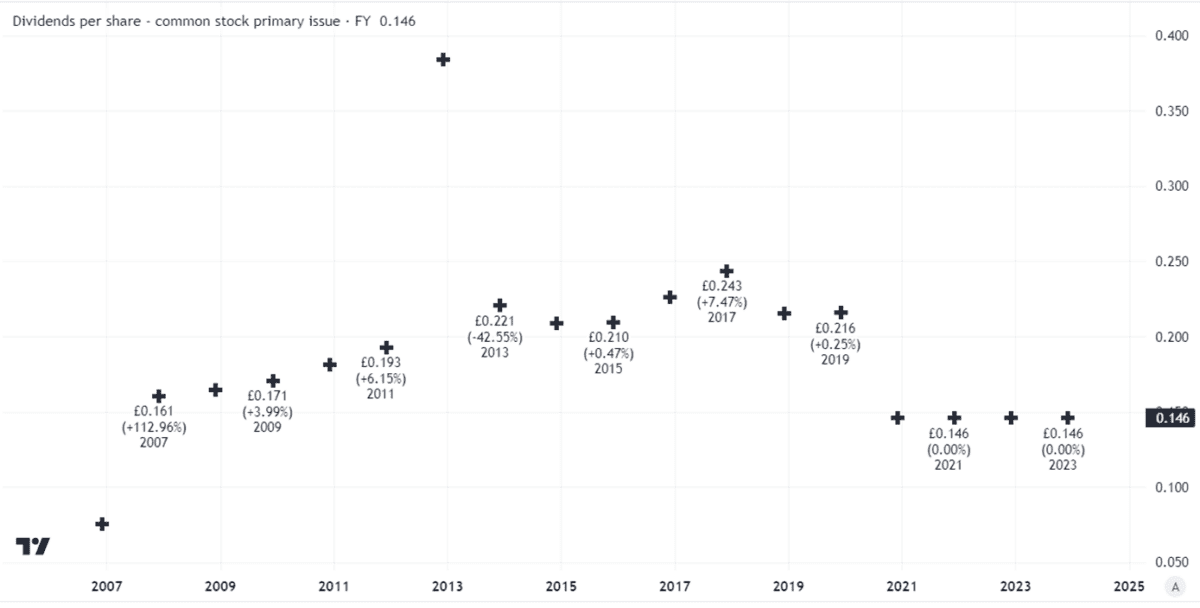

But uneven and often weak business performance has taken its toll on the dividend.

While the yield of 9.8% is attractive, the payout per share has been flat for years — and was cut significantly in 2020.

That is not typically a sign of a company in the pink (another company that cut its dividend then held it flat for years is Vodafone, which this year announced plans to halve its payout per share).

Potential for ongoing juicy yield

Still, what matters now is not the past but the future. Can the FTSE 250 investment manager maintain its payout?

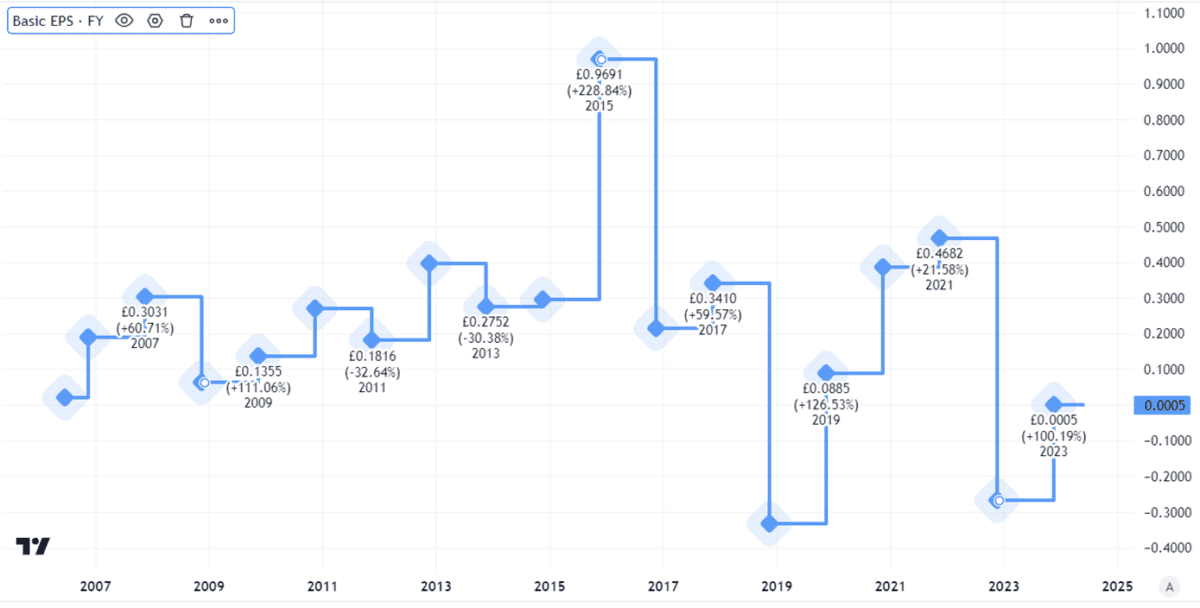

Earnings per share have moved around a lot, and in several recent years have not covered the dividend.

Created using TradingView

But the company has been focusing on improving its performance, reshaping itself and also cutting costs. Share buybacks mean that the total cost of the annual dividend at its current level has fallen to £267m. That is covered 1.1 times by the level of adjusted capital generation achieved last year.

That is narrow coverage — but sufficient.

If the company can increase its capital generation, it could maintain the dividend at its current level, though I would be surprised to see an increase any time soon.

Risks and rewards

There is ongoing work to be done here.

One risk I see is that the cost-cutting programme backfires. You cannot cut your way to growth, as the old saying goes. Maybe a leaner cost base will help earnings (and dividend cover) grow, but I would also like to see ongoing revenue growth as a sign that the business is moving in the right direction.

abrdn definitely faces risks. But the elevated yield reflects that, in my view. So too does a share price down 50% in five years.

If I had spare cash to invest, mindful of those risks, I would still be happy to tuck this FTSE 250 share into my portfolio.