Could around £85bn of passive income be up for grabs from FTSE 100 stocks?

Analysts at AJ Bell think the answer is yes.

Dividends are never, ever guaranteed. But shares on the Footsie have a terrific record of paying large and sustainable dividends over time. Strong balance sheets and diverse, market-leading operations make them a reliable way to make a second income.

Those analysts I mention certainly expect the index to continue generating big dividends. All investors have to do is own some of these shares to have a chance of enjoying a bumper payday.

Dividend growth

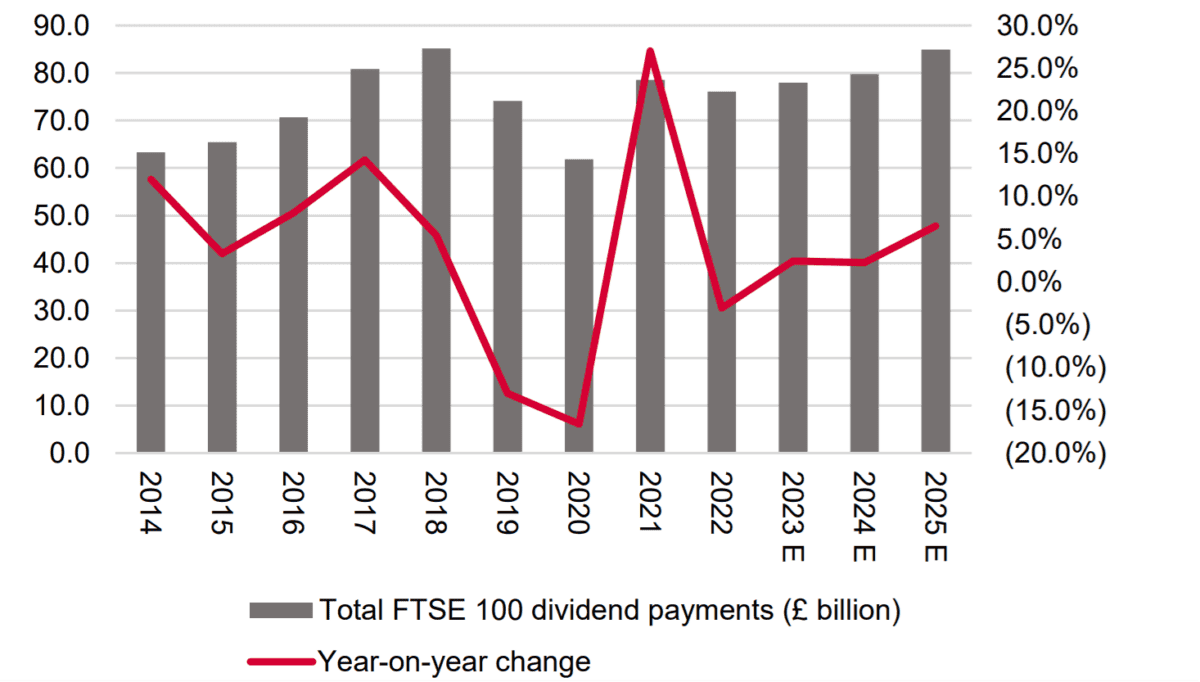

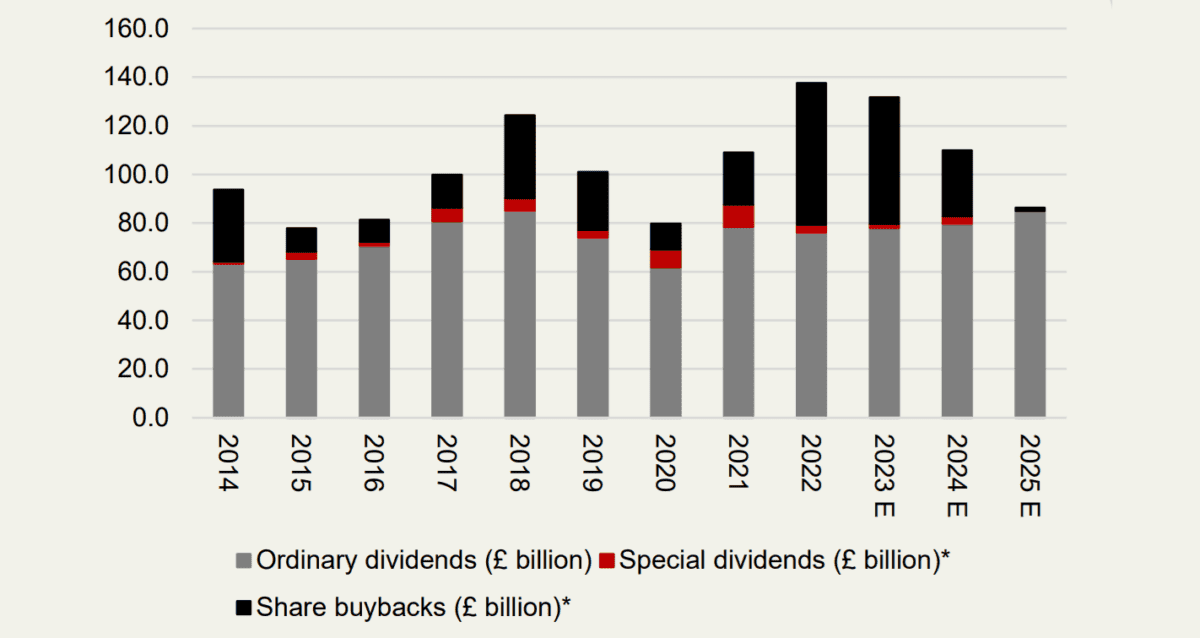

According to AJ Bell, FTSE 100 companies will raise total ordinary dividends to £79.7bn in 2024. That’s up from £77.8bn last year.

