I’m searching for the best dividend shares to buy to make a winning passive income. By targeting big dividends today, I could have a better chance of generating life-changing wealth when I eventually retire.

I reinvest any dividends I receive to buy more UK shares which, in turn, gives me more dividends for further reinvestment. Over time, this powerful cash-building concept — known as compounding — can allow those with even a modest amount to invest each month to build a big nest egg for retirement.

And the more money I have to do this today, the quicker I can potentially meet my investing objectives. This is where the wisdom of buying shares with large dividend yields comes into play.

Dividend checklist

Of course, there’s more to sensible dividend investing that just concentrating on near-term dividend yields. As someone who invests for the long haul, I’m seeking companies that have a good chance of providing a decent dividend today and growing it over time.

So I’m also searching for companies that have several — or, ideally, all — of the following qualities:

- Long records of dividend growth

- Consistent earnings

- Leading positions in growing markets

- Diverse revenue streams

- Economic moats (also known as competitive advantages)

- Robust balance sheets (with strong cash flows and/or low debt)

- Dividend cover of at least 2 times

10.9% dividend yield

With all of this in mind, I think Phoenix Group Holdings (LSE:PHNX) shares are worth serious consideration today.

Dividends are never guaranteed. But based on the company’s 10.9% forward dividend yield, a £20,000 investment right now could make me £2,180 in passive income this year alone. I could then reinvest this to help me make those significant compound gains I described.

The good news is that City analysts expect Phoenix to continue raising shareholder payouts through to 2026 too, driving the yield comfortably above 11%.

| Year | Predicted dividend per share | Dividend yield |

|---|---|---|

| 2024 | 54.3p | 10.9% |

| 2025 | 56.1p | 11.2% |

| 2026 | 57.5p | 11.5% |

Payout growth

As a financial services stock, Phoenix Group’s very vulnerable when economic conditions worsen and people have less money to spend. It lacks the earnings stability of businesses like utilities, defence and healthcare, for instance.

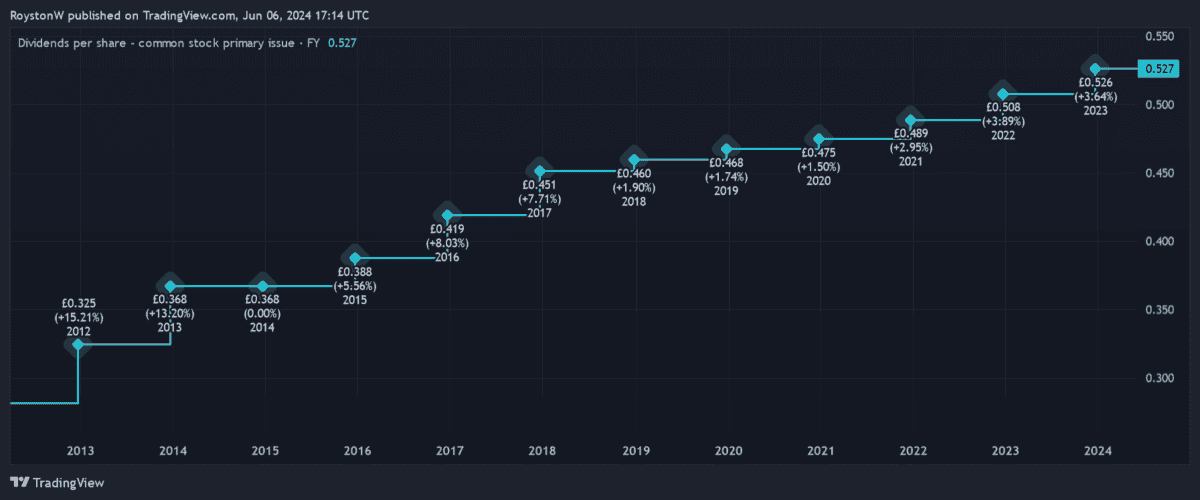

Earnings have certainly been volatile at Phoenix in recent years. Yet this FTSE 100 share still has an exceptional record of dividend growth, as shown in the graph below. Unlike many UK shares, Phoenix even continued to raise shareholder payouts during the pandemic.

This has been underpinned by the company’s rock-solid balance sheet, while market-leading positions in the mature life insurance and pensions markets have also helped to support payouts, despite tough conditions.

Phoenix is a cash machine and in 2023, it generated a whopping £2bn of cash, beating its £1.8bn target by a healthy margin.

And with a Solvency II capital ratio of 176% — at the upper end of its 140-180% target — the company looks in good shape to continue paying large and growing dividends through the forecast period.

As I say, I’m also looking for companies that can increase payouts over the long term. I’m confident Phoenix will be able to do this as Britain’s growing ageing population supercharges the life insurance and retirement products industry.