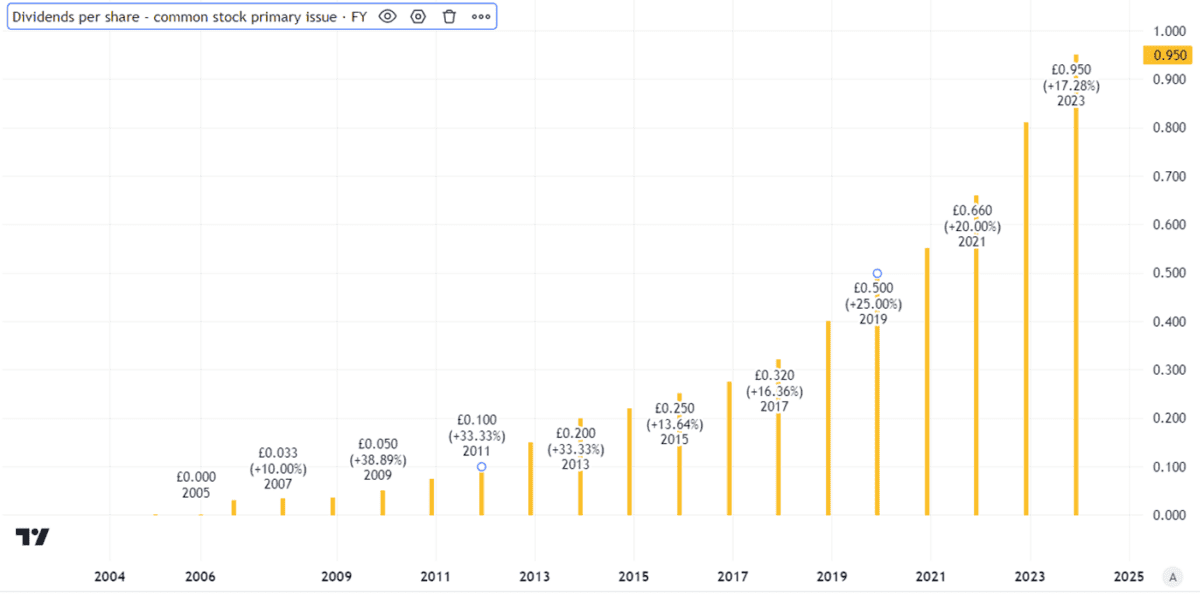

When it comes to income shares, a high yield can look attractive. But dividends are never guaranteed, so it is also important to consider how likely the dividend per share is to move up, down, or stay the same.

One UK share last year raised its dividend per share by 25%. That followed 23% growth the prior year – and 20% the year before that.

As I weigh whether to buy it for my portfolio, I wonder whether such double-digit increases can keep coming?

Impressive track record of shareholder payouts

The company in question is lab measurement tool specialist Judges Scientific (LSE: JDG). Its track record of dividend increases speaks for itself.

Created using TradingView

The business model that underpins that impressive run of dividend growth is simple but attractive.

By buying up small and medium-sized specialist instrument manufacturers then improving their cost efficiency (for example, by offering some shared services centrally), Judges is able to make a decent profit.

