The idea of passive income is what first attracted me to investing. But what put me off was the impression that I needed a lot of money. It felt like there was no point in starting unless I had at least £10,000.

Now I realise the absurdity of that thought process. I could have started at any time with as little as £100 a month (or less). The key factor was time, not money. The sooner I began, the better. Looking back, I now see how much I could have been earning had I just put £100 a month into dividend stocks.

But which stocks are best?

Knowing what I know now, the first thing I’d have looked at was the dividend yields of popular FTSE 100 shares.

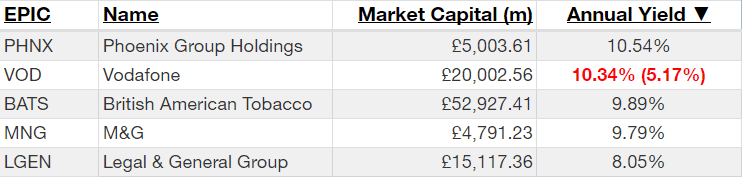

The table below shows the top five companies with the highest yields currently.

My initial reaction would be to invest in Phoenix Group, the highest-paying dividend stock. But will it stay that way?

Building passive income takes time, so I need to think long-term. Looking at its history, the company’s been paying a dividend since 2010 but, for much of that time, the yield was between 6% and 7%.

The volatility makes it unreliable.

Next on the list, Vodafone, recently cut its dividend so it won’t be 10.34% for much longer. Until recently, British American Tobacco was only paying 6% and before 2018, it was only 3%. And M&G has only been paying a dividend for four years.

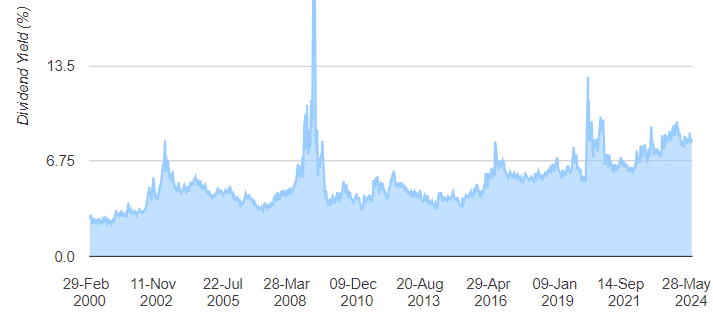

Which takes me to Legal & General (LSE: LGEN). L&G’s been paying a consistent and reliable dividend for 24 years. In that time, it’s steadily risen from 3% to 8%. When it comes to passive income, consistency and reliability are the key factors I’m looking for.

Legal & General Group Dividend Yield History

Yes, it’s had ups and downs so it might dip back below 7% for short periods. But in the long term, I’d expect it to keep growing.

Of course, there are some risks. Profit margins are down to 3.6% from 6.4% last year, so performance is slipping. I also see that earnings per share (EPS) is only 7p, while dividends are currently 20p. That makes the payout ratio well over 200%, meaning dividends could be cut if earnings don’t improve soon. And with a price-to-earnings (P/E) ratio more than double the industry average, the share price could be overvalued.

But it isn’t a growth share so that’s not unusual. The share price is only up 176% in the past 20 years. This equates to annualised returns of 5.22%, which is a fairly acceptable rate for an income share.

Taking these figures into account and averaging a 2% annual yield increase, I can calculate my potential passive income. By reinvesting the dividends and compounding the returns over 10 years, my pot could grow to £23,642, paying annual dividends of £1,953.

If I continued investing £100 a month for a further 10 years, the total could grow to around £132,149, paying annual dividends of £13,700. That’s a decent £1,141 a month in passive income.

Of course, these are just projections based on the past performance of one stock. Ideally, I would diversify my investment over several reliable dividend stocks to safeguard against a single failure.