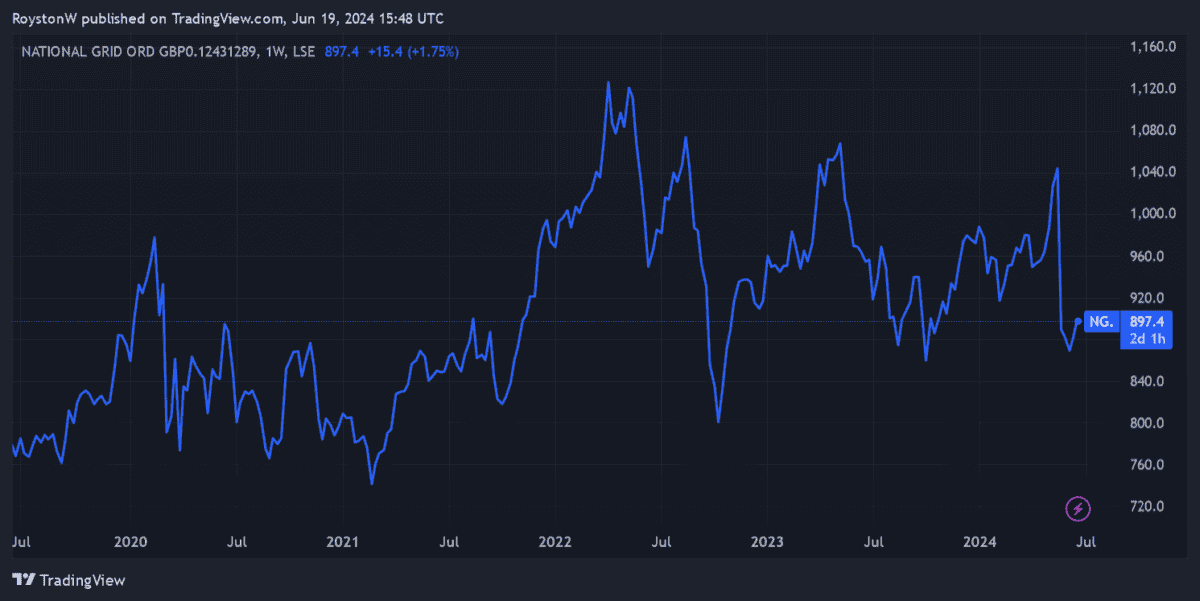

National Grid (LSE:NG.) is often described as one of the most stable shares that one can buy for a long-term portfolio. The company’s reputation took a battering in May, though, as it announced a mammoth £7bn rights issue, along with a rebasement of the dividend, to help it achieve its green growth strategy.

National Grid’s share price plummeted 16% as a result. And it remains anchored around recent lows as investor confidence in the stock has dropped.

I believe the FTSE 100 business is now worth serious consideration by share pickers. Here are three reasons why.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Reason 1: supreme stability

It’s understandable why National Grid shares have slumped so badly. Share dilution tends to be severely frowned upon by investors.

But this is not all. The transmission business is most popular with its investors due to its credentials as a dividend stock. With the payment reduced, its reputation as a top dividend stock has received a hammerblow.

Yet on balance, I believe National Grid remains an exceptional S.W.A.N. (or Sleep Well At Night) stock. Its essential functions mean it can bank on steady earnings and robust cash flows at all points of the economic cycle.

What’s more, under current Ofgem regulations it has a monopoly on what it does. This is one of the greatest economic moats (as Warren Buffett puts it) that a business can have to defend profits.

Combined, these qualities make National Grid shares a great way for investors to manage risk.

Reason 2: going green

As that announced rights issue shows, building infrastructure for the green revolution is hugely expensive. Under current plans, National Grid will spend £60bn during the five years to March 2029. This is around double what it spent in the previous half decade.

There’s always a risk that costs could overrun, too, resulting in further rights issues or a sharp rise in debt. However, the potential boost to long-term earnings could also be spectacular as demand for renewable energy picks up.

National Grid expects its asset base to expand at a compound annual growth rate (CAGR) of 10% between 2024 and 2029. With electricity consumption in the UK tipped to double between now and 2050, this strategy could be considered a no-brainer.

Reason 3: stunning value

The slumping National Grid share price means the business looks ultra-cheap right now.

At 897.4p per share, they trade on a trailing price-to-earnings (P/E) ratio of 12.8 times. This is far below the five-year average, which comes in at around 19 times.

On top of this, the grid operator continues to offer a market-dividend yield, despite those plans to trim shareholder payouts. For this financial year (to March 2025) the yield stands at 5.4%.

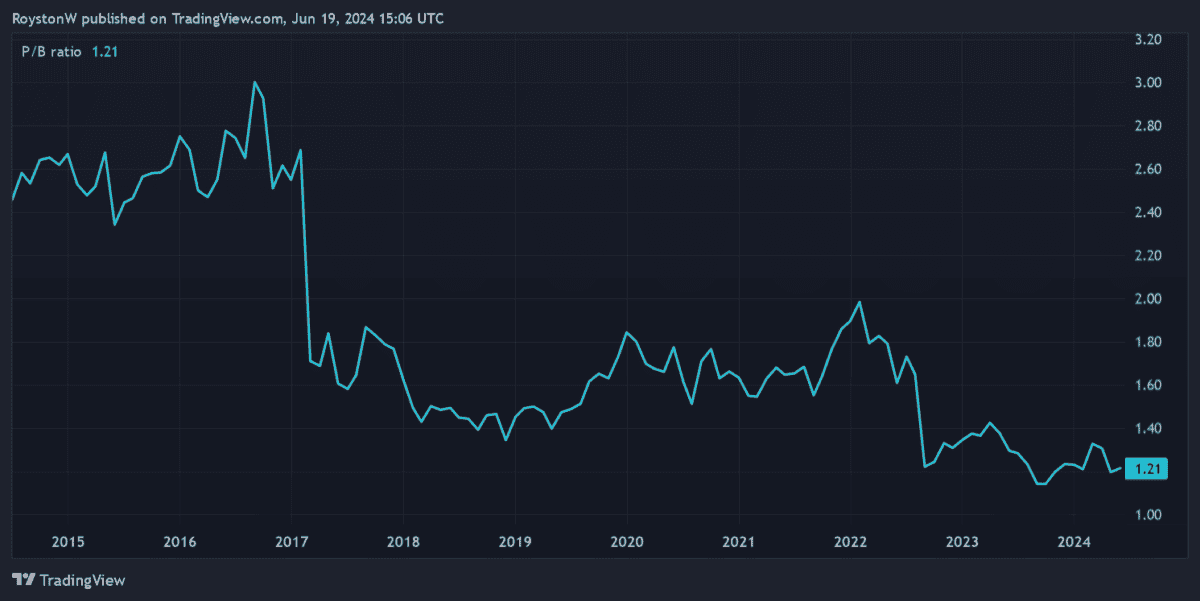

And finally, National Grid’s price-to-book (P/B) ratio has tumbled back towards late 2023’s troughs, as shown in the chart above. At 1.2 times, it now fails to reflect qualities such as the firm’s large asset portfolio, regulated operations, and stable earnings and cash flows.

While it isn’t without risk, I think National Grid shares are worth a close look at today’s prices.