FTSE 100 stocks are soaring at the minute. Yet thanks to years of underperformance, the UK’s blue-chip share index remains packed with brilliant bargains.

NatWest Group (LSE:NWG), Barclays (LSE:BARC), and Imperial Brands (LSE:IMB) are a few Footsie shares that have surged in value in recent weeks and months. But they still look dirt cheap on paper, as the table below shows.

| Company | P/E ratio for this FY | P/E ratio for next FY |

|---|---|---|

| NatWest Group | 7.9 times | 7.3 times |

| Imperial Brands | 7.3 times | 6.6 times |

| Barclays | 7 times | 5.7 times |

It’s worth remembering that some stocks trade cheaply for good reason. With this in mind, should I buy these recovering shares today?

Big banks

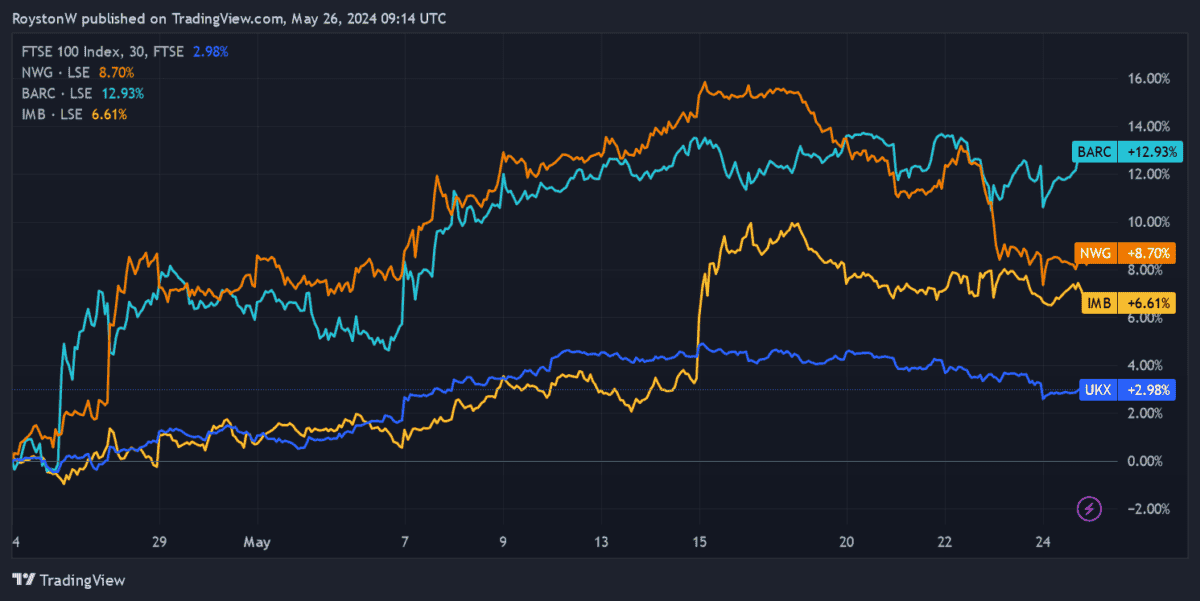

UK high street banks NatWest and Barclays have been among the FTSE 100’s strongest performers of late, as the above graph shows.

Investor demand has been boosted by signs of Britain’s economy turning the corner. Further drops in inflation, and the implication this could have for interest rate movements, have also helped their share prices.

But bear in mind that rate cuts are a double-edged sword for banks. Sure, they stimulate economic activity, but they also reduce banks’ profit margins.

NatWest’s net interest income slumped 9% in quarter one, reflecting the end of the Bank of England’s rate-rising programme. Barclays’ comparable income meanwhile, dipped by 4%.

It’s also questionable how far interest rate rises will boost Britain’s economic recovery. In fact, the broader growth outlook remains poor. The OECD thinks the UK will post the lowest growth among G7 nations in 2025.

Major structural problems (like labour shortages, trade frictions and regional disparities) pose threats in the medium-to-long-term too, reducing banks’ potential for earnings growth.

