A FTSE 100 household name with a dividend yield of over 8% and a history of raising its dividend almost every year for the past decade? That certainly grabs my attention as an investor.

The share in question is Legal & General (LSE: LGEN). The track record looks good – but what might happen in future to the Legal & General dividend?

Long-term cash generation potential

Dividends are basically a way for a company to use some (or all) of its surplus cash. So, to sustain a dividend over the long run, a business needs to be generating surplus cash.

In this regard, the business model of Legal & General is well proven. Last year, for example, the company reported what is known as Solvency II capital generation of £1.8bn.

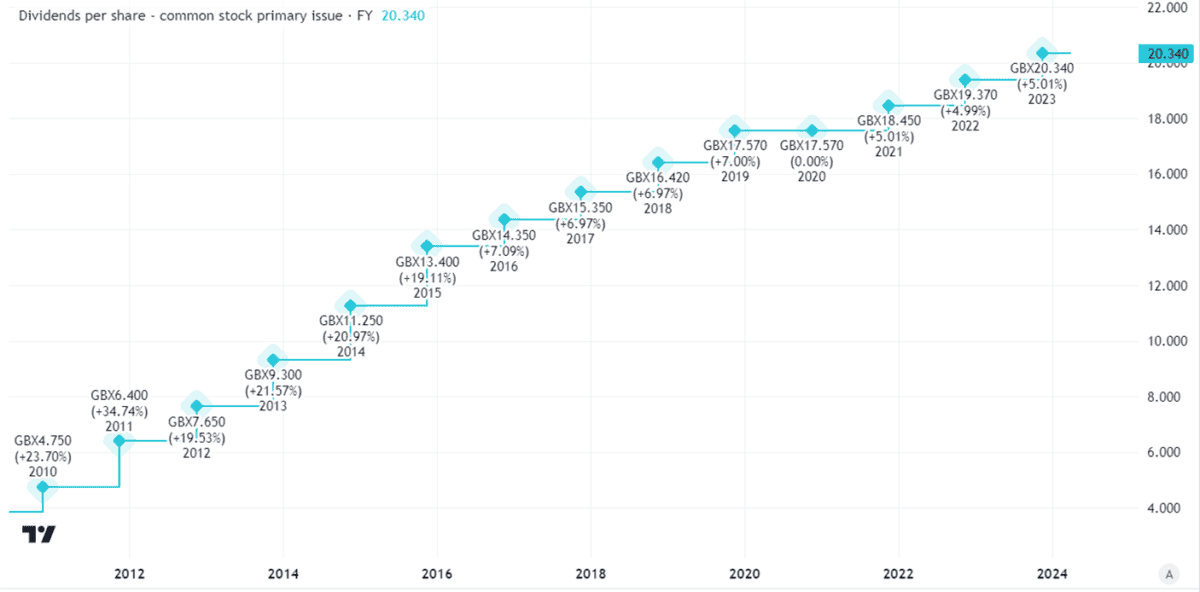

The Legal & General dividend has grown in most of the past 20 years. The exceptions were after the 2008 financial crisis, when it was cut, and 2020, when it was held flat for a year.

