Finding a good growth stock is about identifying a business that can reinvest its income at a high rate of return for a long time. And I think Halma (LSE:HLMA) fits the bill.

The FTSE 100 conglomerate has underperformed the broader index since the start of the year. But it has some extremely attractive characteristics that I think investors should pay attention to.

Business overview

Halma is a collection of subsidiaries focused on industrial safety, environmental monitoring, and life sciences. The company aims to grow by acquiring other businesses and improving them.

Should you invest £1,000 in Halma Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Halma Plc made the list?

This has resulted in revenue growth of 10% a year over the last decade and earnings per share have increased from 28p to 62p. But this is only part of why Halma is such an impressive company.

With growth stocks, it’s important to see sales and profits increasing. But a company also needs to be using its cash intelligently, particularly when it comes to acquiring other businesses.

Pretty much any acquisition will increase revenues, but overpaying for a subsidiary is a bad use of cash. And even for billionaire inveastor Warren Buffett, the risk of paying too much is impossible to eliminate entirely.

Culture

One of the best things a firm can do to try and limit the risk of overpaying for an acquisition is to build the right culture. And Halma has worked hard to achieve this.

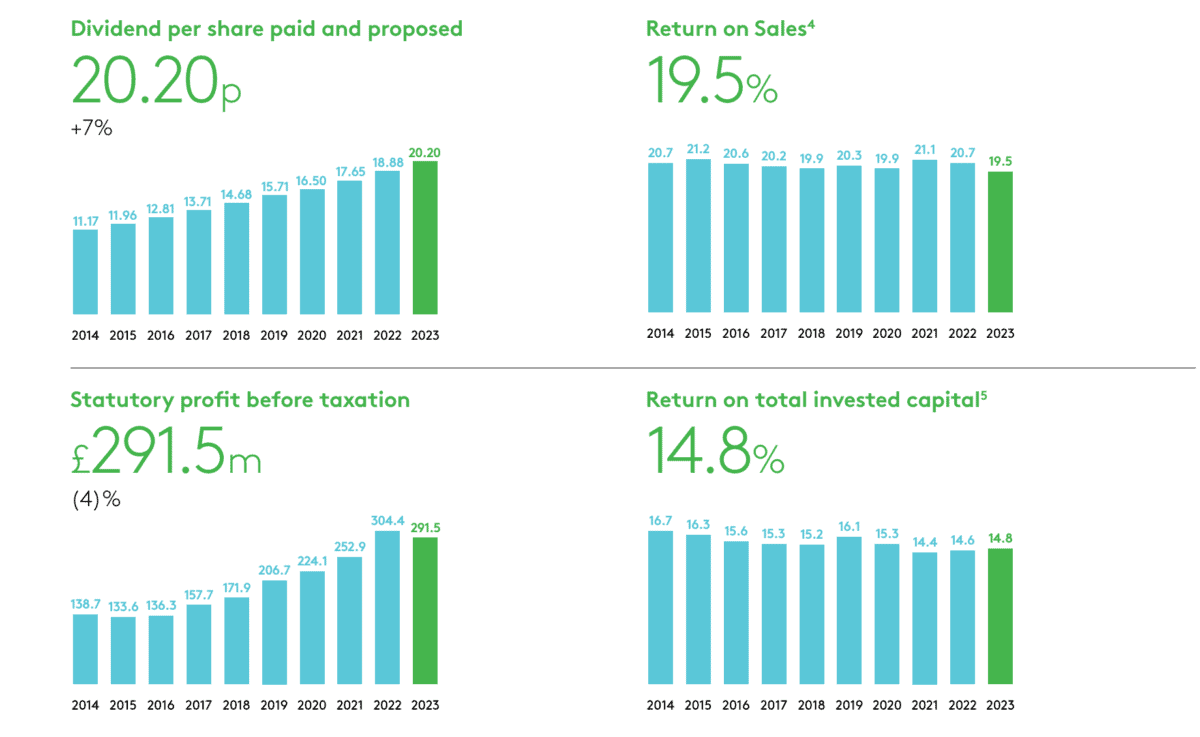

When a company pays too much for a business, it generates a poor return and this shows up in its returns on invested capital. This is a metric that Halma presents in its annual report.

Source: Halma Annual Report 2023

This gives management little incentive to pursue growth at unreasonable prices. If it does, returns on invested capital will fall and this will show up in the annual report.

Halma’s focus is therefore not just on growth, but on how much that growth costs. And I see this as a clear sign the firm’s alert to the danger of overpaying for acquisitions.

Subsidiaries

Halma typically focuses on acquiring companies that have dominant positions in relatively small markets. This makes them difficult to disrupt for either larger or smaller competitors.

Importantly, the company operates on a decentralised basis. Managers of its individual subsidiaries have the freedom to make decisions themselves and are accountable for their own performances.

There’s a big advantage to this. It allows individual businesses to be flexible and respond quickly to the needs of their clients, instead of having to go through a central headquarters.

As a result, Halma combines the size and scale of a large enterprise as well as the agility of a smaller operation. That’s been a powerful combination in recent years and I expect it to continue.

Investing in growth stocks inevitably involves being willing to wait as the companies increase their revenues and profits. I think this is the case with Halma.

The stock trades at a price-to-earnings (P/E) ratio of 35, which is high. But the firm has a winning formula that I think will continue to reward patient investors for a long time to come.