Investing in penny stocks is a high-risk, high-reward strategy.

On the downside, prices of these small-cap companies can be highly volatile. Heavy selling of their shares can ramp up when industry or economic conditions worsen and fears over their survival increase.

But when investors get it right, buying young companies when they trade below £1 can deliver stunning — and in some cases, life-changing — returns. This is because these shares can have much better growth (and therefore share price) potential than the broader stock market.

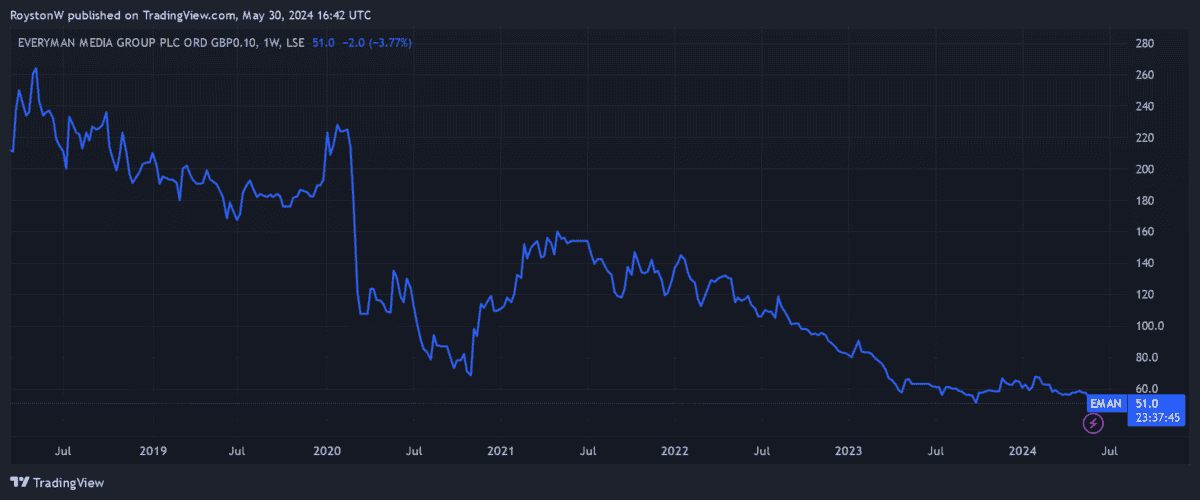

Everyman Cinema Group (LSE:EMAN) is a company I think has significant long-term investment appeal. And following recent share price weakness, I believe it’s worth serious consideration from clever investors.

Industry pressure

Investing in cinema stocks has been a risky strategy since the end of Covid-19. Changes to viewing habits and the movie studio model means box office takings remain some way off their pre-pandemic highs.

Weak bookings over the US Memorial Day weekend underlined the scale of the problem. Despite high-profile releases Furiosa: A Mad Max Saga and Garfield, the American box office endured its worst performance since 1995.

So why on earth would I consider buying Everyman shares?

Put briefly, it offers more than the bog standard film theatre, which means it’s more resilient to the state of the broader cinema industry.

Flying high

The AIM-listed firm operates 44 venues across the UK, from which it runs the latest blockbusters, silver screen classics, independent movies and specal film events. Patrons can also grab some food in its restaurants and have a drink delivered to their seat.

This has proved to be a winning formula. As Everyman explains: “With a focus on hospitality, Everyman is re-defining how film is being consumed and is therefore outperforming the wider cinema market”.

Latest financials in April reveal how its business model’s thriving. Admissions jumped 9.5% over the course of 2023, to 3.75m, while the average ticket price rose 3.2% to £11.65.

With food and beverage spend per head soaring — up 10.2% year on year to £10.29 — sales jumped 15.3% from 2022 levels, to £90.9m.

Growth potential

Everyman’s formidable results fly in the face of the broader cinema industry’s problems. And the business — which grew its market share 30 basis points last year, to 4.8% — believes it can continue making strong progress.

Last year it completed four organic cinema openings during the year. It also acquired two Tivoli cinemas in December after previous owner Empire Cinemas went into administration.

Consumers in the UK are feeling the pinch, and Everyman’s sales might cool if economic conditions remain tough. But I believe the eventual rewards this penny stock could deliver still make it a top buy.

And especially at current prices too.

A bargain penny stock

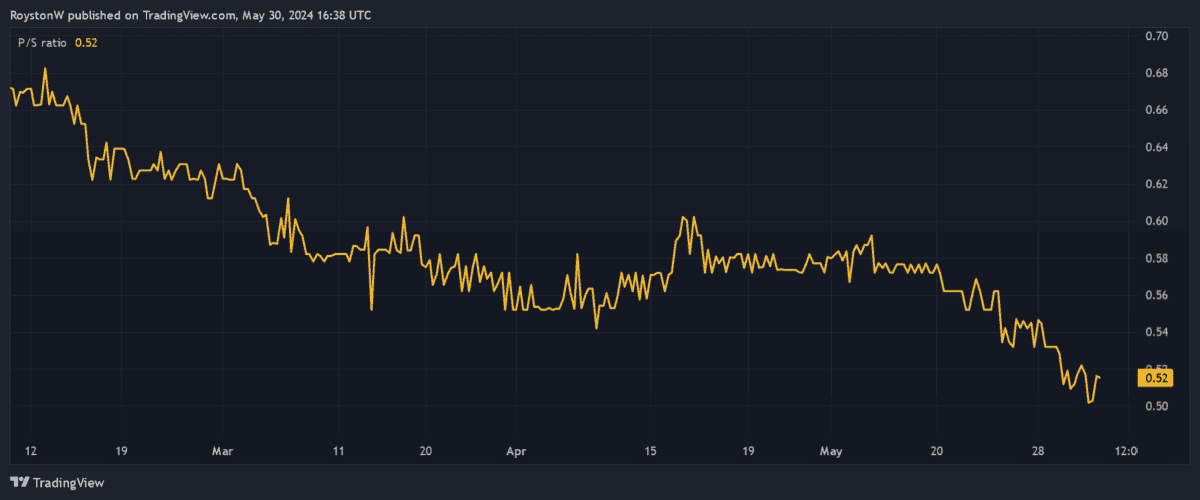

Losses are narrowing sharply following the end of the pandemic. But the company isn’t expected to punch a profit until 2025. This means a price-to-earnings (P/E) ratio isn’t available.

However, Everyman’s price-to-sales (P/S) ratio can be used to gauge its value. And today, this sits at just 0.5, comfortably below the value benchmark of 1.

All things considered, I think value investors should give this overperforming penny stock a close look.