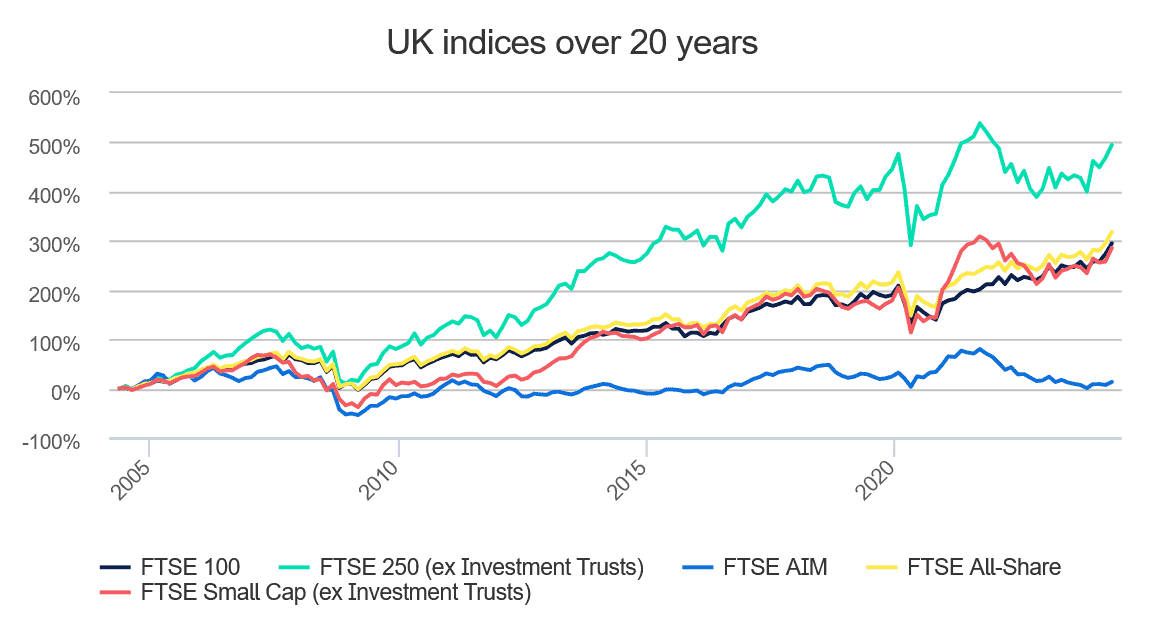

Investing in FTSE 100 shares can have its advantages and disadvantages. Britain’s premier share index has delivered weaker long-term returns than the FTSE 250, as the graph from Hargreaves Lansdown below shows.

But you can also see that the Footsie still has the capacity to deliver impressive returns. Indeed, the graph shows the index has delivered a return of around 300% during the past two decades.

Importantly, the FTSE 100 also tends to exhibit significantly less volatility compared to other indices on the London Stock Exchange, including the FTSE 250.

ETFs vs individual shares

There are a couple of ways I can try to make this sort of impressive return. I can invest in an exchange-traded fund (ETF), which tracks the broader performance of the index.

One example is the iShares Core FTSE 100 UCITS ETF. Products like this help me to manage risk by investing across the whole index. But there’s some downside to just investing in a Footsie tracker fund.

These ETFs contain stocks that I as an investor may be keen to avoid. An ESG investor, for instance, may be turned off by the idea of owning shares in oil producer BP and cigarette manufacturer Imperial Brands.

Additionally, since these ETFs aim to replicate the FTSE 100, they lack the potential to outperform the broader market. By investing in individual shares, I have the opportunity to achieve higher returns if these companies perform well.

A top FTSE 100 stock

One share I’m tipping to deliver market-beating returns is Ashtead Group (LSE:AHT). I already own it in my Self-Invested Personal Pension (SIPP). And after recent price weakness I’m considering adding to my holdings.

Ashtead is one of the largest rental equipment suppliers in North America. In fact, it’s second only to United Rentals, where it supplies hardware to a broad range of sectors including construction, emergency response, and entertainment and events.

Past performance isn’t always a reliable guide as what to expect. But the company’s delivered a stunning return of 35,219% in the 20 years to 2024, according to Hargreaves Lansdown, as its share price exploded and dividends steadily grew.

I feel too that Ashtead can continue comfortably outperforming the broader index during the next two decades. That’s even though it faces some softness in end markets in the near term (this week, it warned that sales growth would cool to between 5% and 8% this year).

Bright future

Ashtead has multiple things in its favour. Equipment users are increasingly favouring rental over straight-out ownership. The company looks set to exploit this change too, as the North American construction sector grows, and the next generation of US mega-projects come online.

It also has considerable scope to continue growing through acquisitions. The rental market remains highly fragmented and last year the business acquired 26 businesses for $905m.

It’s worth keeping an eye on the company’s rising debt pile as it could limit future acquisitions. Its net debt to EBITDA ratio rose to 1.7 times last year, from 1.6 times.

That said, Ashtead’s balance sheet remains broadly robust with that ratio remaining within target, below 2 times. In my opinion, this FTSE 100 share has the tools to continue delivering market-beating returns looking ahead.