As an income investor, I like dividend stocks. The idea of generating income from doing very little appeals to me. That’s why I recently purchased shares in Legal & General (LSE:LGEN).

For the year ended 31 December 2023 (FY23), the company declared a dividend of 20.34p a share. This means it’s currently yielding 8.6% — comfortably above the FTSE 100 average of 3.9%.

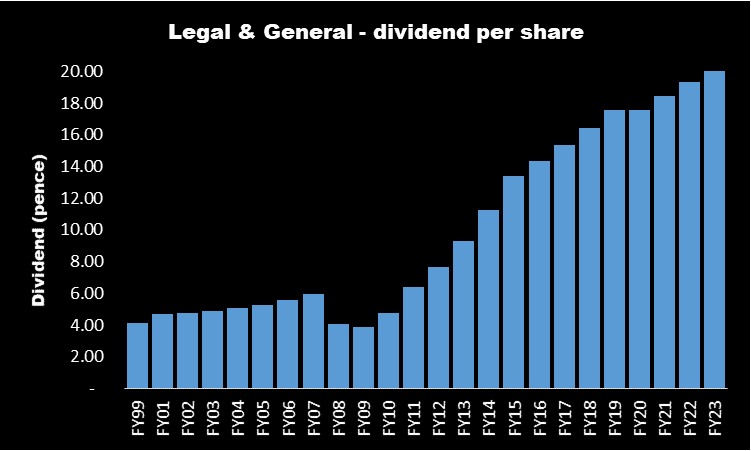

As the chart below illustrates, during 13 of the past 14 years, the company has increased its dividend. The only exception was during FY20 when, due to the pandemic, the directors felt it was prudent to leave it unchanged.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

The last time it cut its payout was FY09 when the global financial crisis wreaked havoc on world markets.

A high-ranking stock?

Although impressive, this is not good enough for it to qualify as a Dividend Aristocrat. To achieve this accolade, it needs to have increased its payout for 25 successive years. As you can imagine, there’s not many of these about.

However, despite not being a member of the stock market aristocracy, the company’s shares are carrying a dividend just under five times what they were a quarter of a century ago.

Those who invested £1,000 on 30 April 2009 would have been able to buy 1,715 shares. In the subsequent 25 years, these shares will have generated dividends of just under 245p a share – that’s £4,197!

Future prospects

But to grow its payout annually, the company’s earnings need to increase. In FY23, it recorded an operating profit of £2.1bn — the second successive annual fall. Earnings were 21% lower than in FY21.

The company’s performance is affected by macroeconomic events. It does better when there’s financial stability. And with approximately 40% of its assets located outside the UK, it’s not just the domestic economy that it’s exposed to.

However, with economies starting to recover after the pandemic and rampant inflation, it looks as though a turbulent few years are now behind us.

The company sees its biggest opportunity coming from its pension risk transfer (PRT) business, where it wants to become the global leader. This is where it buys existing company defined benefit plans. It’s part of its Retirement Institutional division, which contributed 53% of adjusted operating profit in FY23.

But there are risks.

The company owns £8.9bn of investment properties, a market which can be volatile. In addition, it has exposure to illiquid assets which could be difficult to turn into cash should the need arise. And its ability to make money depends on the accuracy of its assumptions about life expectancy and mortality. If it gets these wrong then it will face larger than anticipated retirement obligations.

But with a strong product pipeline and an excellent reputation for careful management, I think the company is well placed to grow its earnings and dividend.

Of course, it’s important to remember that dividends are never guaranteed. But for the reasons outlined above, I remain hopeful that Legal & General will be able to continue to steadily increase its returns to shareholders. Who knows, in 22 years’ time it might be considered a Dividend Aristocrat!