A cyclical recovery in the US and strong growth in Latin America is sending the Experian (LSE:EXPN) share price to all-time highs. But it might not be too late to buy the stock.

With revenue growth at 6% and a price-to-earnings (P/E) ratio of 42, Experian shares look expensive at first sight. Despite this, I think investors should take a closer look.

Investment thesis

Experian has attractive unit economics and a business that’s extremely difficult to disrupt. But is that worth paying 42 times earnings for when the FTSE 100 trades at 12.5 times?

Should you invest £1,000 in Ocado right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ocado made the list?

The answer comes down to how much the business is going to grow. Right now, the firm has a market-cap of around £34bn and generates around £1.1bn a year in free cash.

That implies a 3.2% annual return. With a 10-year UK government bond coming with a 4.1% yield, the company has to grow over the next decade to be a good investment.

The question for investors is how much Experian is going to grow and where that growth is going to come from? And the latest earnings report provided some insight here.

Growth

Experian reported revenue growth of 6% for the 12 months ending in March. That doesn’t sound like a lot, but there are a couple of reasons for shareholders to be positive.

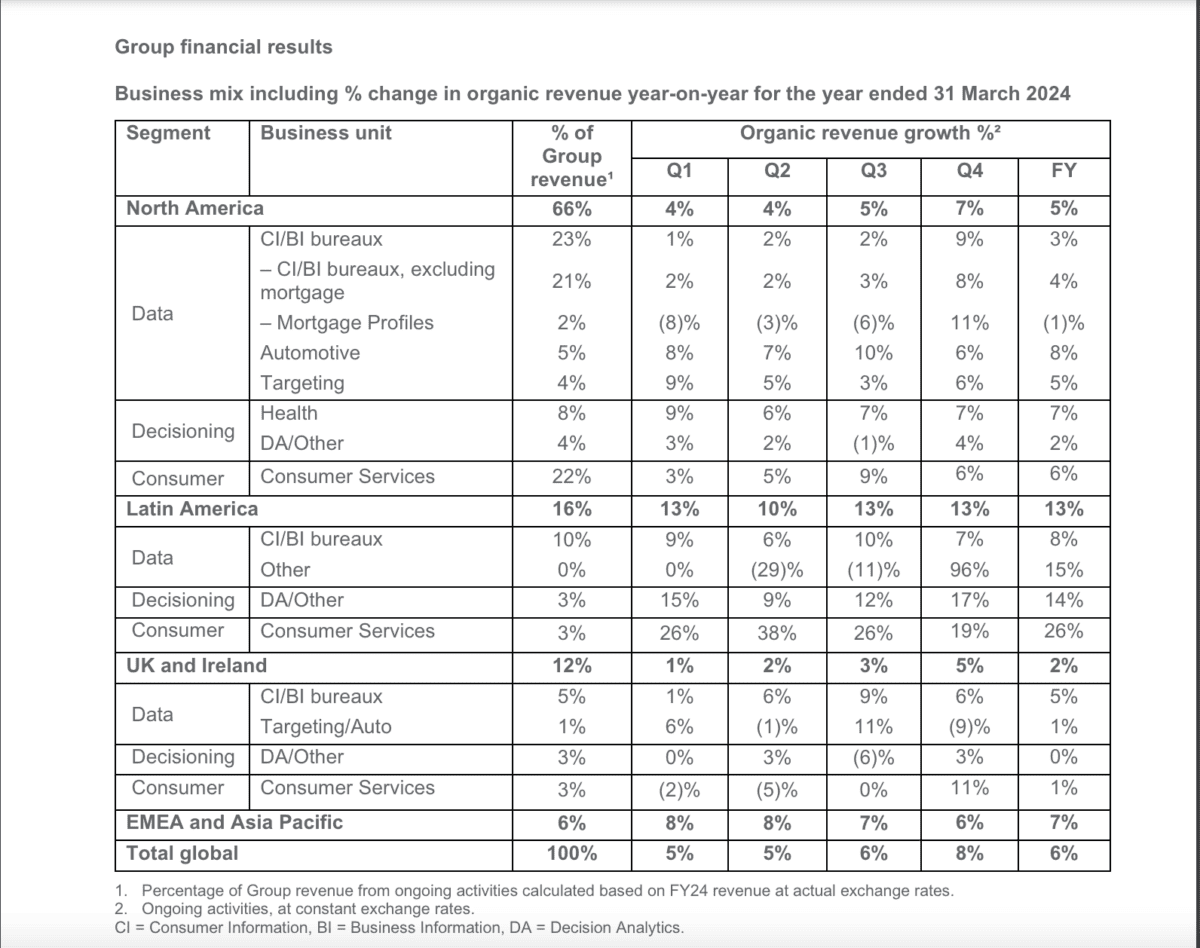

First, the rate of growth is increasing. Sales grew 8% between January and March, compared with 6%, 5%, and 5% during the previous three.

Source: Experian Full Year FY2024 Results Announcement

Additionally, the US credit bureau grew its revenues by 9% (compared with 1%, 2%, and 2% earlier in the year). This is the largest part of the business, accounting for 23% of sales.

Lastly, the fastest growing part of the company – Latin America – continued its 13% growth rate. The highlight was the consumer division, which reported 19% growth.

Outlook

Looking ahead, management forecasts revenue growth of around 8% is likely to prove sustainable over the medium term. And it also said it expects margins to expand.

This growth isn’t guaranteed though. The earlier part of the year has demonstrated just how exposed the company still is to a macroeconomic downturn, especially in the US.

The longer it takes for interest rate cuts to arrive, the more difficult it will be for Experian to hit its growth targets. And this is a risk investors should bear in mind.

If the company does hit its targets though, free cash flow could grow by 10% a year. That would result in an average free cash return of 5% a year over the next decade.

A stock to consider buying

Experian shares are at all-time highs. It’s difficult to buy a stock when it’s never been more expensive, but there’s something else investors should note.

It’s obviously true – but it’s worth pointing out that the stock has been at all-time highs before. And it’s always found a way to go higher from there.

That’s because Experian is a quality business and quality businesses often make great investments. I think it’s worth considering for investors looking for stocks to buy.