I’m looking for the best dividend shares to buy for a market-beating passive income. And I think I’ve found two that have rich histories of dividend growth.

This isn’t all. While dividends are never guaranteed, these companies — revealed in the table below — offer dividend yields that sail above the 3.5% average for FTSE 100 shares.

If broker estimates prove correct, £20,000 invested equally across them could yield £1,080 in 2024. That’s based on an average 5.4% forward yield.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

I’m confident they could grow their dividends over time as well. Here’s why I think they’re worth considering for a second income.

In recovery

There’s a huge amount of uncertainty that still surrounds the UK housing market, and with it, the earnings (and dividend) prospects of housebuilding shares.

The industry’s recovery has weakened more recently as mortgage rates have ticked up again. But make no mistake, the outlook has improved from six months ago. Estate agency Savills has even upped its home price forecasts, now expecting average values to rise 2.5%. The business had previously tipped a 3% fall.

So I’m considering increasing my existing stake in construction giant Taylor Wimpey. Strong trading news here of late certainly points to conditions become more stable.

Excluding bulk sales, its net private sales rate between 1 January and 21 April was 0.69 per outlet a week. This was up from 0.66 in the same 2023 period.

The builder’s order book was down around £300m year on year in the period. But orders still stood at £2.1bn as of April, giving it solid earnings visibility for the near term.

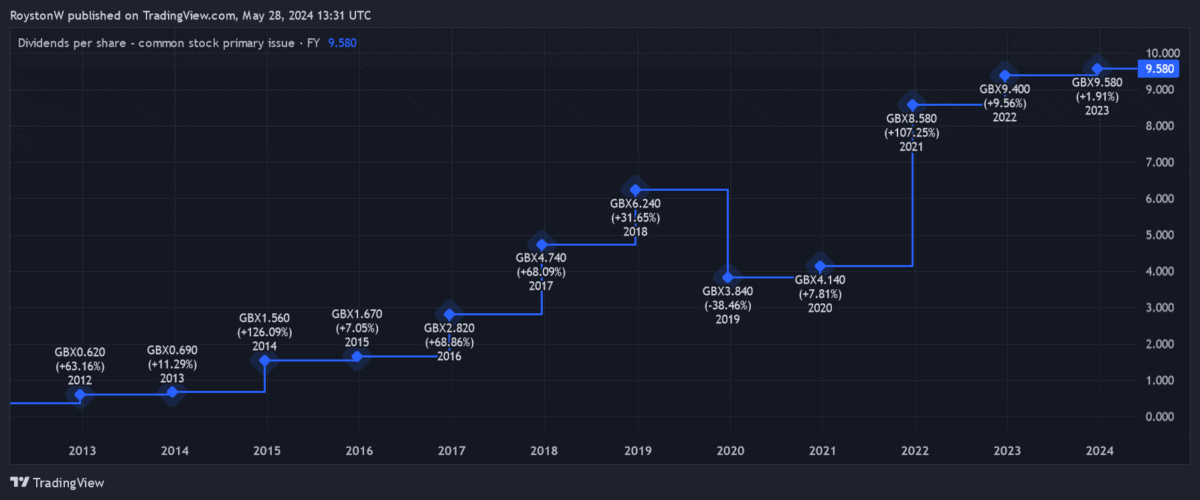

Taylor Wimpey has a strong record of dividend growth, with payouts having only fallen during the middle of the pandemic. And City analysts expect shareholder rewards to keep rising this year, resulting in that huge 6%-plus dividend yield.

With a strong balance sheet — it had £677.9m of net cash as of December — it looks in good shape to meet this bullish forecast too.

Another dividend hero

Recovering homes demand also bodes well for building material suppliers like Michelmersh. This former penny stock makes 125m clay bricks and pavers each year that it sells to the construction and RMI (repair, maintenance and improvement) sectors.

Like Taylor Wimpey, it’s also been exhibiting green shoots of recovery of late. In mid-May, It announced that “order intake momentum [is] at levels not seen since the end of 2022” which, in turn, is “driving improved volume and quality of the forward order book“.

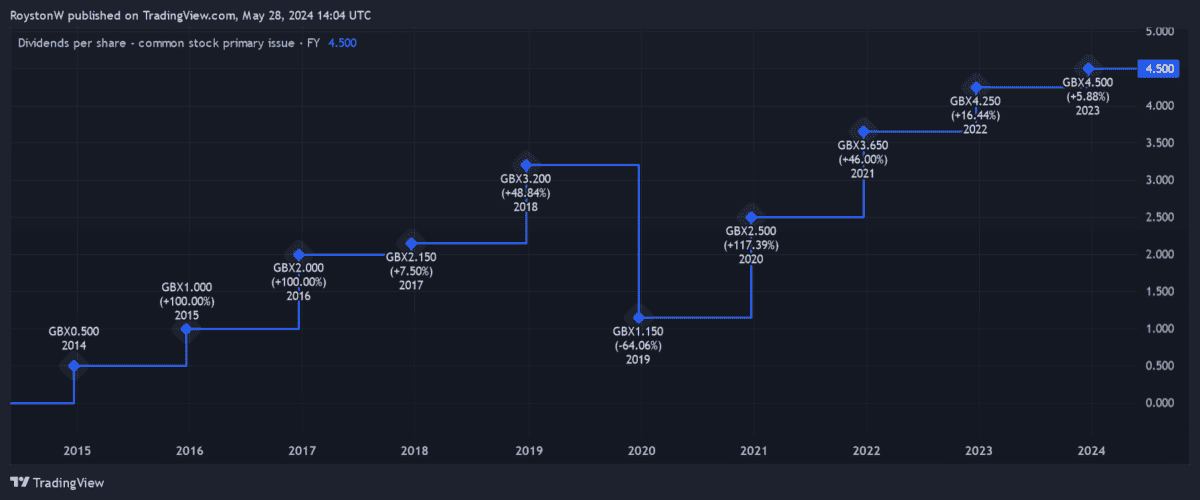

This explains why City brokers think Michelmersh’s solid track record (excluding the pandemic, as shown above) will continue.

And like the housebuilder I’ve described, a robust financial base gives current forecasts added strength. It held net cash of £11m at the end of 2023.

Brickmakers like this are vulnerable to a sudden spike in energy prices. But all things considered, I think this is a top dividend share to consider, and especially at today’s price. It currently trades on a price-to-earnings (P/E) ratio of just 9.7 times.