Having a second retirement income in addition to a pension is the dream of many. But rather than waiting to win the lottery, I believe a strategic UK share portfolio could be one way to achieve this. And unlike buying property, stock investing doesn’t require a lot of cash to get started.

Plus, history shows evidence of equities’ impressive long-term returns, often exceeding other options.

Imagine turning a mere £5,000 investment into a self-sustaining income stream of over £1,000 every month. Sounds fantastical, right? Well, buckle up, because I’m about to unveil my plan to try and make this dream a reality!

Select an investment account

I think the best option for UK citizens is to open a Stocks and Shares ISA. With this product, users can invest in a wide range of assets up to £20,000 a year with no tax obligations on the capital gains. It’s probably one of the best ways to get the most out of a portfolio of stocks.

Other investors solely focused on retirement may prefer a Self-Invested Personal Pension (SIPP), allowing up to £60,000 a year. But remember, this money is locked up until retirement.

Both options are a great way to invest tax-free in stocks and shares to build a second income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Choosing the best-performing shares

I don’t know anybody with a crystal ball that can predict the best stocks to buy. Nobody truly knows for sure exactly which shares will outperform others. But there are ways to make better-informed choices.

There’s a common disclaimer used in finance: “Past performance is no indication of future results.” That may be true. But I still find that established companies with a good history have a better chance of performing well.

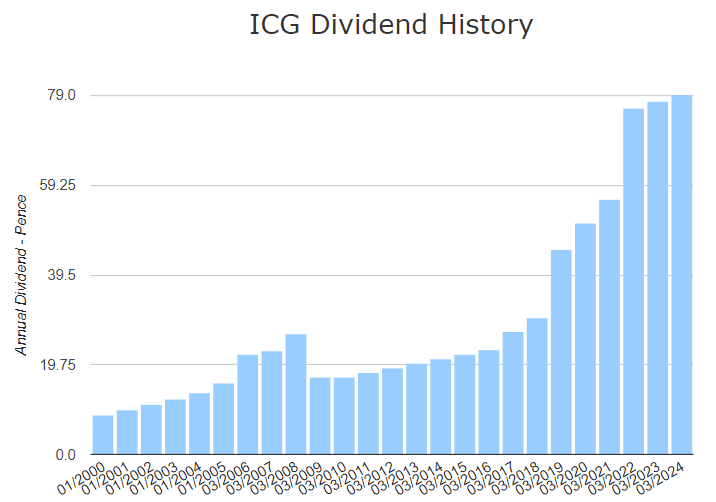

That’s why I look at a company’s payment history when considering stocks for dividends. Take the UK-based private equity investment firm Intermediate Capital Group (LSE: ICG) for example.

Other than a brief reduction in 2009, this FTSE 100 constituent has been paying a consistently increasing dividend for 24 years. From 8.65p per share in 2000, the dividend has increased to 79p per share this year. In just the past 10 years, it’s grown at a compound annual growth rate (CAGR) of 14.17%.

And it’s not just dividends. In the same period, the share price has increased by 787.4%, representing an annualised return of 9.52% per year.

So £5,000 invested into a stock with those returns could grow to £145,635 in 22 years. Assuming the dividends continue to grow as they have been, that amount would pay out £12,898 in annual dividends — over £1,000 a month.

But private equity can be risky.

It’s heavily reliant on global markets performing well. A financial crash or recession could hurt the share price and dividend payments, which happened in 2008 and 2020. If interest rates remain high it could drive up borrowing costs and dampen market sentiment.

The share price has also shot up in recent years, suggesting it may be overvalued and could experience a reversal soon. The company is valued at £6.4bn but doesn’t have a lot of cash to cover its £1.49bn debt.

Still, I think it’s a good example of a long-term, reliable dividend payer. As such, I think it’s worth considering as part of a portfolio of income shares aimed at building wealth for retirement.