UK small-cap and penny stocks aren’t traditionally popular with investors looking to make a second income.

Smaller companies are often in the early stages of their lifecycle, which means they invest any extra cash they have to fuel earnings growth.

These businesses also often have limited financial resources, while their cash flows can be volatile, making it difficult to pay regular dividends.

Should you invest £1,000 in Babcock right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Babcock made the list?

7% dividend yield

However, it’s not impossible for investors to find small-cap stocks that pay a tasty dividend. Stelrad Group (LSE:SRAD), Alternative Income REIT (LSE:AIRE) and Ramsdens Holdings (LSE:RFX), for instance, have recently caught my eye with their hot dividend forecasts.

These can be seen in the table below.

| Company | Forward dividend yield |

|---|---|

| Stelrad Group | 6.3% |

| Alternative Income REIT | 9.2% |

| Ramsdens Holdings | 5.5% |

Based on these figures, a £20,000 lump sum invested equally across them could make me £1,400 in passive income this year. The average yield across these three shares is 7%.

So why should investors consider buying them today?

Hot stuff

As a supplier of steel radiators in the UK, mainland Europe and Turkey, Stelrad is at the mercy of tough conditions in these territories’ construction markets.

Indeed, the company advised last week (22 May) that “end markets remain challenging,” and that it had endured “further year-on-year volume declines across most geographies.”

From a long-term perspective, however, I believe Stelrad has plenty of investment appeal. The business is market leader by sales in seven of its countries, and holds a top three position in a further nine.

And has significant opportunities to supercharge volumes in the years ahead, as housebuilding likely picks up and decarbonisation efforts continue.

Income hero

As its name indicates, Alternative Income REIT is set up to supply a steady dividend income to its investors.

Its classification as a real estate investment trust (or REIT) means it must pay 90% or more of annual rental profits out in dividends. This is in exchange for certain tax advantages.

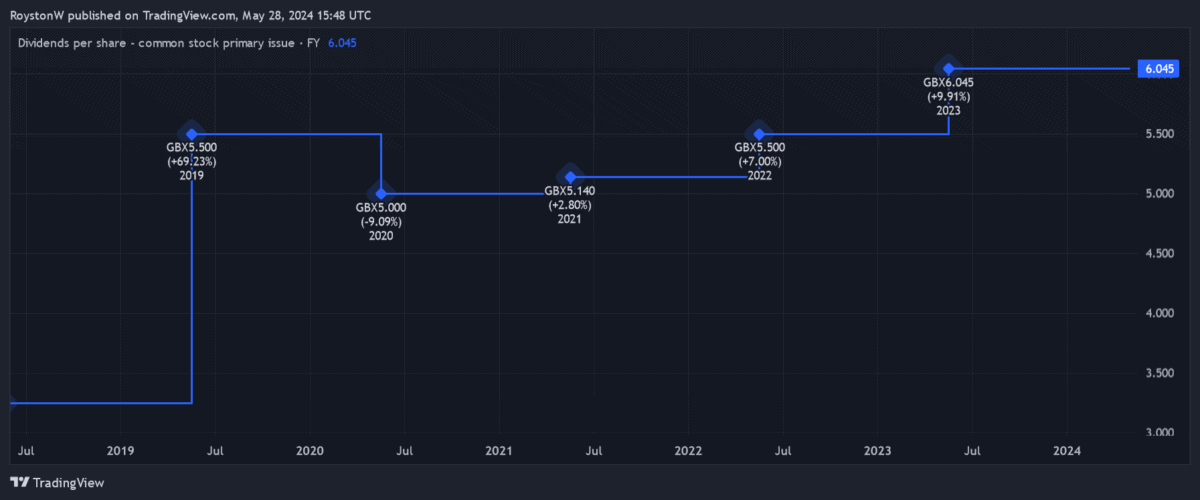

Alternative Income REIT’s dividend history

Property businesses like this are sensitive to interest rates. Indeed, Alternative Income has seen its asset values come under pressure from central bank rate hikes in recent years.

But I’m still a fan of the company. I especially like its diversified property portfolio that helps to spread risk. This includes care homes, hotels, gyms and retail parks.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Top bargain

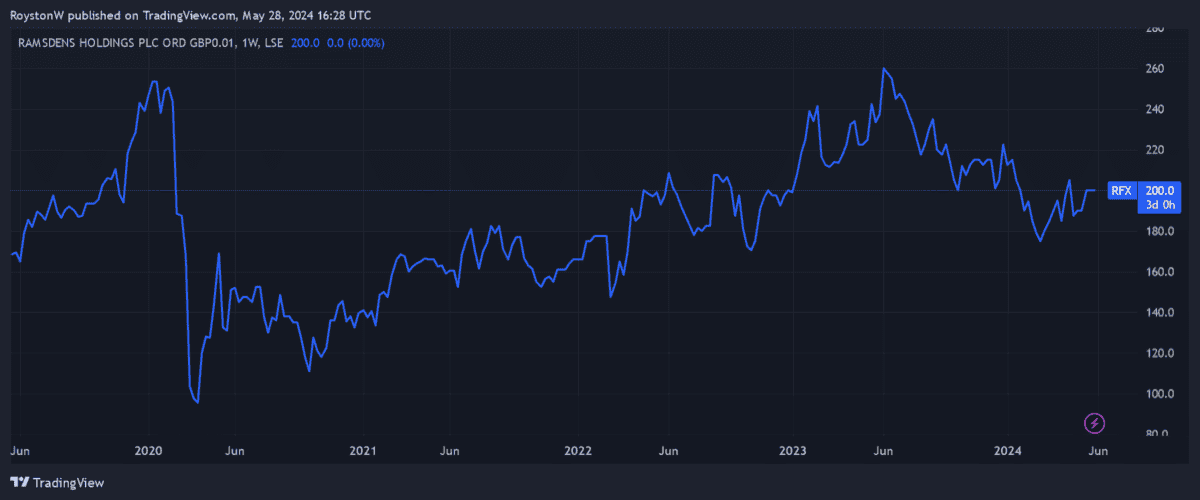

Ramsdens’ share price performance since 2019.

Ramsdens Holdings has suffered from slowing sales in recent months. It has also been struck by a rise in labour and power costs.

While these remain a threat, I still believe its low, low share price makes it highly attractive. The company — which also provides foreign exchange services and deals in precious metals — now trades on a forward price-to-earnings (P/E) ratio of 8.2 times.

And as I say, the firm also carries that 5%+ dividend yield.

I believe Ramsdens still has considerable long-term investment potential. It continues to rapidly expand, and now has 167 stores in its portfolio. The firm has also been investing heavily in its online operation to capitalise on the e-commerce boom.