Some share price charts are more pleasing to look at than others. Take Rolls-Royce (LSE: RR) as an example. Over the long term, its stock market performance has been very mixed. In the past year, though, Rolls-Royce shares have tripled.

While a hot growth stock can sometimes triple in a year, it is unusual for a long-established old economy stock in a mature industry to see such dramatic price action.

What has been going on – and could I still potentially set myself up for success by jumping on the bandwagon now?

Sentiment and value are not always the same

In one sense, Rolls-Royce shares were a bargain hiding in plain sight in the stock market after they had taken a battering during the pandemic.

New management coming in and setting ambitious targets has undoubtedly improved investor sentiment towards Rolls-Royce shares. Financial performance last year improved sharply. But even before that, the company had the makings of long-term success.

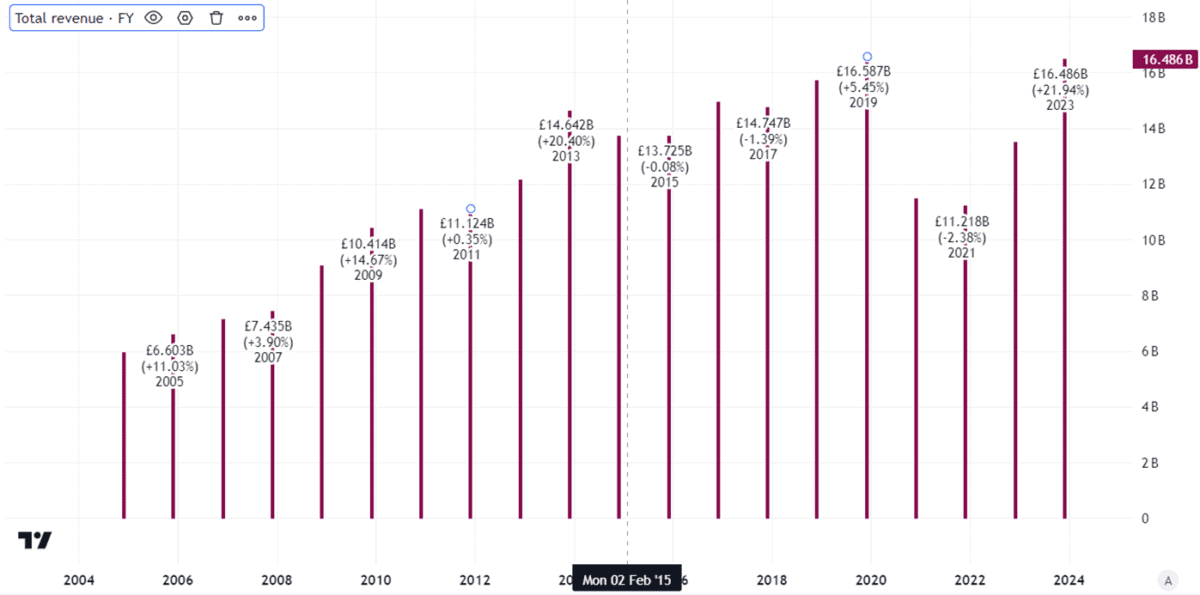

Despite a tough few years in the pandemic, for example, revenues have clearly been on a long-term growth trajectory.

Created using TradingView

That is not surprising and I expect it to last, unless there is a sudden unexpected drop in civil aviation demand.

The company has an installed base of thousands of engines. They need to be serviced regularly and there is a limited pool of companies with the technical expertise to do that.

Similarly, when it comes to buying new engines, airlines have a limited number of potential suppliers. That gives manufacturers like Rolls-Royce pricing power.

The problem with profitability

Still, if the long-term revenue outlook is strong, why did Rolls-Royce shares do so badly at points during the past five years?

