The FTSE 100 might be on fire lately, powering above 8,150 points for the first time, but there are still plenty of value stocks about.

The numbers alone tell us this. UK stocks are trading at about half the forward price-to-earnings (P/E) ratios of US firms. So the recent UK market rally could have some way to go yet.

One Footsie share that I’ve had my eye on is drinks bottler Coca-Cola HBC (LSE:CCH). The share price has just reached a 12-month high of £26, but I think the stock still offers great value. Here’s why.

How the setup works

First, a little bit of info on this Swiss-based company. It has the exclusive rights to manufacture and sell Coca-Cola products across 29 countries, ranging from Ireland and Poland to Nigeria.

This provides a nice blend of established, developing, and emerging markets. If one or two nations’ economies falter, which is always a risk, there are all the others to offset such weakness.

Indeed, no single country represents more than 20% of sales volume. I like this diversification.

The company generally buys the bases and syrups from Coca-Cola to produce drinks like Fanta, Sprite, and Coca-Cola, then distributes the finished products. Meanwhile, the US drinks giant controls the brand identity and product development.

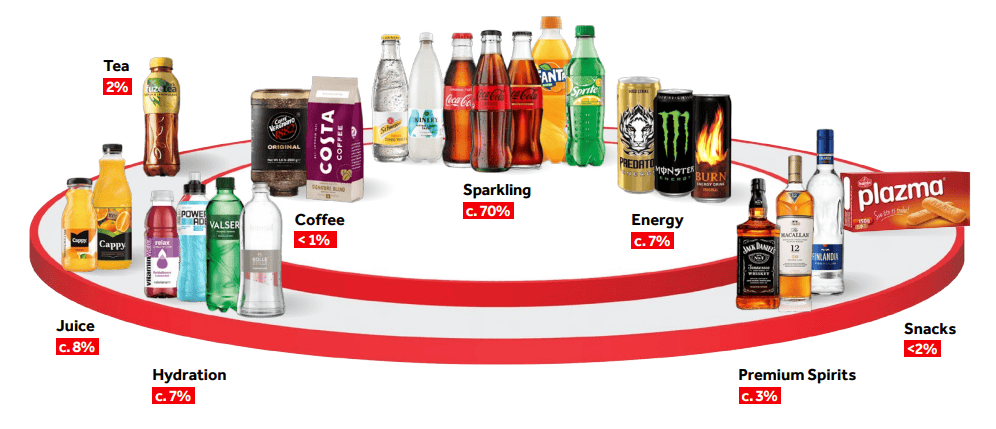

Beyond carbonated soft drinks, it makes and sells energy drinks, bottled water, and juice, as well as snacks.

Below, we can see the varied portfolio (the figures are FY 2023’s sales weighting of each category).

Some eagle-eyed readers will have noticed other brands in the lineup, including Monster Beverage. The great thing here is that the firm also benefits from Coca-Cola’s strategic partnerships with top brands like Monster.

Strong financial performance

In its latest Q1 results (for the three months to 29 March), the company announced a 12.6% increase in organic net sales revenue, reaching €2.23bn. This was higher than analysts’ expectations for 9.5% growth.

The firm successfully passed on price rises to consumers, thereby displaying pricing power, while seeing volume growth and market share gains.

For the full year, it expects annual organic operating profit growth in the 3%-9% range.

In 2019, Coca-Cola acquired Costa Coffee for $4.9bn, and Coca-Cola HBC sees branded coffee products as a high-growth market. In the quarter, this segment grew 34.3%, backing this theory up.

It also just launched Monster Energy Green Zero Sugar in 16 markets.

I like the value here

Despite rising 23.3% in six months, the stock is trading on a forward P/E ratio of 14.

For a firm selling to 740m potential consumers across three continents, with plenty of growth potential left, I reckon that is a certified bargain.

Remember, many of its markets, including Italy, Croatia, and Egypt, should continue to see rising tourism, which means more holidaymakers sipping Coca-Cola and Fanta (drinks they’re familiar with) in hotels and restaurants.

The flip side to this, of course, is that another pandemic could hammer global tourism and therefore sales growth. So this is a risk.

However, I like the long-term investment case here. As Coca-Cola brings more fast-growing brands into its stable over time, the FTSE 100 bottler should continue growing its profits.

As such, I plan to snap up this value stock in May.