Lloyds Banking Group‘s (LSE:LLOY) shares have gone absolutely gangbusters in the past three months.

At 54.4p per share, the stock has risen around a fifth since the final days of February. Like the FTSE 100‘s other major banks, Lloyds has leapt as hopes of growth-boosting interest rate cuts have risen.

There’s a couple of important questions I need to ask right now. Do the company’s shares still offer solid value at current prices? And is the bank really an attractive stock to buy today?

Should you invest £1,000 in National Grid right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if National Grid made the list?

All-round value

Broker forecasts can often miss their target. But using projections from seasoned City analysts is a good way to gauge a stock’s investment appeal.

Based on current estimates, it seems at first glance that there’s still plenty of value to be had with Lloyds shares.

Today, the Black Horse Bank trades on a forward price-to-earnings (P/E) ratio of 9.5 times. It also carries a huge 5.4% dividend yield.

By comparison, the average readings for FTSE 100 stocks are 11 times and 3.5%, respectively.

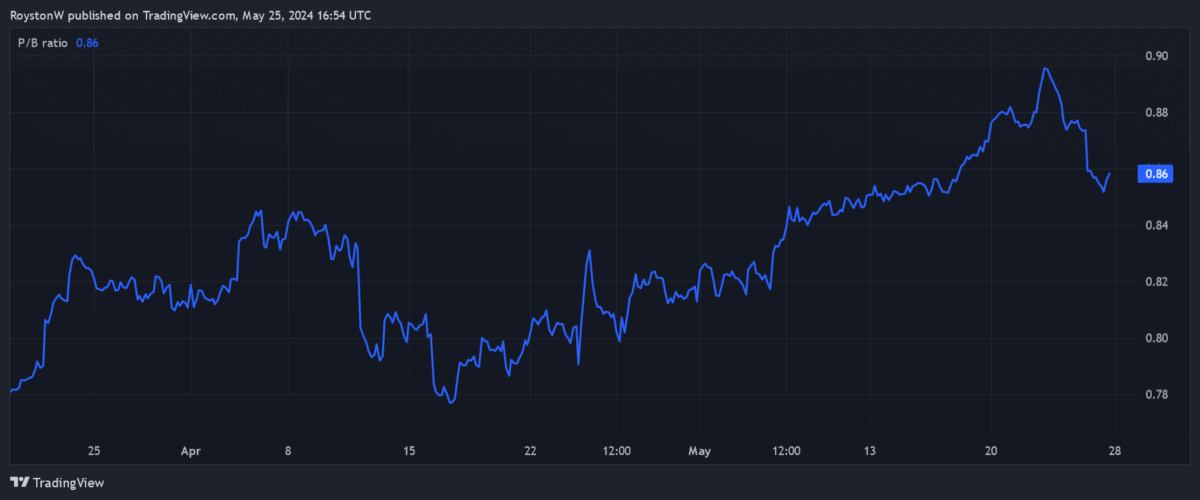

This is not all. Lloyds also looks cheap when you consider the value of its assets using the price-to-book (P/B) ratio.

As the chart above shows, the shares trade on a sub-1 multiple, indicating that Lloyds is at a discount to its book value (total assets minus total liabilities).

Bargain or basket case?

As an investor, I have to consider whether a stock’s low valuation is merited or not.

Some stocks are genuinely underpriced by the market, and have the potential to rise strongly as investors wise up to this fact.

However, some businesses trade cheaply for good reason. They have poor growth prospects, expose investors’ cash to significant risk, or both.

It’s my belief that Lloyds falls into the final category.

Risk vs reward

It’s not all bad for the banking giant. A (likely) fall in interest rates could boost revenues and reduce loan impairments. Signs of recovery in the housing market are another good omen as Lloyds is by far the country’s biggest home loan provider.

Yet I believe the risks of owning Lloyds shares outweigh the potential benefits. For one, while reversing interest rates can boost banks’ earnings indirectly, they also squeeze net interest margins (NIMs), a key gauge of profitability.

The outlook for the UK economy also looks bleak even if interest rates drop as predicted. Labour market problems, post-Brexit turbulence, low productivity, and high public debt are just a few challenges to growth in the short term and beyond.

Huge challenge

Lloyds also has an almighty fight to stop challenger banks eating into its profits.

These new entrants are not only offering market-leading products. The likes of Monzo and Starling are also winning when it comes to their internet platforms, as the graphic from Fairer Finance above shows. You’ll see that the challengers are better trusted than Lloyds and the other established banks.

Given the growing popularity of online banking, and the importance of trust when it comes to money matters, this is extremely worrying data. And it explains why the challengers are gaining market share.

As I say, Lloyds shares are cheap, but I believe they’re cheap for a reason. I’d much rather buy other UK value shares today.