I’ve been building a portfolio of growth and dividend stocks with my Individual Savings Account (ISA) for years. The next part of my investing journey is to prioritise funding a Self-Invested Personal Pension (SIPP).

With a SIPP, I have an opportunity to invest up to £60,000 each tax year, according to what I earn. I also have a wider range of investments to choose from with one of these products than with an ISA.

The big deal for me though, is the enormous tax relief investors enjoy. For every £1,000 I invest, the government will add another £250.

Higher- and additional-rate taxpayers can enjoy even bigger benefits too. People in these brackets can enjoy tax relief of up to 40% and 45% respectively.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The quest for dividends

In recent weeks, I’ve bought Legal & General, CRH and Ashtead Group shares for my SIPP. I’ve also included a couple of funds, including the HSBC S&P 500 UCITS ETF (which tracks the S&P 500 stock market index).

I bought Legal & General shares to give me extra passive income to buy more shares. The forward dividend yield here sits at an enormous 8.6%, and I’ve my eye on several other dividend stocks to help me build out my portfolio.

I’m reluctant to invest in banks like Lloyds and NatWest due to the UK’s gloomy economic outlook. But buying TBC Bank Group (LSE:TBCG) helps me sidestep this problem.

This FTSE 250 share is focused on the rapidly expanding emerging market of Georgia. So it has strong growth potential. Like all banks, it also has reliable income streams from loan interest which it can use to pay dividends.

Of course, Georgia’s economy isn’t immune to downturns. This means TBC is also vulnerable to bouts of profit volatility. But a robust long-term outlook still makes the business an attractive investment to me.

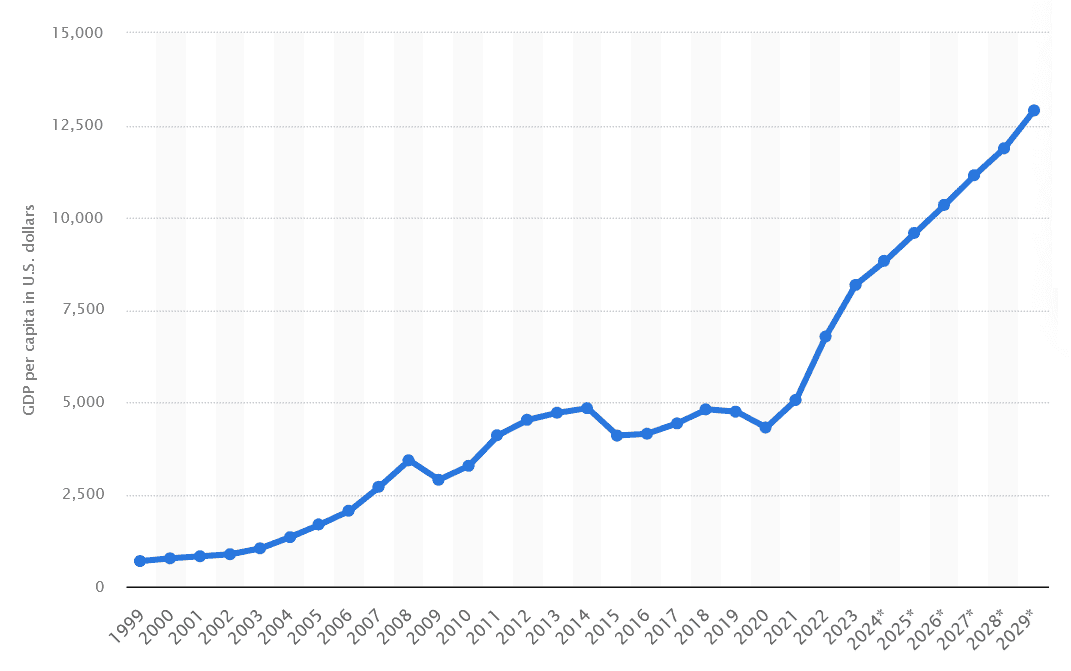

GDP per capita is tipped to rise strongly to the end of the decade, as the chart above shows. As a consequence, I expect TBC to keep delivering a large and growing dividend as demand for financial services steadily increases.

As for 2024, the bank currently offers up a giant 8.1% dividend yield.

Bank on it

Bankers Investment Trust (LSE:BNKR) is another share I’m hoping to add to my pension soon. It’s paid an annual dividend every year since the late 1890s! And it’s increased them without a break for the past 57 years.

The trust invests in some of the world’s largest companies which, in turn, gives it excellent stability and thus the ability to pay dividends every year. Some of its biggest holdings include Microsoft, Accenture, Toyota and American Express.

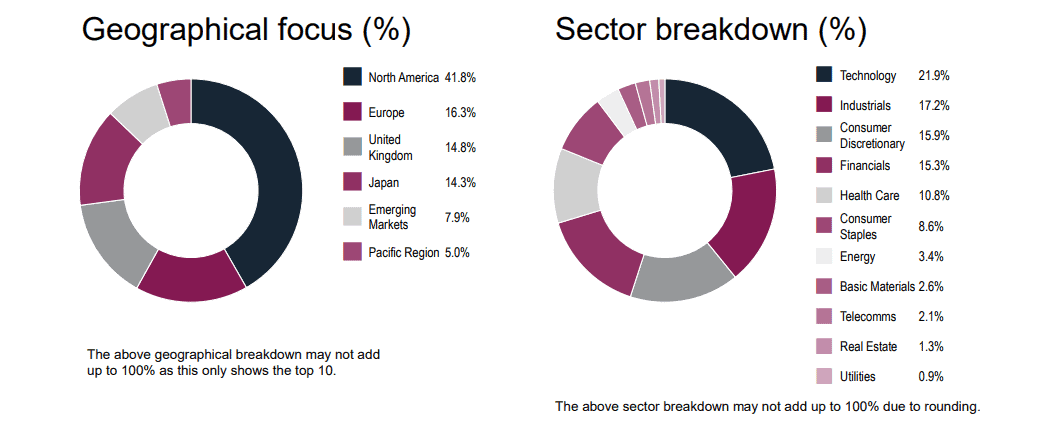

Bankers is also robust because of its highly diversified portfolio. The company spreads its capital across a broad range of regions and sectors, as the graphic below shows.

The trust does have a significant weighting to cyclical sectors like technology, industrials and financials however. This means it could deliver worse returns than other trusts during tough economic times.

But as a long-term investor, this doesn’t put me off. Bankers’ exceptional dividend record makes it a top buy for a SIPP. For this financial year, it carries a handy 2.3% dividend yield.