One of the attractions of buying shares in a proven FTSE 100 business can be the income potential from dividends. Insurer Aviva (LSE: AV) is an example. The Aviva dividend yield is currently 7%.

Could it go higher from here – and ought I to buy this share for my ISA?

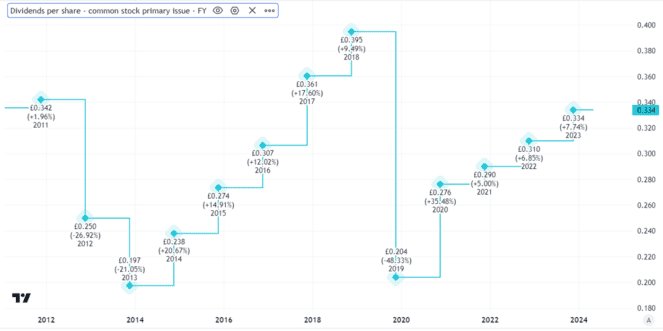

Uneven dividend history

At first glance, the dividend story here looks strong. Ordinary shareholder payouts have grown annually for the past few years. Last year, for example, the dividend increased by 7%.

But as a long-term investor, I consider more than just the most recent data when I can. Looking back over the past decade and more, we can see that the dividend has been cut more than once.

Created using TradingView

Dividends are never guaranteed at any company. The chart demonstrates what this has meant in practice. Aviva dividend growth has been healthy more than once before, only for the payout to be cut at some later point.

Reshaped company with strong prospects

Still, just because that has happened before does not necessarily mean it will again.

Over recent years, Aviva has changed the shape of its business significantly. It sold multiple ops, distributing some of the proceeds in the form of a special dividend (not represented in the chart above).

That has allowed it to focus its energy on key markets, such as the UK. It has a number of competitive advantages, including a large customer base, strong brands including Norwich Union and deep experience in underwriting.

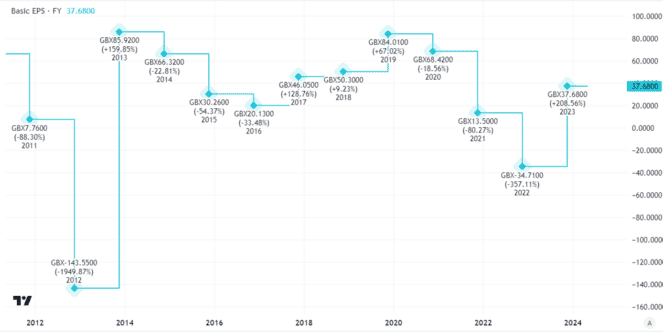

So far, however, the results may not be obvious from the company’s profit performance. Basic earnings per share improved last year but that followed a run of declining performance.

Created using TradingView

Earnings are an accounting measure, so do not always provide the most useful info when it comes to valuing financial services firms. They can move around a lot due to changes in the value of assets a firm holds on its books, something that may bear little relation to cash flows.

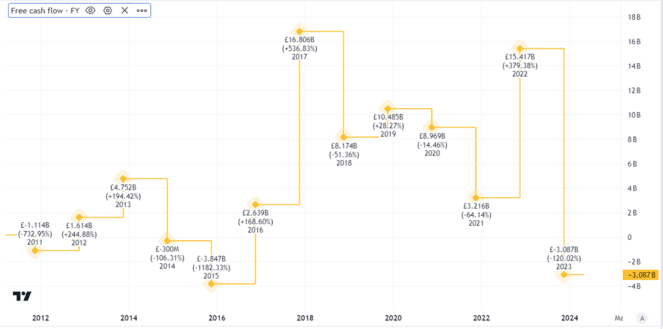

When it comes to Aviva’s dividend, cash flows matter because ultimately a dividend is a means for a company to distribute surplus cash.

Here again, the company’s performance has moved around a lot.

Created using TradingView

What gives me confidence though, is that Aviva has demonstrated that it can generate significant excess cash even though the amount may move around from one year to the next.

One measure of that is what is known as ‘Solvency II operating own funds generation’. Last year that came in at £1.7bn, 12% higher than the prior year.

Future prospects look good

If Aviva can continue to generate surplus cash at a high level — which I think it likely can — then I expect the dividend to grow from here. The company says it expects to grow the cash cost of the dividend, which if the share count remains the same means the per share payout should go up. The prospective Aviva dividend yield would be higher than 7% in that case.

There are risks along the way. Poor underwriting choices could unexpectedly hurt profits, as happened at rival Direct Line last year. Its increased focus on the UK market also ties Aviva more closely to the UK economy: a recession could make policyholders more price-sensitive, hurting renewal rates.

But the income prospects attract me. If I had spare cash to invest, I would be happy to buy Aviva shares.