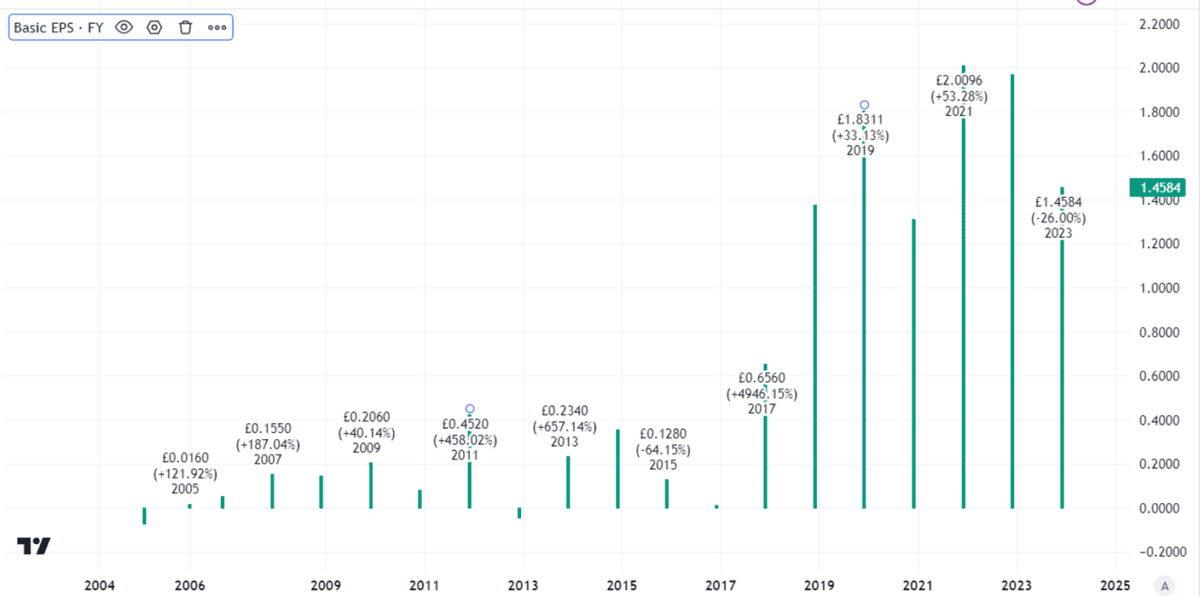

Not only have total profits grown sharply in the past decade, so have basic earnings per share.

Created using TradingView

That demonstrates the company has been growing how much it makes for each share, giving it space to grow the dividend. As shares are often priced based on their earnings, among other things, it has also been good for the Judges Scientific share price. That has risen 165% over the past five years.

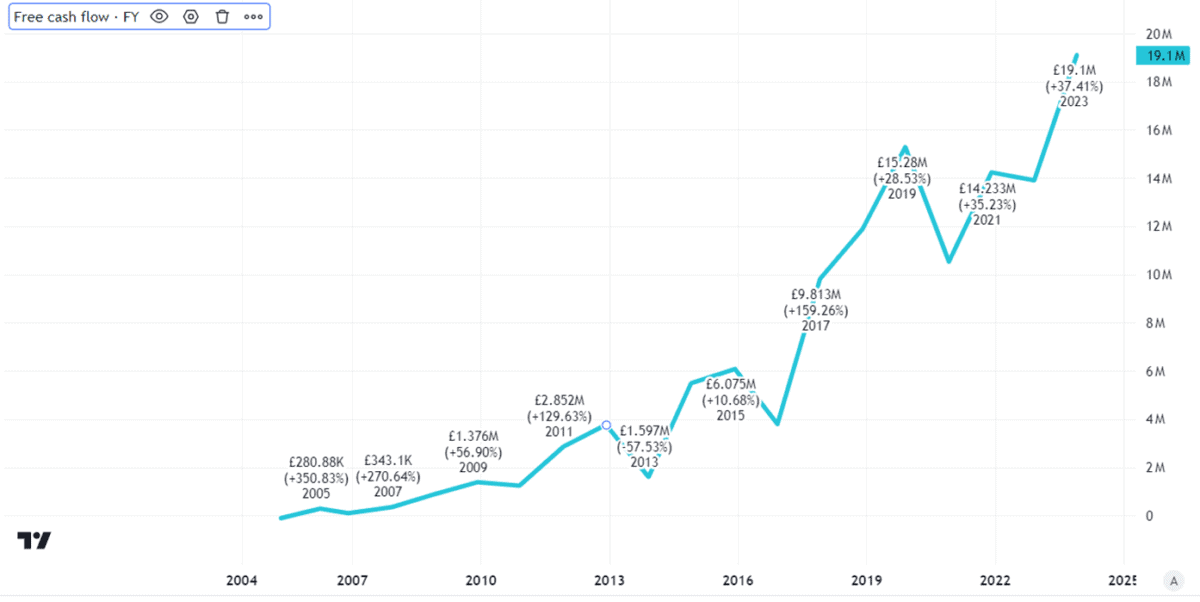

Strong cash flows could support ongoing dividend growth

But past performance is not necessarily a guide to what may happen in future. On top of that, while earnings are important, over the long run what a company needs to pay dividends is hard cash. So, when looking at income shares, I always dig into their free cash flows as well as earnings.

Judges has been growing organically but also through acquisitions. One risk is overpaying for an acquisition, putting stress on its balance sheet if it borrows to buy a firm then later realises that the deal did not generate the sort of returns anticipated. Statutory net debt at the end of last year was £52m. That may not sound much, but five years ago the business was net debt-free.

Looking at free cash flows, though, I reckon the enterprise’s growth strategy has been paying off handsomely.

Created using TradingView

If it can keep wringing efficiencies out of its existing businesses as well as grow through smartly picked and attractively priced acquisitions, I think the company could continue to grow its dividend in years to come.

Since its first dividend in 2006, the payout per share has grown at a compound annual rate of 23%. I think the dividends could keep getting bigger from here.

Why I’m not buying

The very success of the business model poses a risk. Others might try to copy it. Even if they do not succeed, having a bigger pool of bidders could push up the price of acquisitions for Judges.

That is not why I am not buying, though. I am bullish about Judges – I just don’t like the price of this income share.

It currently trades at 64 times earnings. I am waiting for a serious pullback in price before buying.