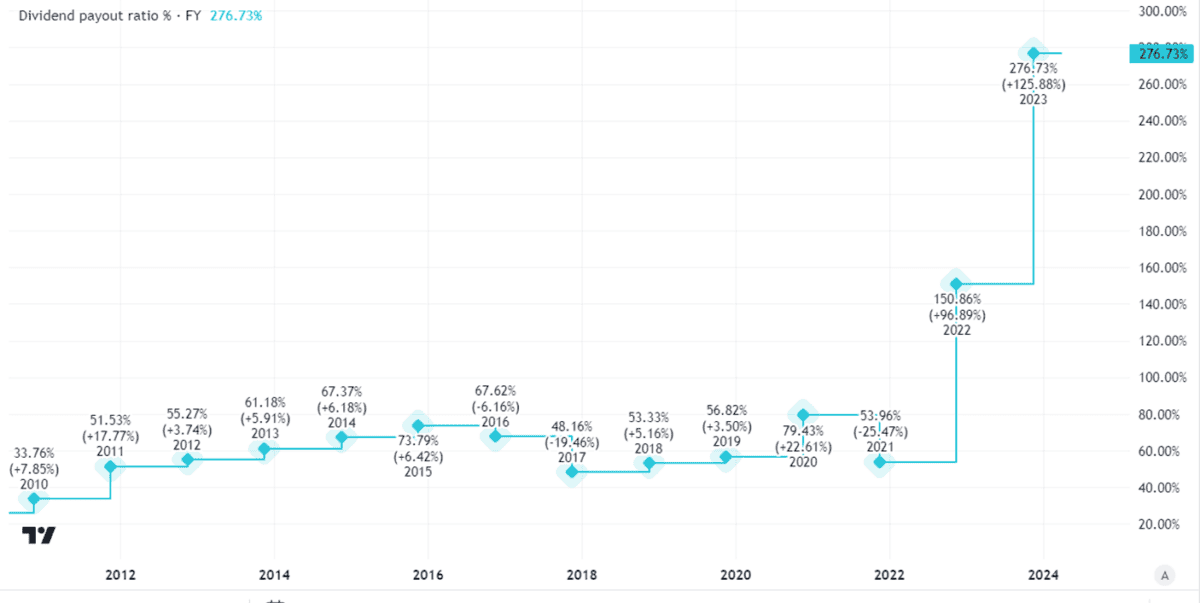

In general, the dividend has been well-covered by earnings.

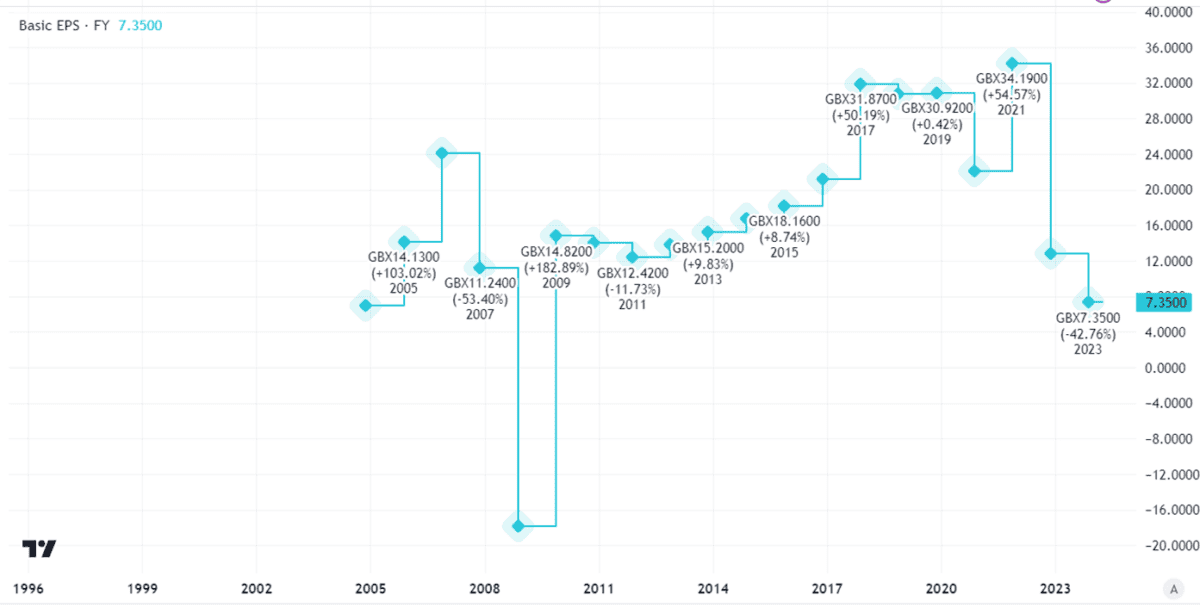

That reflects a long-term upwards trend in the financial services company’s earnings.

They have moved around, but broadly speaking have been rising for much of the past 20 years.

What comes next?

Still, as the charts above show, the past couple of years have seen less impressive performance. The annual dividend grew 5% last year, but earnings fell sharply.

That was largely down to shifts in asset valuations. That is an ongoing risk for a financial services provider such as Legal & General.

Given that I think capital generation and cash flows are a more useful indicator of whether the Legal & General dividend can be sustained, however, those weaker earnings do not bother me much.

The capital generation potential remains strong in my view, something that could see the dividend continue at its current level or rise again.

By the end of this year, the business expects to have paid out £5.6bn-£5.9bn in dividends over a five-year period. For a business with a market capitalisation of £14.2bn, that is a sizeable amount of cash being distributed to shareholders.

I’m bullish

The pensions market is huge, so it is not surprising that Legal & General faces sizeable competition. That remains a risk to its ability to generate substantial surplus cash.

But I think, as its track record demonstrates, that its proven business model, strong brand, large customer base, and market expertise are a formidable combination.

Despite that, the shares have lost 14% of their value over the past five years.

That has helped push up the Legal & General dividend yield. I find this high-yield FTSE 100 share an attractive proposition right now.

No dividend is ever guaranteed, but I think the dividend could well continue at or above its current level, in the absence of a major economic shock like a deep recession. If I had spare money to invest, I would happily buy the shares.