I think now’s a great time to search for passive income shares to buy.

UK share prices have (broadly speaking) enjoyed healthy gains in recent weeks. But years of underperformance mean that many top stocks continue to trade at rock-bottom prices.

Old Mutual Limited (LSE:OMU) and H&T Group (LSE:HAT) are two bargain stocks I think are worth serious consideration today.

As the table below shows, their current dividend yields soar above the market average. The average yield for both companies stands at an impressive 5.7%.

And they trade on rock-bottom price-to-earnings (P/E) ratios.

| Company | Forward dividend yield | Forward P/E ratio |

|---|---|---|

| Old Mutual Limited | 7.1% | 7.3 times |

| H&T Group | 4.2% | 8.2 times |

Here’s why I think they’re worth a close look today.

Old Mutual

Old Mutual has been selling financial products for 178 years. It has operations in 14 African countries, and sources the majority of its revenues from South Africa.

I believe it has considerable scope to increase profits as population sizes and wealth levels across its markets grow. With just 48% of African people currently using banking services, there’s plenty of business for the industry’s biggest players like this to win.

So why do I like Old Mutual specifically? Firstly, I like its exposure to multiple sectors like banking, life insurance and asset management. This gives it multiple opportunities to increase long-term earnings, while also reducing dependence on one product area.

I’m also a fan because of its incredible brand power. In 2023 it was deemed the world’s strongest insurance brand, according to Brand Finance.

Trading here is linked closely to the health of South Africa’s economy. This in turn leaves it vulnerable to changes in commodity prices.

But given its low earnings multiple, I think this risk is more than reflected in its current share price.

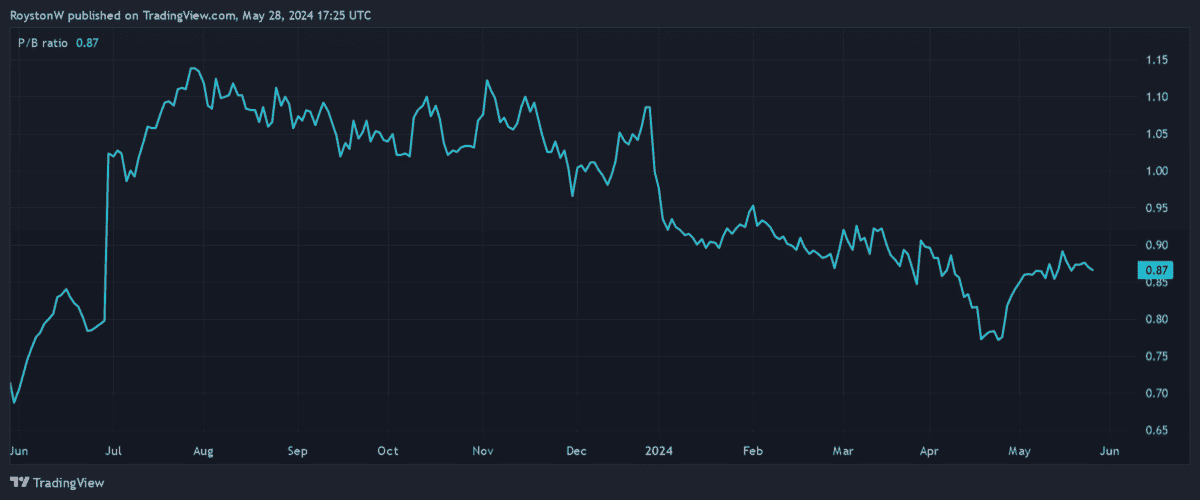

Old Mutual’s impressive value is further illustrated by its price-to-book (P/B) value. Any sub-1 reading indicates that a share is trading at a discount to the value of its assets.

H&T Group

H&T is the UK’s biggest pawnbroker, with 280 stores zig-zagging the UK. It also provides other services like foreign currency exchange, money transfer and precious metals dealing.

It’s doing a roaring trade at the moment, and in April 2024 demand for its pledge loans hit record levels. This is perhaps unsurprising given current economic conditions.

Naturally, revenues here could come under pressure if Britain’s economy bounces back. But from a long term perspective there’s a lot I still like about H&T shares.

I’m especially excited by its commitment to steady expansion. It opened 11 new stores in 2023, and plans to cut the ribbon on another eight to 12 this year.

With a strong balance sheet — its net debt to EBITDA ratio was just 0.9 as of December — H&T looks in good shape to continue expanding without compromising its progressive dividend policy.

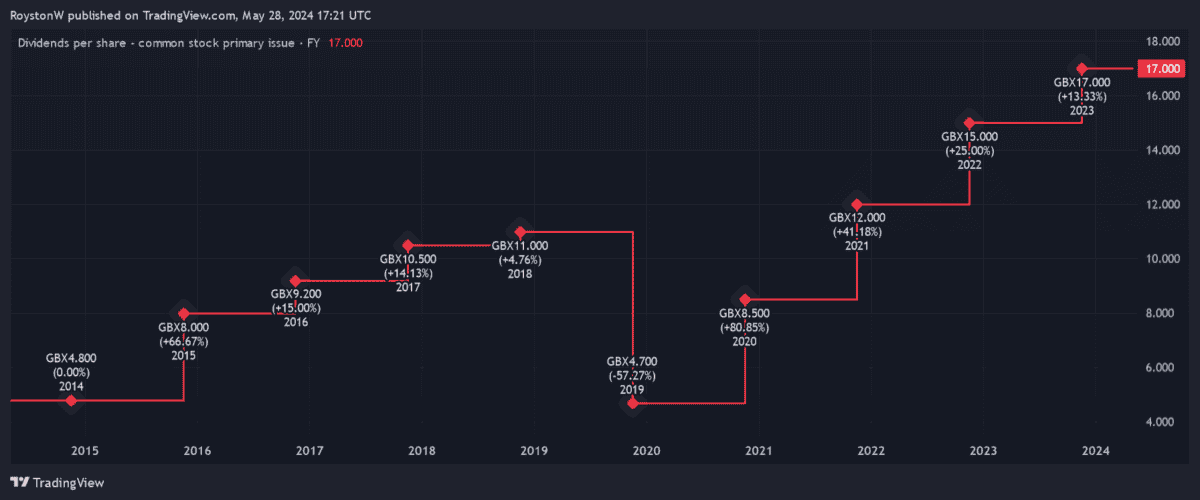

Indeed, H&T has a terrific record of dividend growth, as the chart above shows. Shareholder payouts were slashed in the middle of the pandemic but have sharply rebounded from those levels.

Like Old Mutual, I think the company could be a great way to make a market-beating dividend income at low cost.