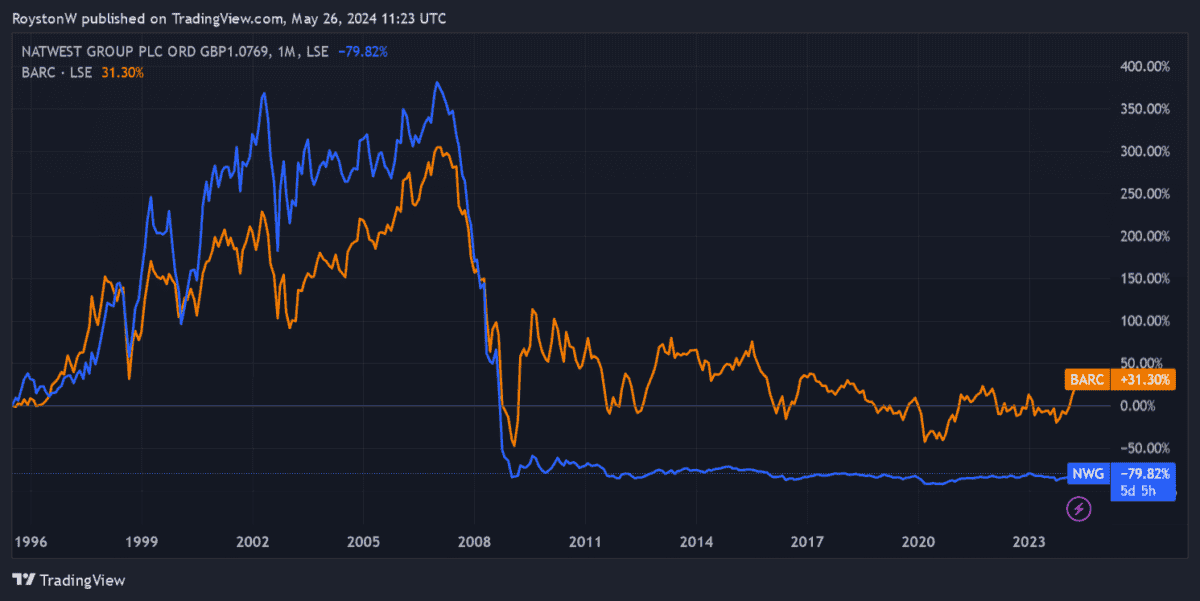

NatWest’s share price is down 17% in the past decade. Barclays’ shares are 12% cheaper over the same period. With competitive pressures also rising, I can’t see the businesses breaking out of this long-term downtrend.

Tobacco titan

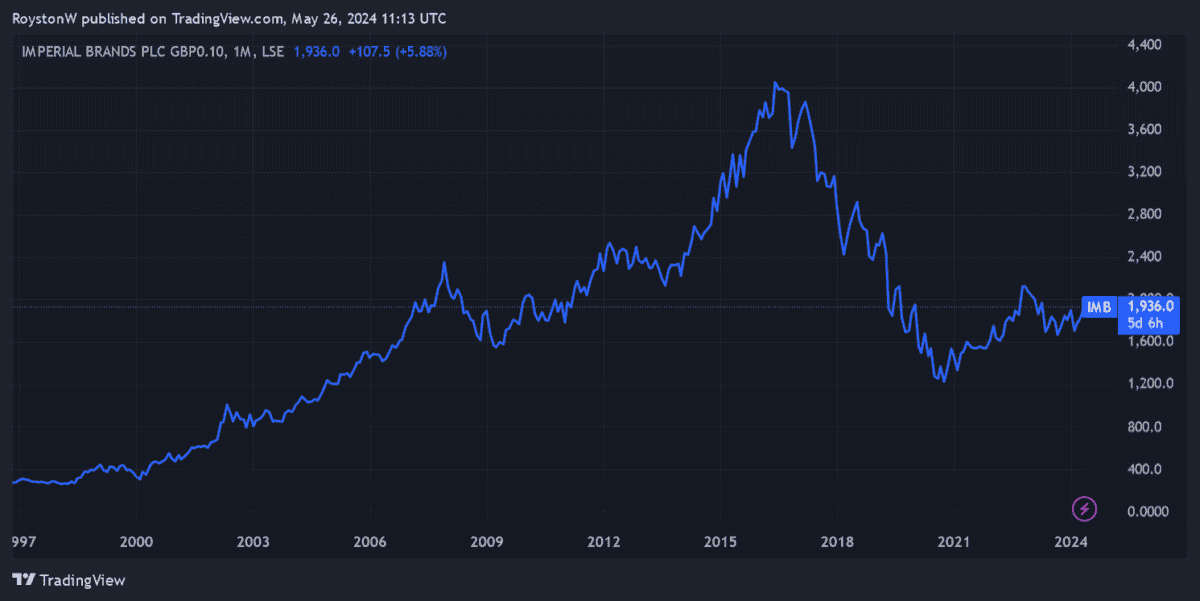

Imperial Brands is another UK share with a long history of underperformance. Its share price has plunged 27% during the past decade as smoking rates have steadily declined.

This isn’t a problem that’s going away either. Imperial Brands’ volumes reversed more than 6% in the six months to March. Big Tobacco will remain under pressure too, as legislators continue to restrict how these products are sold, marketed and consumed.

But it’s not all bad. Indeed, the Footsie stock’s latest financials showed how it could still thrive even as the total market shrinks.

Mighty brands like Davidoff and West continue to claim market share in important regions, even as prices are hiked to drive revenues. Sales of next-generation products like vapes are also rising sharply. These factors drove Imperial Brands’ net revenues 3% higher in the first half.

But this isn’t enough to make me invest. The pace at which global cigarette sales are declining gives the firm an increasingly small opportunity to grow revenues.

According to the World Health Organisation, one in five adults worldwide currently consume tobacco compared to one in three in 2000. And, worryingly, rising restrictions on vapes and similar products threaten the growth potential of these next-generation products.

Like NatWest and Barclays, Imperial Brands is a share I plan to avoid at all costs.