I’m a big fan of dividend shares. Not because I spend the income they provide on discretionary things like holidays or one-off treats. Instead, I use it to buy more shares, helping to compound my gains.

The chief executive of LondonMetric Property — newly promoted to the FTSE 100 — recently said: “Income compounding is the eighth wonder of the world — the secret sauce and the rocket fuel that creates wealth.”

The most common method used to identify income shares is to compare dividend yields. It stands to reason that those offering the most generous returns are the ones to buy, right?

Not necessarily.

Some could be value traps, appearing to offer good value when in reality the opposite is true.

A pinch of salt

Enwell Energy is a good example.

Some league tables are showing this stock as yielding 86%! But take a closer look and all is not what it seems. The company is an oil and gas explorer in Ukraine. Today (10 June), its shares are trading at 17.5p. It last paid a dividend of 15p in June 2023. And this is being used to calculate its yield. However, since then the war has seriously impacted its operations and the government has suspended two of its licences. I don’t believe another dividend will be paid soon.

In May, Vodafone announced that it was cutting its dividend by 50%. The Hargreaves Lansdown trading platform is still quoting a yield of over 10% for the stock whereas it should be around 5%.

Looking back

As with any investment, I think it’s vital to do lots of research before choosing dividend shares.

Unfortunately, nobody can see into the future.

History is therefore one of the best tools available. But there’s no guarantee that past trends will continue. As Warren Buffett cautions: “If past history was all that is needed to play the game of money, the richest people would be librarians.”

Getting into the detail

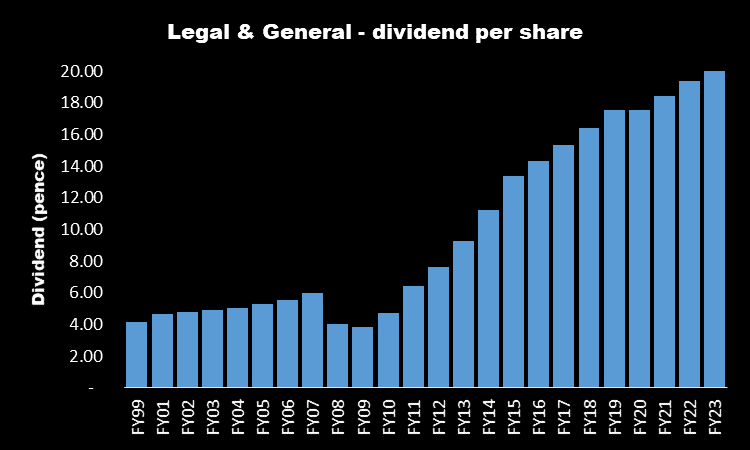

However, there’s one Footsie stock with an excellent track record of returning cash to shareholders, one that should continue. As the chart below shows, Legal and General (LSE:LGEN) has increased its dividend during 13 of the past 14 years. The financial services provider kept it unchanged during the pandemic.

Admittedly, it had to make a cut during the 2008-09 financial crisis. But during the past 25 years it’s only reduced it twice.

Based on its payout for the year ended 31 December 2023 (FY23), it’s currently yielding over 8%. That compares to the average for the FTSE 100 of 3.8%.

Analysts are predicting earnings per share (EPS) of 23.31p for FY24. This means the stock currently trades on a multiple of 10.6 times forward earnings.

But to maintain a healthy dividend, a company needs to grow its earnings. Analysts are expecting EPS to increase to 25.96p (FY25) and 28.25p (FY26).

However, the company is sensitive to macroeconomic conditions both in the UK and US. In my opinion, any sign of inflation rearing its head again or interest rates being increased would adversely impact its profits and share price.

But because the shares look to offer good value and due to the healthy dividend, I’m going to keep Legal & General on my watchlist for when I next have some spare cash.