The FTSE 100‘s home to a variety of popular passive income stocks. It’s jam-packed with businesses that have multiple revenue streams, market leading positions, and strong balance sheets. These qualities in turn give them the ability to pay a decent and typically growing dividend.

But the outlook for many popular income shares is becoming cloudier. Shell’s long-term dividend record, for instance, is under threat as renewable energy steadily takes over. For Lloyds, the rise of challenger banks and structural problems for the UK economy pose colossal problems going forward.

2 top dividend stocks

Yet there are plenty of other top stocks for investors to consider today. Take Legal & General Group (LSE:LGEN) and Bunzl (LSE:BNZL), for instance. I think they could deliver exceptional long-term returns through a combination of dividend income and share price gains.

It’s never a good idea to buy just one or two shares. A lack of diversification significantly increases risk for investors. But if I were to go ‘all in’ and spend all of my cash on just a couple of Footsie shares, I would choose these two. Here’s why.

Generally brilliant

Legal & General’s share price has struggled for traction in recent years. But I expect it to pick up steam looking ahead, thanks to favourable demographic factors.

In the UK, the number of people aged 75 and over is tipped to double between now and 2039, to 10m. The rapid growth in elderly populations is a phenomena being witnessed across the globe.

This has the potential to drive profits at Legal & General steadily higher. It will have to paddle hard to thrive in a fiercely competitive marketplace. But demand for its retirement, wealth and protection products could still take off as people get older.

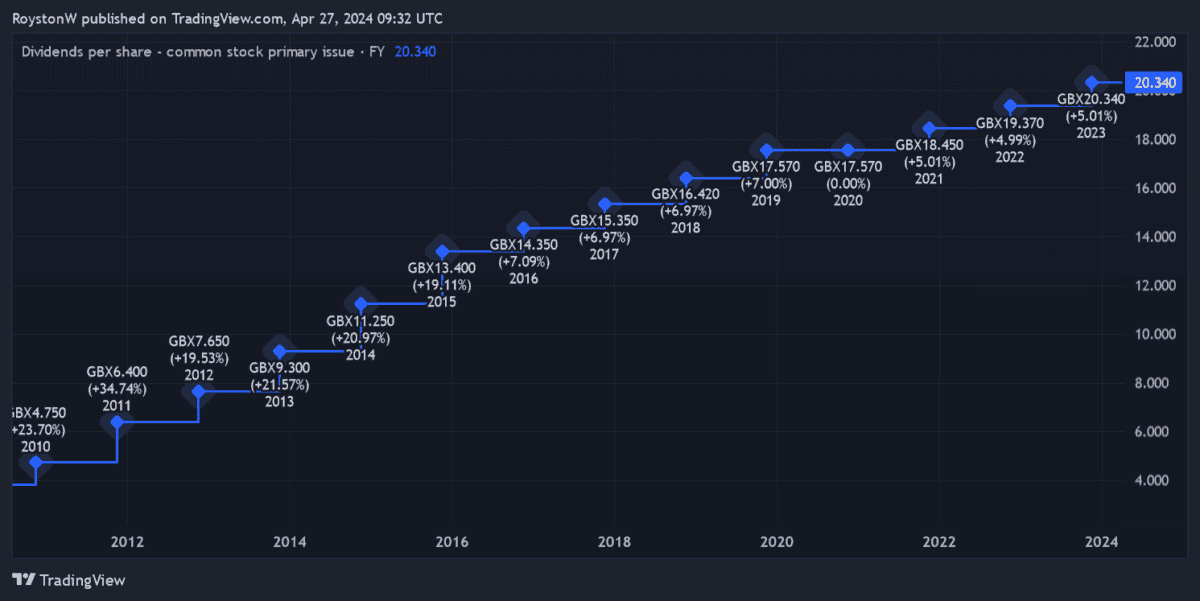

I like Legal & General as a passive income stock because of its stunning cash generation. This has laid the bedrock for long-running dividend growth, as shown in the chart below, and for market-beating yields.

Dividends are never guaranteed. But City analysts expect dividends to continue rising for the foreseeable future. This results in huge yields of 9.1% and 9.6% for 2024 and 2025 respectively.

Stunning dividend growth

Bunzl’s another FTSE stock with a stunning record of dividend growth. Annual payouts have risen for 31 straight years, including by 8.9% last time out in 2023.

This reflects the essential role its products play in everyday society. Its wide range of goods — from food packaging and medical gloves to cleaning products — are in high demand, regardless of economic conditions.

As a consequence, Bunzl’s predictable cash flows and excellent earnings visibility, and thus the means to reliably raise dividends. This enables investors like me to reduce the impact of rising inflation on our returns.

On the downside, the company’s acquisition-led growth strategy leaves it open to nasty surprises. Unexpected costs, for instance, can have a large impact on earnings.

But fortunately, Bunzl has an excellent history of identifying acquisitions and integrating them into the wider group. It’s why the business is one of the most dependable profit growers out there.

Like Legal & General, this is a share I’d happily invest a large chunk of cash into at the next opportunity.