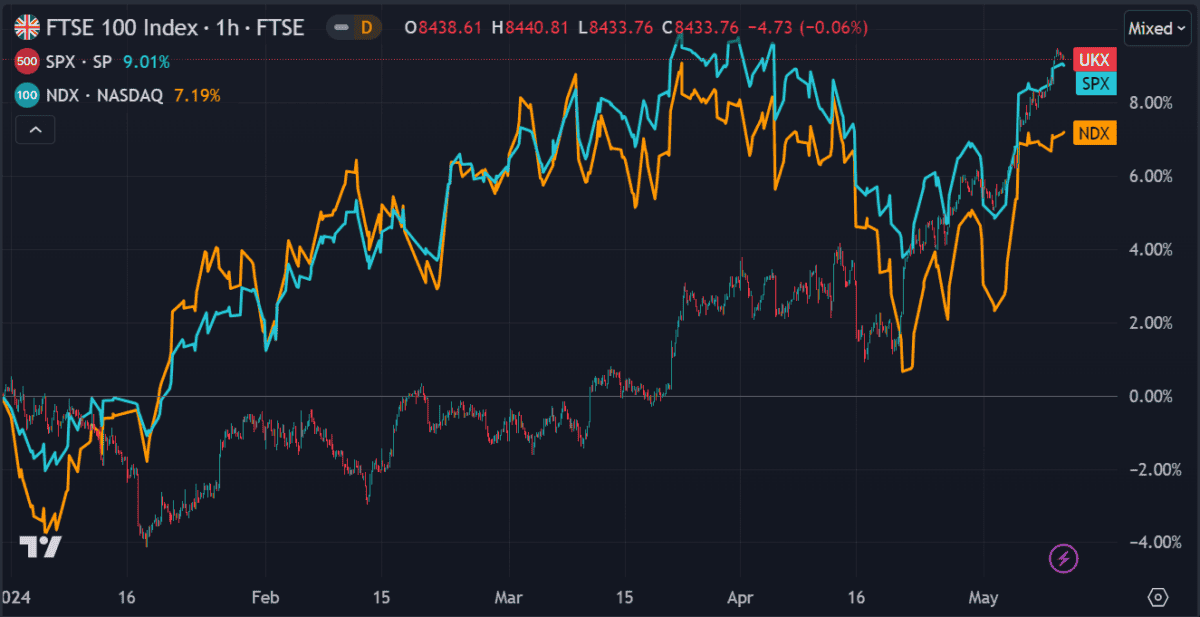

The FTSE 100 is up almost 10% this year, beating major US indexes like the S&P 500 and NASDAQ, which are up 9% and 7.19%.

The UK’s leading index spent the first quarter of the year making losses. But in the past two months, it’s taken off, breaking a new all-time high above 8,400 points.

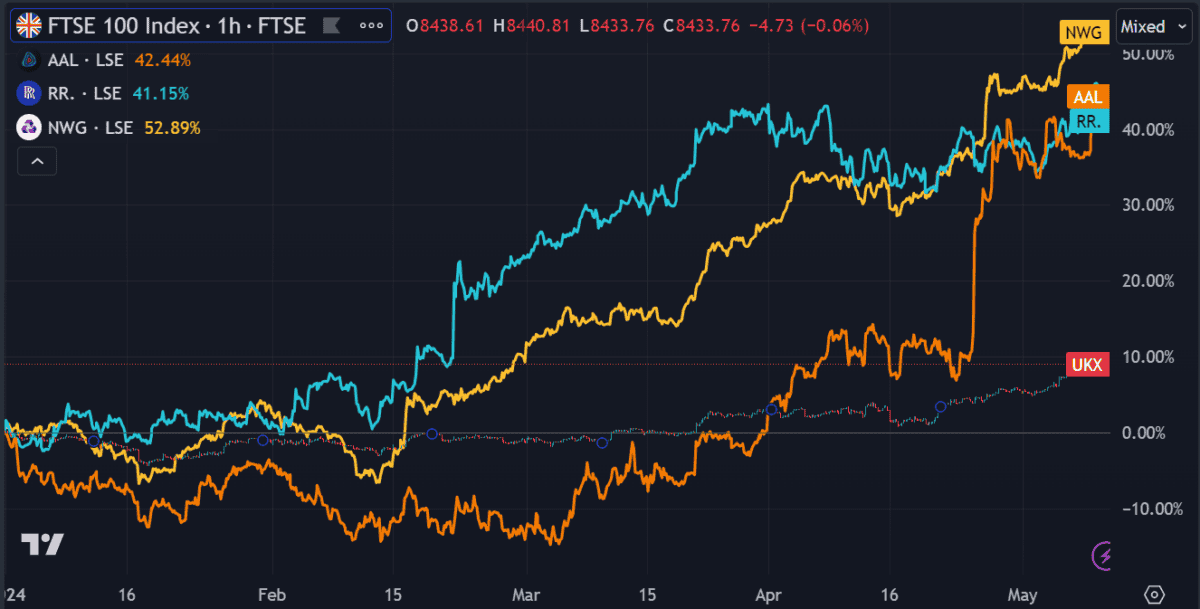

The top three stocks driving the growth? Natwest Group (LSE: NWG), Anglo American (LSE: AAL), and Rolls-Royce (LSE: RR.), up 52%, 42%, and 41%, respectively, year-to-date (YTD).

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

But I think those three stocks are now likely overbought and have limited room to grow further. Instead, I’m looking at a smaller-cap stock with more room to grow.

OSB Group

OSB Group (LSE: OSB) is a relatively new specialist lending and retail savings group, also known as OneSavings Bank. It has a £1.8bn market cap and £4.64 share price that’s up 24.8% in the past month.

The bank has only been operating for a bit over a decade but has made some serious inroads in that time. Its key value proposition is a focus on mortgages for buy-to-let properties, which could benefit from growth in the UK’s private rental sector.

Its most recent trading update released on 8 May revealed retail deposits up 4%. However, new originations are down 16.6% to £1bn from £1.3bn in Q1 2023. Still, CEO Andy Golding noted the group’s “strong and resilient business model“, stating it is “well positioned to deliver attractive and sustainable returns”.

With a trailing price-to-earnings (P/E) ratio of 6.7, OSB Group is well below the UK diversified financial services industry average of 11.7. This indicates the share price still has a decent amount of room to grow based on earnings. The average 12-month price target of the 10 analysts evaluating the stock is 32%, although the range is quite widely spread.

Risks

The bank does pose some risks to investors. Earnings growth is down 31% from last year, a fair bit above the industry average of -13.8%. And while it has an appropriate loan-to-deposit ratio, its allowance for bad loans is low. If debtors begin to default, the bank could find itself in trouble.

It’s also operating with a high level of debt, bringing its debt-to-equity (D/E) ratio up to 242%. While a high D/E ratio is not unusual for banks, this level is cause for concern. OSB is performing well currently but if it doesn’t keep it up, it could find itself on the ropes. As it is heavily exposed to the UK housing market, a declining economy would hurt the bank’s bottom line.

But wait, there’s more!

OSB Group has a trick up its sleeve – a 6.9% dividend yield that’s well-covered by earnings. Dividend payments have been increasing steadily for the past nine years, barring the expected gap during Covid. Analysts predict they will continue to grow, with a yield of 8.5% expected in three years.

Overall, I’m bullish on the stock and I wasn’t surprised to find several major brokers are too. Deutsche Bank and Shore Capital put in ‘buy’ ratings for the stock last week, reassuring my confidence. I plan on buying the shares as soon as I’ve freed up some capital.