And things look even better for 2025, with total distributions of £84.9bn predicted. And that’s excluding special dividends.

With these supplementary payouts included, aggregate payouts for both years exceed £80bn, as shown below.

Careful now

Of course there’s a few important things to remember. The first of which is that — as I said above — dividends are never a certainty.

Those AJ Bell forecasts reflect hopes that FTSE 100 companies will grow profits through to 2025. But a fresh economic crash or trouble in particular sectors could well scupper these predictions.

Furthermore, Footsie businesses can use their discretion when it comes to deciding how much of their capital to pay in dividends. They don’t have to pay any at all!

To illustrate this point, both Vodafone and National Grid have rebased their dividends in 2024.

A top dividend stock

However, there are steps I can take as an investor to boost my chances of receiving a dividend. Studying trading reports, financial news, and broker estimates might set me up to receive a lavish passive income.

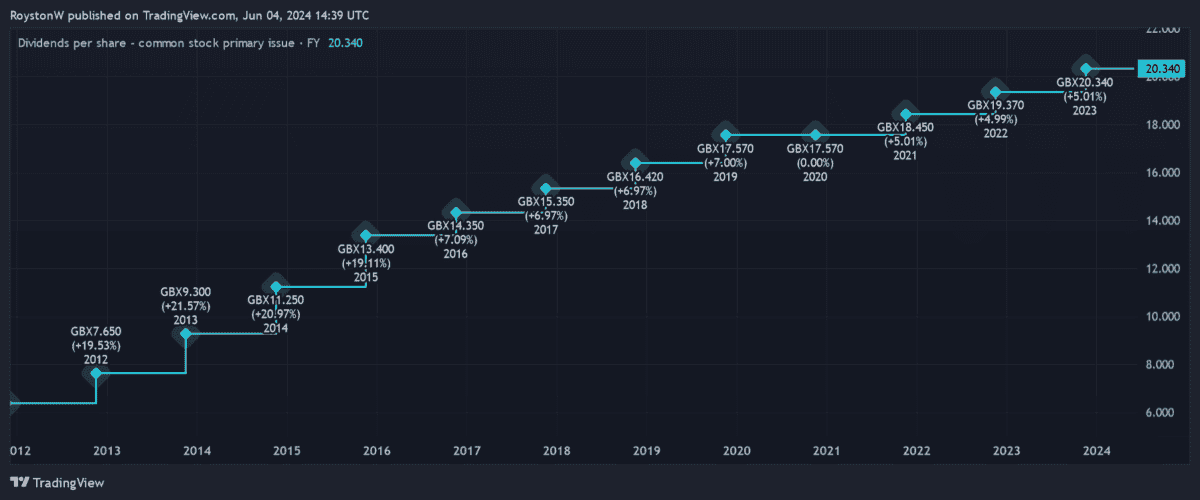

Legal & General Group (LSE:LGEN) is a company I’d buy for dividend income. History shows us that the life insurance giant has a generous approach to dividends, as shown by its long record of sustained payout growth.

A strong balance sheet means the firm looks good to keep this impressive trend going, too. Its Solvency II capital ratio was 224% as of December. This puts it in good shape to hit its target of growing dividends by 5% each year.

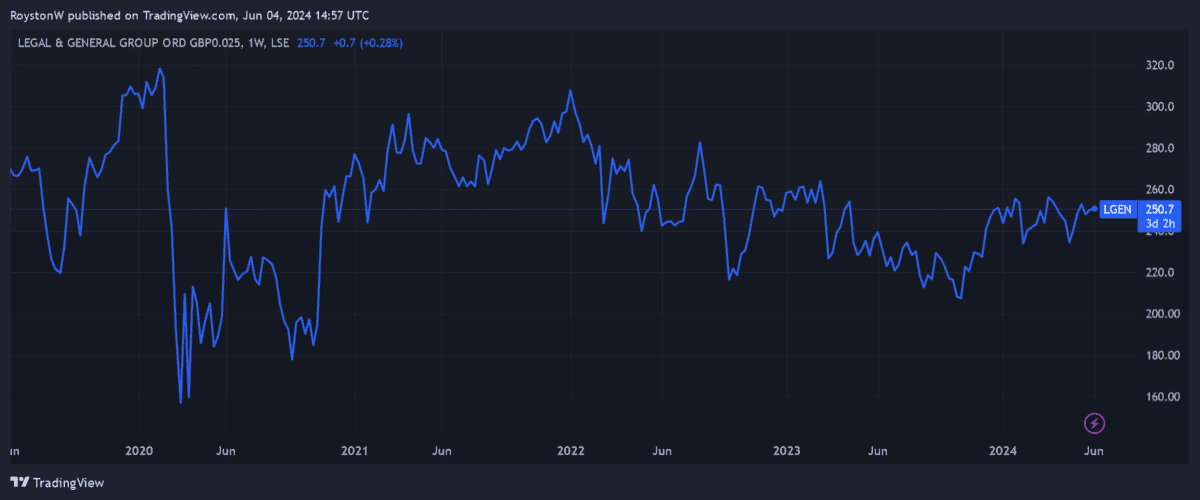

On the downside, Legal & General is struggling to grow profits due to the tough interest rate environment. And this could remain a problem heading into the second half of 2024.

However, I don’t believe this should impact dividends in the near term. And these problems are likely to be temporary, too. In fact, I believe earnings could rise strongly over the long term, driven by demographic trends that supercharge demand for financial products.

One final but important thing when it comes to Legal & General shares. At 250.7p per share, they carry a mighty 8.1% dividend yield. This is the sort of figure that could help turbocharge the total passive income I receive.