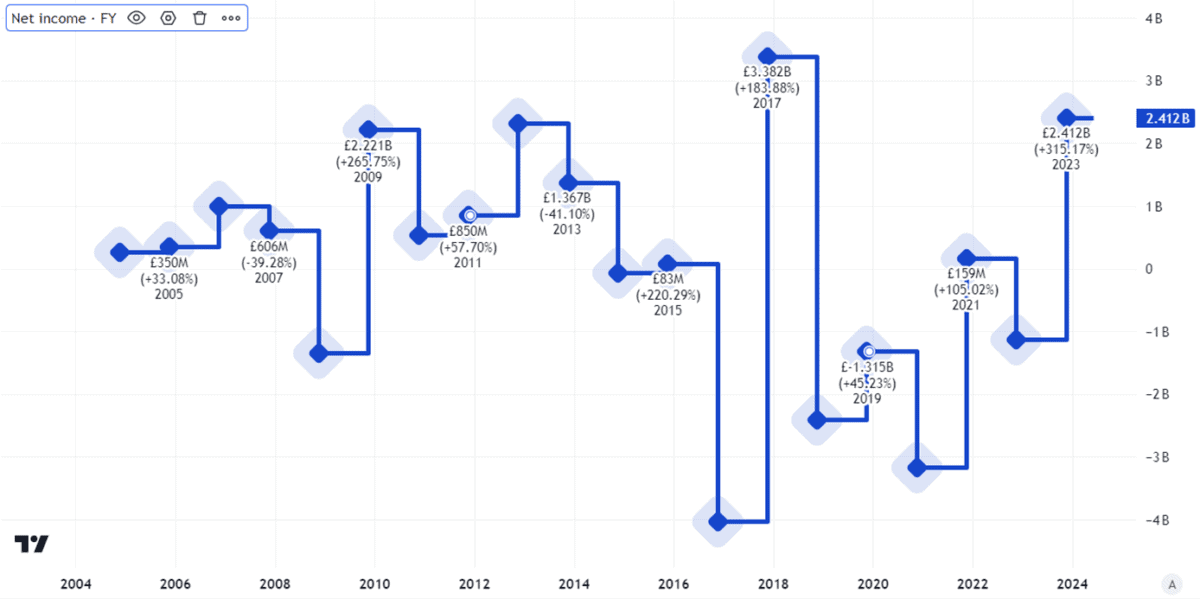

Sales revenues – known as the top line in a company’s financial accounts – fell dramatically in 2020 but remained substantial and have since bounced back. The issue was with profits, or what we call the bottom line.

Developing, selling, and servicing engines and power equipment is a specialist industry with high fixed costs. That can mean earnings move around wildly even before taking a sudden plunge in sales volumes into account.

Created using TradingView

Rolls-Royce shares plunged during the pandemic not because investors were scared by collapsing sales. What worried the City was the engineering firm’s enormous cash burn.

To raise funds, it issued new shares, diluting existing shareholders. I see a risk that could happen again the next time a pandemic or geopolitical event sends civil aviation demand into a tailspin.

There could still be value here

Indeed, that sizeable risk over which the company has no control is why I have no plans to buy Rolls-Royce shares at the current price.

Despite the tripling over the past year, though, I do see potential for further gains.

If the company cannot deliver on its ambitious growth plans I expect the shares to move down sharply. But if the business does hit its targets, the shares may merit a higher price than now.

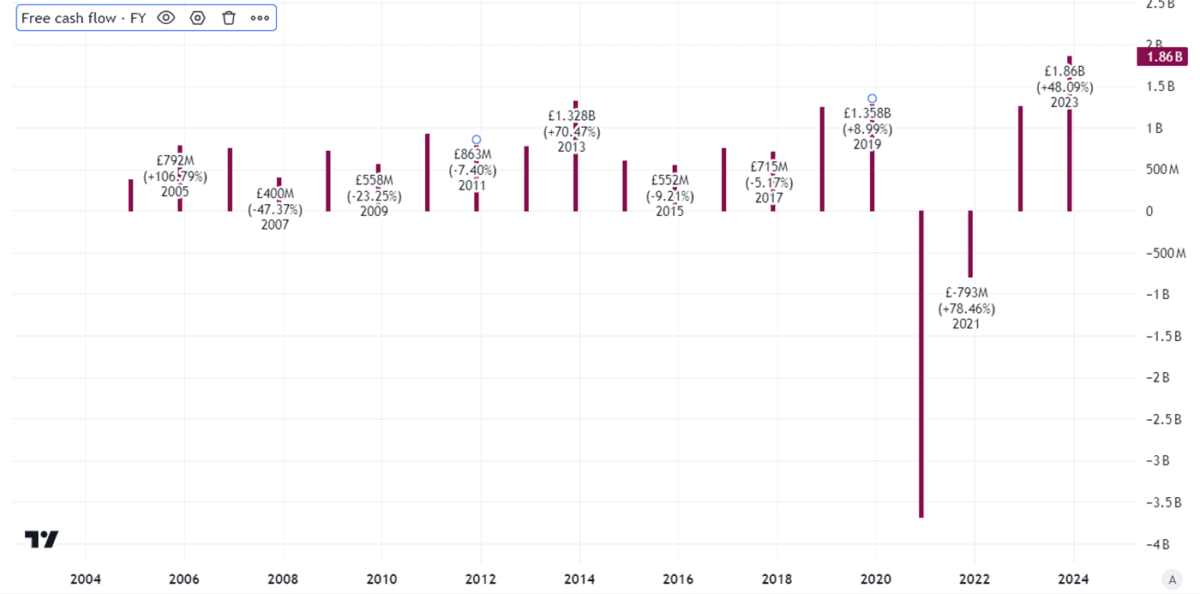

It expects £1.7bn–£1.9bn of free cash flow this year and is targeting £2.8bn–£3.1bn by 2027.

Created using TradingView

That could mean Rolls-Royce shares are trading on just 12 times 2027 free cash flows. That strikes me as good value – but only if the company manages to achieve its financial targets.