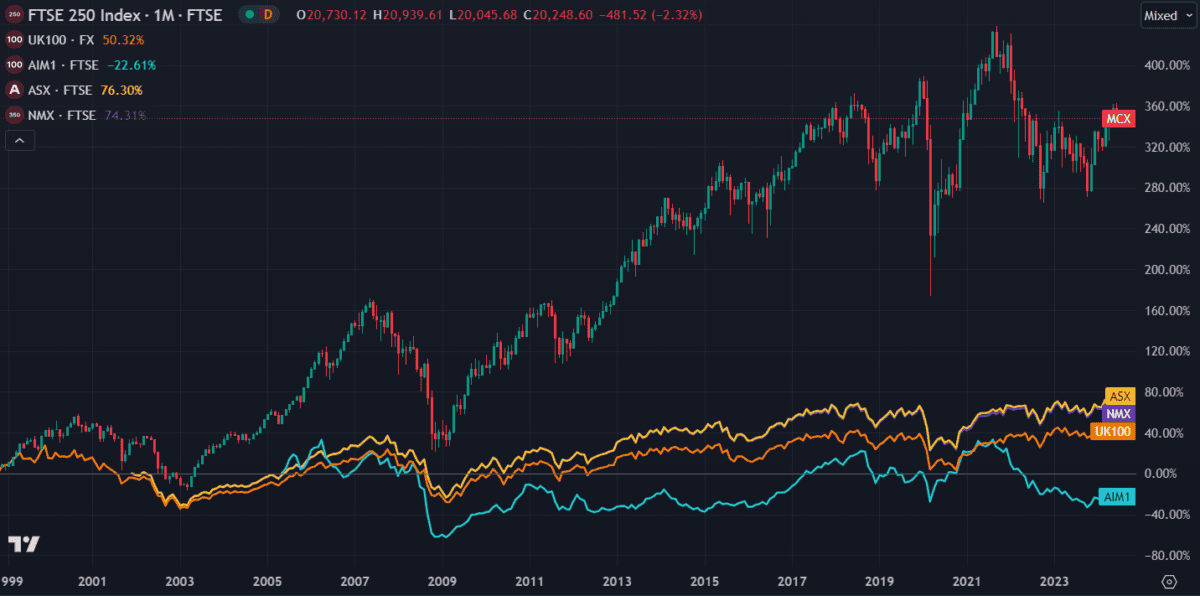

The value in the FTSE 250 should not be overlooked. The index has outperformed all other UK indexes in the past 20 years. From major leader FTSE 100 to the tiny FTSE Small Cap, the 250 is the clear winner across the board.

But with the combined value of its listings now so high, is there still benefit from investing in it?

Pros and Cons

Investing in the UK’s second-largest index has its advantages and disadvantages. Due to the smaller market caps of the listings, there’s a higher chance of volatility. And with less exposure to international markets, they’re at the whim of the local economy. This makes the 250 more risky in times of economic uncertainty.

Should you invest £1,000 in Currys Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Currys Plc made the list?

But it benefits too.

Emerging tech stocks can make a killing. Take online review site Trustpilot — it’s on a tear lately, up 166% in the past year. Or Indivior, the upcoming pharma giant that split from Reckitt in the 90s — it’s up 485% in five years!

But while those shareholders celebrate, I’m more interested in a heavily undervalued stock. One that I think could climb 500% in the next few years.

Currys

What use is all this new ground breaking tech if there are no stores to market it, right? Despite a humble £867m market cap, Currys (LSE:CURY) is one of the UK’s best-known UK high street electronics retailers. But the surging popularity of online shopping sent its profits spiralling in the late 2010s. Between 2016 and 2020, the company’s shares lost over 70% of their value — and much of that was BEFORE Covid!

But now the stock looks ready to skyrocket again.

Since hitting a 15-year low of 43p late last year, the shares recovered an impressive 75%. And they’re still a far way off the company’s dizzying all-time high of 500p. So is increasing foot traffic on British high streets turning the tide for the struggling retailer?

I think so.

There’s no denying that online shopping is the future. But there’s still a place for physical shops. I never buy clothes online and I like to feel new tech in my hands before buying. Currys recently conducted research that found online shoppers frequently buy inaccurate or unsuitable items. Subsequently, almost half of consumers prefer to receive guidance from in-store staff before buying.

This trend is reflected in its own e-commerce platform. Online sales saw a significant spike during lockdown but have since returned to pre-pandemic levels. With foot traffic increasing, Currys returned to profit last year and earnings are expected to keep growing.

Based on future cash flow estimates, the shares may be undervalued by 60%.

Still, there are risks.

Earlier this year, Currys turned down two takeover bids from US investment firm Elliott and a third from Chinese e-commerce giant JD.com. Back then, interest rate cuts seemed imminent and the economy was looking strong. But now things are less certain. If the company fails to deliver results now, shareholders could signal their displeasure that the bods were rejected.

For now it’s holding strong. If it continues to deliver strong results, I think it might regain pre-Covid highs around 400p in the next 10 years — a 500% gain. That’s why the shares are on the top of my buying list for July.