The prospect of building a stock market portfolio can seem enticing. But a lot of people who say they want to start buying shares keep putting off making a move – sometimes forever.

One reason can be a perception that it takes a lot of money. In fact, it is possible to start investing with just a few hundred pounds. That would be a foundation on which to build if more money became available down the road.

Some basic principles of sound investment

I would want to start buying shares as I meant to go on: as an investor, not a speculator.

So I would follow some basic principles I think characterise sound investment. For example, I would only invest in businesses I felt I understood. I would manage my risks carefully: the stock market can be a surprising place for all investors, and especially new ones.

I would diversify my portfolio across a few different shares. For the portfolio, incidentally, I would set up a share-dealing account or Stocks and Shares ISA.

Choosing shares to buy

To illustrate the sort of share I would happily buy for my portfolio, consider one I recently did buy: Reckitt (LSE: RKT).

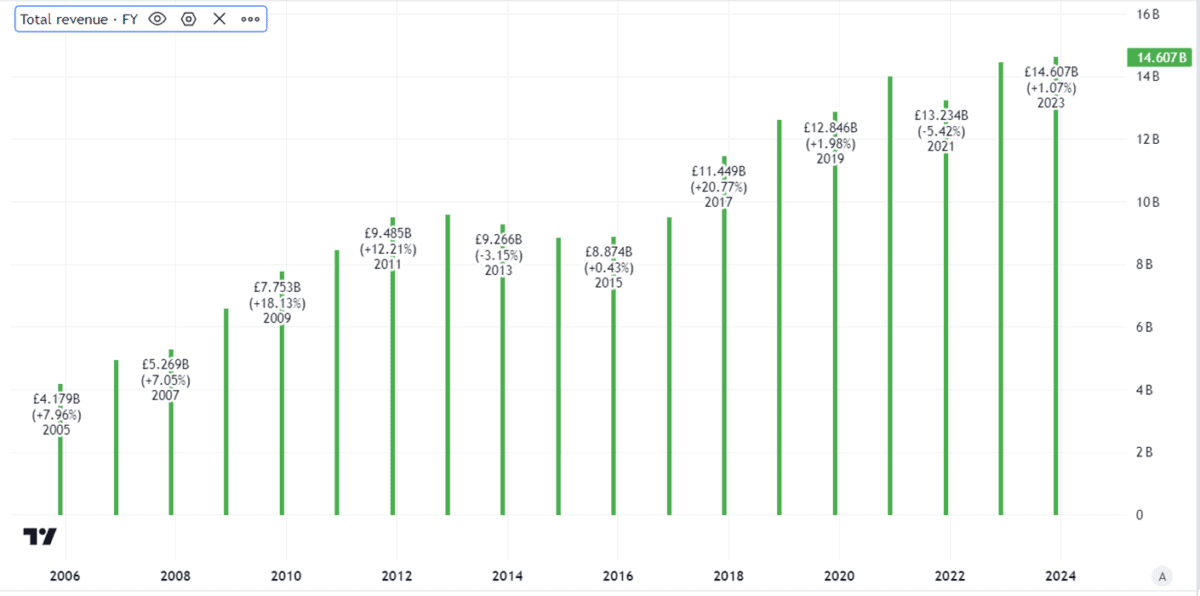

The company operates in a market that is large and likely to endure: consumer goods. That helps explain its sizeable revenues.

Note too that, broadly speaking, those revenues have been increasing over time.

Created using TradingView

But revenues are only one part of what makes a successful business. It also matters how well a company is able to convert them into profits.

Here, again, I find Reckitt attractive. Last year, it made £1.6bn in profits after tax. Thanks to its unique brands such as Finish it is able to charge a pricing premium, helping profitability.

But a common mistake when people start buying shares is looking at only one year’s accounts. It is always important to get the broader picture. Reckitt’s very volatile earnings over the past few years demonstrate why.

Created using TradingView

A number of factors explain that. But the key one is a disastrous acquisition in 2017 of a nutrition business. It was expensive and has performed weakly ever since.

Reading company accounts

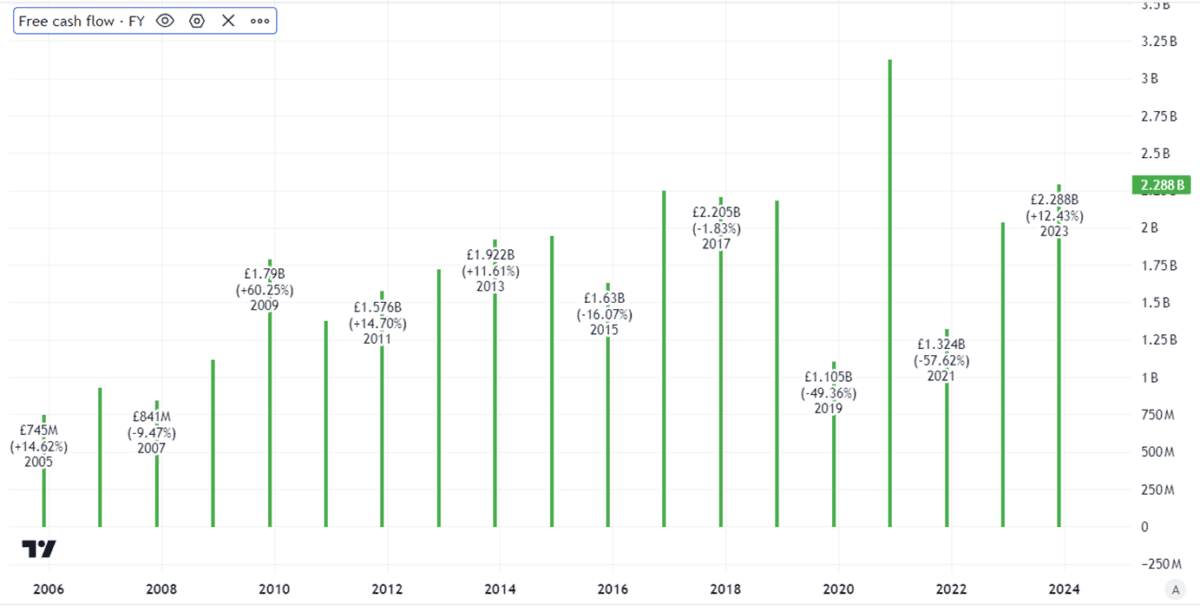

Earnings and losses are not necessarily the same as money coming in or going out the door, however. Earnings are an accounting concept that do not necessarily reflect actual cash flows.

I would not start buying shares before getting to grips with at least the basic principles of company accounts.

Looking at Reckitt’s earnings from the past few years, the inconsistency looks like a possible red flag. Free cash flows have also jumped around — but they have stayed positive and alarm me less than the earnings.

Created using TradingView

Valuing shares

Reckitt is not out of the woods yet.

The scaled-down nutrition operation continues to be problematic. A tight economy could make consumers less willing to pay premium prices for everyday products.

But I see it as an attractive business. Another mistake some investors make when they start buying shares though, is to confuse a good business with a good investment.

That is why valuation matters. I think Reckitt’s is reasonable – and am now the happy owner of some Reckitt shares.