Voters will go to the polls on 4 July to choose the country’s next government. Whatever the outcome, I think there are going to be some FTSE 100 winners and losers.

Construction

All political parties appear to agree that there’s a shortage of housing in the UK.

The Labour Party is committed to building 1.5m new homes during the next Parliament. The Conservative Party is promising 1.6m. To trump both, the Liberal Democrats are aiming for 1.9m, including 150,000 social homes and 10 new garden cities.

There are four housebuilders on the index. All of them should benefit from this cross-party emphasis on getting Britain building.

Defence

The FTSE 100 has two defence contractors — BAE Systems and Rolls-Royce Holdings.

Both will be happy to learn that all three political parties are committed to spending 2.5% (currently 2%) of gross domestic product on the military.

The Conservatives have pledged to reach the target by 2030. In contrast To this, the Liberal Democrats state it’s their “ambition” but don’t provide a timescale.

Labour says it will undertake a Strategic Defence Review. Afterwards it “will set out the path” to spending 2.5%.

Other industries

If re-elected, Rishi Sunak is promising to deregulate the financial services sector. This should help the FTSE 100’s five banks, which account for 11.5% of the value of the index.

The Liberal Democrats promise to reverse “the Conservatives’ tax cuts for big banks”.

The party also want to impose a “proper” windfall tax on the “super-profits” of oil and gas producers. What this means is unclear.

Labour has pledged to increase the energy profits levy (windfall tax) on North Sea earnings by three percentage points.

BP and Shell will be disappointed. These two companies make up 12.9% of the index.

Asset sale

In its manifesto, the Conservatives have committed to a “retail sale” of the government’s remaining NatWest Group (LSE:NWG) shares. Based on the bank’s current share price, this could raise nearly £6bn.

The stock trades on a modest forward price-to-earnings ratio of 7.6.

And analysts are expecting it to pay a dividend of 16.72p a share in 2024. If correct, this implies a yield of 5.4%. Of course, dividends are never guaranteed. This is particularly true in the banking sector where earnings can be volatile.

Also, NatWest is heavily focused on the UK, which means if the domestic economy doesn’t grow as expected, it’s likely to have an adverse impact on its earnings and share price.

However, on paper the shares appear cheap. If I was in charge, I’d continue holding on to the stake for a little longer, in anticipation that it will increase in value.

A high-level view

All parties claim they will create the economic conditions necessary for the UK’s biggest companies to prosper.

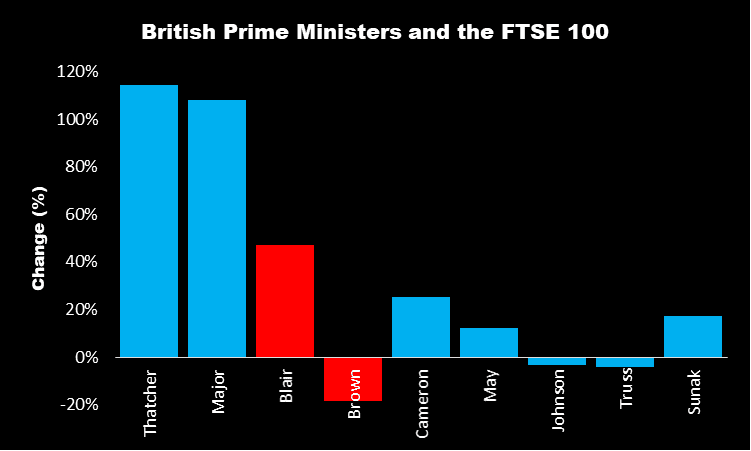

History tells us (see the chart below) that global events — and longevity of service — have been the biggest factors in determining how the FTSE 100 has performed under each of the country’s Prime Ministers.

Gordon Brown had to deal with a financial crisis. And Boris Johnson oversaw a pandemic. Both were largely beyond their control.

In my opinion, I believe the FTSE 100 will continue largely unaffected, irrespective of which party wins the election.

Specific policy changes will create some winners and losers. But overall it’s likely to be business as usual.