After treading water for much of 2023, Lloyds Banking Group (LSE:LLOY) shares have shot higher this year. The Lloyds share price recently hit 52-week highs at 57p. It’s currently up 23% over the past year. This growth is great for existing investors. But for those on the sidelines, is the stock overvalued right now?

Profits falling

A key way that the bank makes money is via net interest income. This refers to the difference in margin it makes from charging clients for loans versus paying clients on deposits. For example, if it charges 5% for a loan but pays 3% on deposit, the net interest margin is 2%.

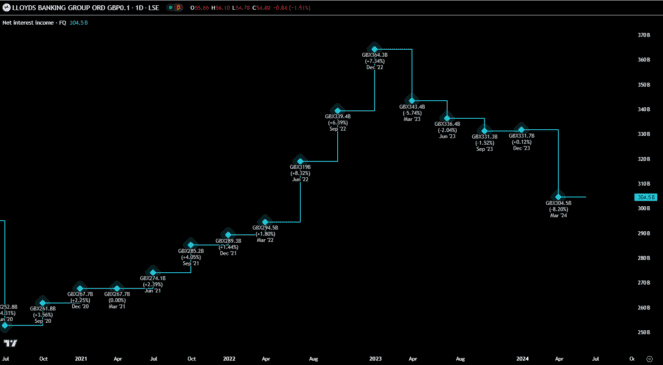

Thanks to rising interest rates, the income from this has been growing. This can be seen from the below chart, with 2021 and 2022 being periods of increasing net interest income.

However, the 23% jump in the share price over the past year has coincided with a period when net interest income hasn’t been increasing. In fact, it has been falling. The latest quarterly results showed that it dropped by around 8%. This is because expectations are for interest rates to start to fall. Further, savvy clients are shopping around for better deposit deals, meaning that the margin is becoming smaller.

Based on this metric, the share price could be considered to be overvalued as it shouldn’t really be rising based on overall profits falling.

Value remains

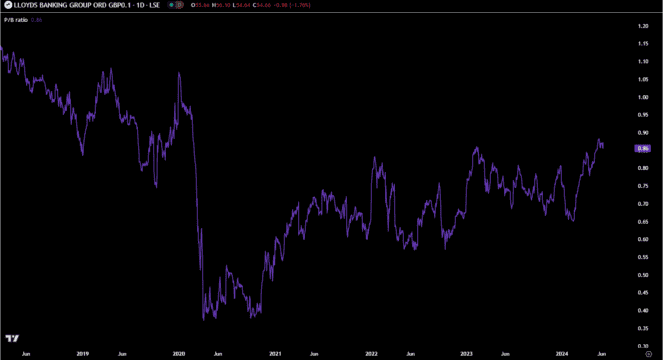

On the other hand, some investors might flag up that the stock is still cheap when you compare the share price to the book value. The book value of a firm refers to the total assets minus both intangible assets and total liabilities. Given how a bank operates, the book value is quite an accurate way of getting a feel for the business.

The price-to-book ratio compares the book value to the current share price. In theory, a value of one is fair, while a value below one shows it’s potentially undervalued. At the moment, the ratio for Lloyds is 0.86.

Clearly, the chart shows that the ratio has been lower over the past year. The rally in the share price has pushed the ratio higher. Yet just because the stock isn’t as undervalued as it was at periods last year, it doesn’t mean that it’s now overvalued.

Rather, with a reading like 0.86, it’s still can be considered undervalued.

The long-term vision

In the short term, the share price does look like it could take a breather. I wouldn’t be surprised to see some people booking profit and selling the stock after the strong rally. However, I think at this point that I’ll consider adding some exposure.

Sure, the falling net interest income is something I’m concerned about. But interest rate cuts are inevitable. The lower income here could be offset by higher revenue from credit card spending or mortgages, as consumers take advantage of lower rates.