There are very few FTSE 100 stocks that have grown like BAE Systems (LSE:BA.) has over the past couple of years.

Since Russia invaded Ukraine in February 2022, the company’s share price has increased by 125%. And from May 2021 to May 2024, the defence contractor’s stock has been the second-best performer on the index.

Going against the trend

In one sense, it’s a very old-fashioned company. The first army was organised in 3000 BCE and, ever since, companies have made money selling weapons and military hardware.

Its shares have clearly gained on the back of tragic events in Eastern Europe, but there’s also a wider trend towards more military expenditure.

According to the International Institute for Strategic Studies, global defence spending hit a record high of $2.2trn, in 2023.

For comparison, this is over 2.5 times larger than where the artificial intelligence (AI) market is expected to be in six years time. But very few appear to be talking about the defence sector. Instead, most prefer to focus on machine learning and large language models.

Despite this, I think it’s worth noting that the NASDAQ CTA Artificial Intelligence and Robotics Index has fallen by 8%, since the war in Ukraine started.

Is there a risk that investors are too focused on the ‘next big thing’ and are overlooking other markets that are already established? Indeed, I could be one of them. I have an AI fund in my ISA.

Okay, the defence sector isn’t growing as fast as AI, but it is expanding.

And governments tend to ‘buy local’ when it comes to military equipment. BAE Systems should therefore benefit from Rishi Sunak’s pledge to increasing the UK’s defence budget from 2% to 2.5% of GDP by 2030. Assuming, of course, that he’s re-elected.

Financial performance

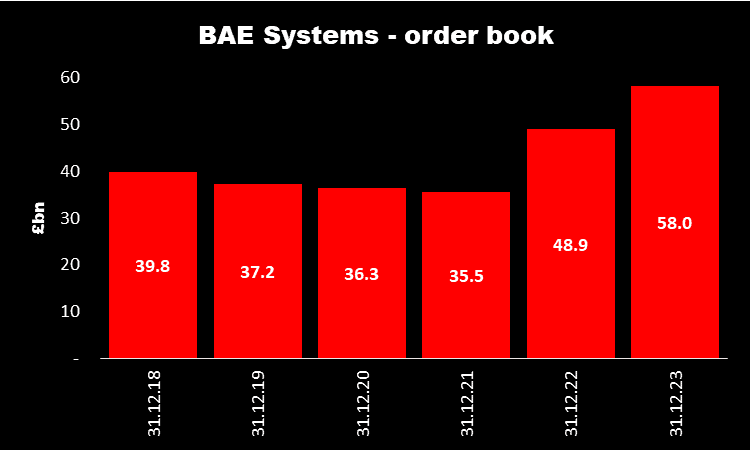

At the end of 2023, the company had an order book of £58bn. This is equivalent to 2.5 times its revenue for the year.

But as the chart below shows, it’s only increased during the past couple of years. This makes me wonder whether events in Ukraine have given the company a one-off — probably temporary — boost.

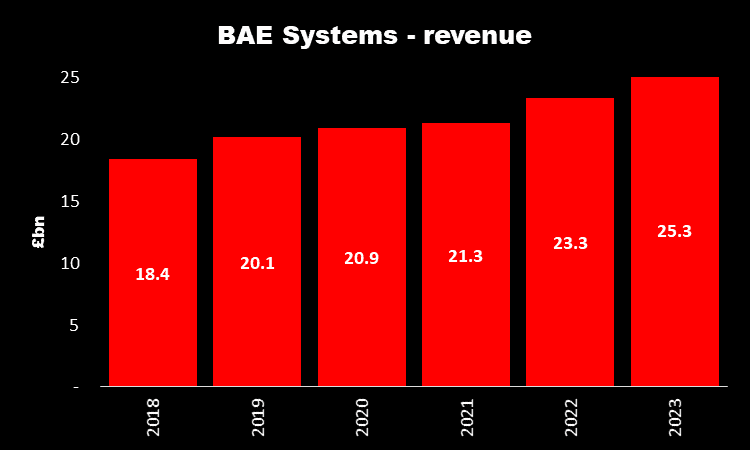

It’s a similar story with revenue. It was relatively flat from 2019 to 2021, growing by £1.2bn. However, during 2022 and 2023, sales increased by £4bn.

However, the recent growth in the company’s share price has made its stock expensive.

At the end of 2019, its shares were valued at nearly 12 times that year’s earnings. Today, the multiple is nearly 22 times its profit after tax for 2023 – over twice the FTSE 100 average.

I’m sure even the most pessimistic of observers don’t think the war is going to last forever. Once over, I suspect BAE System’s earnings and revenue — and share price — will fall from their current elevated levels.

A question of conscience

Before concluding, I think it’s necessary to address the issue of ethics and morality. Many will be appalled at the thought of investing in companies that supply military hardware.

However, I believe the first duty of a democratically elected government is to protect its citizens so I wouldn’t rule out buying shares in a defence contractor for my own portfolio.

Even so, I think BAE Systems shares are no longer offering good value and I believe there are better opportunities elsewhere.