When looking for new dividend stocks I always check three factors: the yield, price performance, and years of consecutive growth. Stocks with high yields that lack a strong history of growth tend to fall as quickly as they rose.

I don’t mind a lower yield if it promises consistent growth for the indefinite future. And of course, I also make sure the stock price isn’t going down the toilet.

With that in mind, these two FTSE 250 investment trusts have caught my attention lately. So I calculated the potential returns they could net me in 10 years.

City of London Investment Trust

Managed by Henderson Funds, the City of London Investment Trust (LSE: CTY) invests primarily in UK-based public equity markets. The 164-year-old trust focuses on dividend-paying growth stocks across a diversified range of sectors.

I believe it’s a safe and stable option for consistent growth and payments. But its price performance leaves much to be desired. It’s up only 130% in the past 20 years, providing rather weak annualised returns of 4.3%.

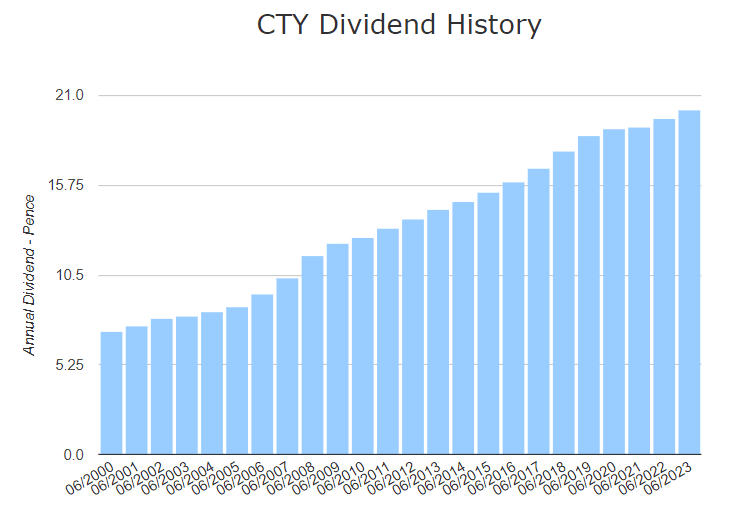

But its dividend growth’s been strong, tripling from 7.18p in 2000 to almost 21p today.

That equates to a 15-year compound annual growth rate (CAGR) of 3.5%. With those numbers, if I bought 3,000 shares for £12,630, I could almost triple my investment to £33,315 in just 10 years. Assuming that the current dividend and price growth rates held and I reinvested the dividends.

I do have one concern though — the trust’s share price may be somewhat overvalued. It’s increased recently to 16.4 times earnings and is calculated to be overvalued by 123%, based on future cash flow estimates.

While the price-to-earnings (P/E) ratio is on-par with the industry, it could stifle future growth if earnings don’t improve. However, while it could affect the overall return, this is unlikely to affect dividend payments.

Murray International Trust

Murray International Trust (LSE: MYI) is a closed-end mutual fund that invests in a diversified mix of public equity markets globally. It’s been around for over 100 years and is managed by Aberdeen Fund Managers.

It currently sports a decent 4.6% yield. Over the past 20 years the yield has fluctuated between 3% and 7% but has been steadily increasing overall. This could make it a reliable choice for a slow but steady stream of passive income.

In the past 20 years the price is up a modest 239%, equating to annualised returns of 6.3%. Admittedly, recent performance has been disappointing. It’s down 7% over the past year, significantly below the GB Capital Markets growth of 9.4%.

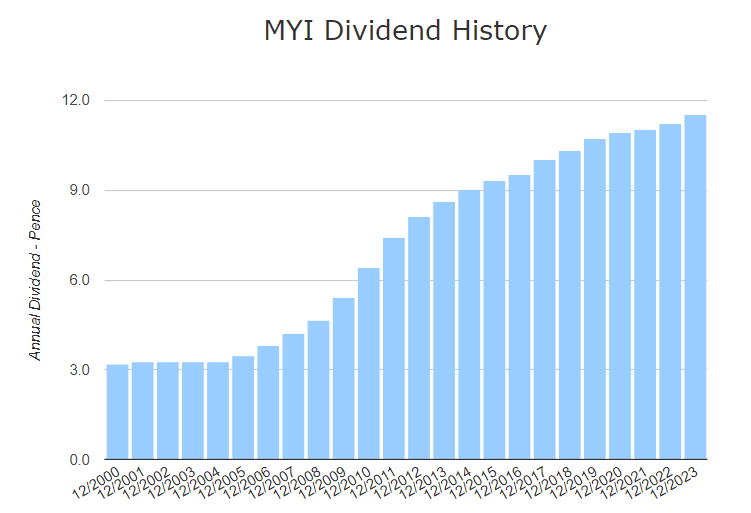

But what I really like is its dividend growth track record. Since 2004, it’s steadily increased from 3.26p per share to 11.5p today.

That equates to a 15-year compound annual growth rate (CAGR) of 6.06%. If that rate remained consistent and I bought 4,000 shares today for £9,960, I could more than triple my investment to £33,792 in just 10 years. Assuming I also reinvested the dividend payments to compound the returns.

To be honest, these types of investments are not super-exciting. But with steady growth and a solid balance sheet, they’re the type that investors could simply ‘set and forget’. I think that makes them a winning combo for a dividend portfolio.