Most people would love to have an extra grand a month in passive income. I most certainly would, which is why I regularly invest in dividend stocks.

Here, I’ll set out a realistic five-step road map to aim for this goal.

1. Build a solid base

Warren Buffett’s right-hand man, the late Charlie Munger, famously said: “The first rule of compounding: Never interrupt it unnecessarily.”

This is something I struggled with when I was younger. Unwittingly driven by FOMO (fear of missing out), I wanted to invest as much as possible to fully maximise any upward moves in the stock market.

However, once a large expense inevitably cropped up, I had to dip into my portfolio and sell shares –sometimes at a loss — to cover the payment. I was breaking Munger’s first rule of the wealth-building process.

Therefore, it’s important to first have a rainy-day fund to cover such expenses and leave the portfolio uninterrupted.

2. Open the right account

Next, I’d make sure I’m investing in the most tax-efficient account possible.

In the UK, this would be a Stocks and Shares ISA, as dividends and interest are free from income tax, while any capital gains are exempt from capital gains tax.

Annual ISA contributions are currently capped at £20,000 per year. However, that is more than enough to build a sizeable second income, as we’ll see below.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

3. Buy top-notch shares

Once I’m ready to buy shares, I’d focus on researching and investing in established companies with a solid track record of generating profits. I’d avoid risky biotech start-ups and speculative penny stocks.

One that I think would make a great starter stock today is Diageo (LSE: DGE). This is the world’s largest spirits company, with a portfolio of world-class premium brands like Smirnoff, Guinness, Johnnie Walker, Don Julio tequila, and Baileys cream liqueur.

Mind you, this hasn’t stopped the FTSE 100 stock from falling 23% in the past year alone!

The reason is that some consumers, especially in North and Latin America, have been trading down from the firm’s premiums brands, hurting profits. This is understandable considering how high inflation has ripped a hole in people’s budgets.

Weak consumer spending is the main risk with the stock today. We don’t know how long it will persist.

However, Diageo encountered slowing sales during the financial crisis almost 20 years ago. It bounced back from that and I reckon it will from this tricky period.

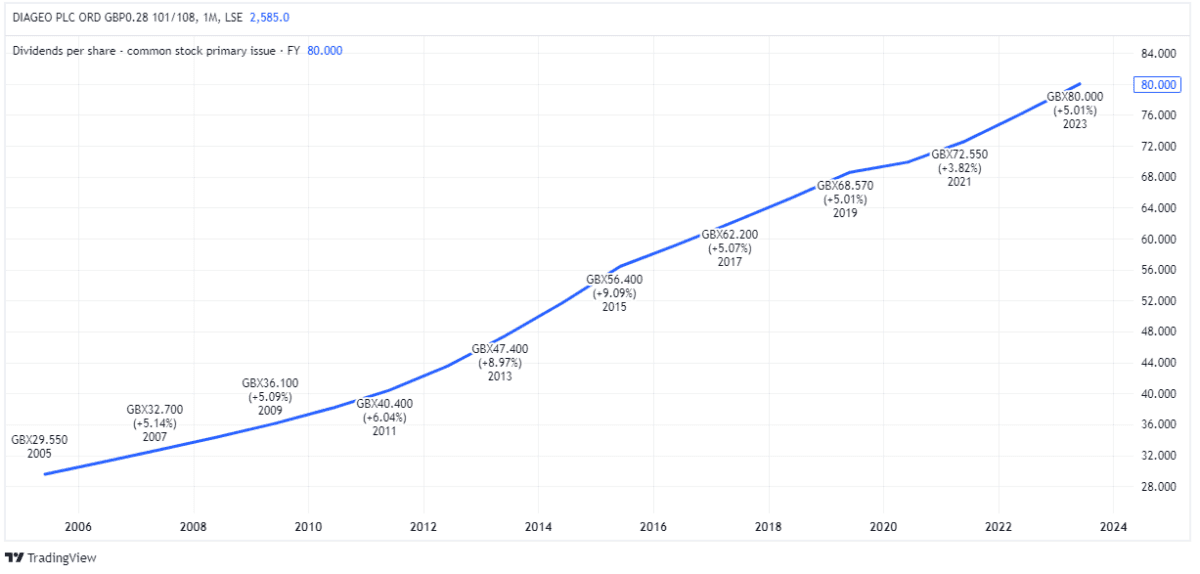

Meanwhile, the stock is cheaper than usual and offering a 3.1% dividend yield for 2024. And while no payout is guaranteed forever, Diageo makes plenty of cash and is classed as a Dividend Aristocrat.

Diageo Dividend per Share (2006-2024)

4. Reinvest dividends

As I’m building my portfolio, I’d want to reinvest the dividends I receive rather than spend them.

This fuels the compounding process, which is where interest earns more interest.

5. Start enjoying dividends

If I invest £500 a month and achieve an average 8% return annually, I’d end up with £284,639 after 20 years.

This return isn’t set in stone, but it is the ballpark average over time.

A £284k portfolio of stocks yielding just 4.25% would generate £12,097 in yearly passive income. Many UK stocks often yield far higher than this though.