The Diploma (LSE:DPLM) share price has gone from £15.09 to £41.94 over the last five years. That makes it one of the FTSE 100’s best-performing stocks.

The business has been a compounding machine, but the question for investors is whether it can continue. And its most recent trading update indicates the company isn’t slowing down.

Growth, growth, and more growth

Diploma reported strong growth across the board in the six months leading up to the end of March. And management is expecting more to come by the end of the year.

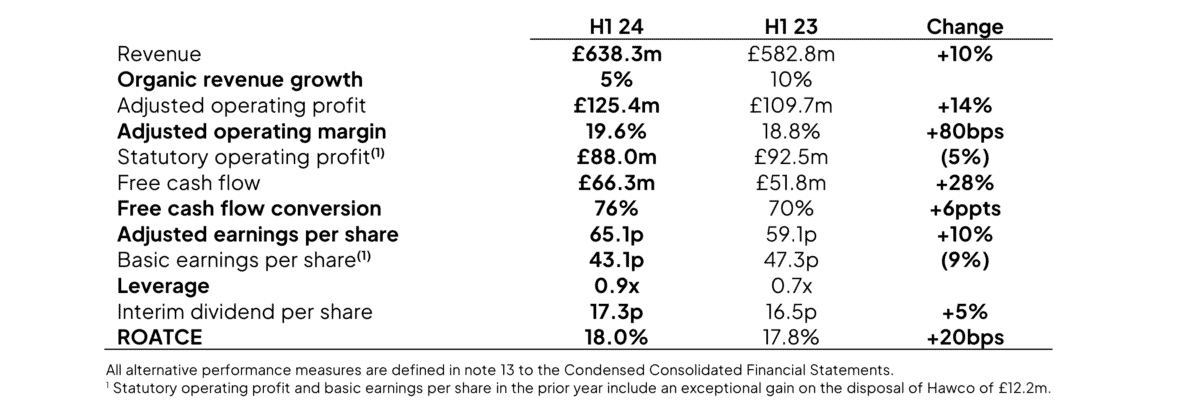

Organic sales grew 5%, operating margins widened to 19.6% and cash conversion reached 76%. As a result, earnings per share reached 65.1p and free cash flow increased to £66.3m.

Diploma Half-Year Results to March 31 2024

Source: Company Report

Importantly, each of the firm’s three divisions reported higher revenues. Against a weak backdrop of consumers looking to use up their existing inventories, this was impressive.

More impressive, though, is the forecast. Management is expecting organic sales to grow, margins to widen, earnings per share to increase, and free cash flow conversion to improve.

Acquisitions

Organic growth is only part of Diploma’s success though. Acquiring other businesses has been a key source of higher revenues.

This is the riskier part of the company’s strategy. Expanding in this way depends on finding enough opportunities at attractive prices, which gets harder as the firm grows.

Diploma’s update is encouraging, however. The business announced 12 deals over the last six months and reported that its pipeline for future acquisitions looks strong going forward.

On top of this, the company is focusing on finding value. Its transactions are coming in at low multiples and the firm’s focus on returns on capital helps it avoid overpaying.

Price

The biggest risk with Diploma shares – in my view – isn’t the danger of acquiring badly. It’s the share price – a price-to-earnings (P/E) ratio of 45, has a lot of growth already priced in.

That implies a 2.2% earnings yield. Even with a 90% cash conversion rate, this still looks low compared to the 4.1% yield a 10-year UK government bond currently comes with.

In order to match up, Diploma will have to grow at an average of around 12% per year for the next 10 years. There’s a risk it might not achieve this, which would be bad for shareholders.

Yet the latest report implies the company is on track. And investors need to be confident the current growth can continue for another decade to consider buying the stock.

A stock to buy?

It’s no surprise Diploma has been one of the FTSE 100’s best-performing shares over the last five years. The business has been firing on all cylinders and looks set to continue.

The stock doesn’t come cheap. But if the company can stay on its current path for another 10 years or more, it could be a terrific investment even at today’s prices.